Laundering of illegal income using bank card accounts of so-called “drops” has long been a concern of the NBU, which announced its intention to create a special register back in the spring. And now, in 5 months, a bill to create such a register may be submitted to parliament.

VIDEO OF THE DAY

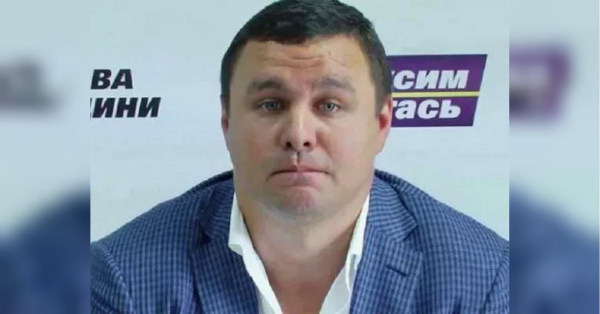

This was reported on his Telegram channel by the Chairman of the Verkhovna Rada Committee on Finance, Tax and Customs Policy Danylo Hetmantsev . According to him, the National Bank has appealed to the Committee regarding amendments to the legislation on the creation of a drop register, and the draft law will be submitted to parliament in the near future.

“Why is the fight against schemes using droppers so important? Because, in addition to other types of fraudulent transactions, they are used for drug trafficking and terrorist financing. Therefore, we must break these schemes and nullify the possibility of their recovery,” the politician explains the importance of passing the upcoming bill.

The People's Deputy also emphasizes that when someone approaches the owner of a bank card and asks him to “rent it out,” the owner should understand that these are definitely not legitimate transactions.

ADVERTISING

“I repeat my request: never give your card physically or the data to access it to anyone. You will never gain more from this than you will lose. Getting into the drop register, limiting the ability to carry out financial transactions – all this is not worth the money that scammers offer you,” emphasized Danylo Hetmantsev.

Meanwhile, banks are advising you on how to avoid being considered a dropout:

- take care of documentary confirmation of income in advance;

- optimize the number of accounts (you should not open an excessive number of accounts to avoid applying limits, instead, you should take care of closing “empty” / inactive accounts);

- setting up automatic payments in mobile applications, in personal accounts (for example, when paying for utilities, subscriptions to electronic services, such as online media);

- use digital payment tools (the “Diya” application, the taxpayer's electronic account, etc.).

Note that the worst-case scenario for a drop may not involve restrictions on the ability to carry out financial transactions, but even a prison term of 12 years.

ADVERTISING