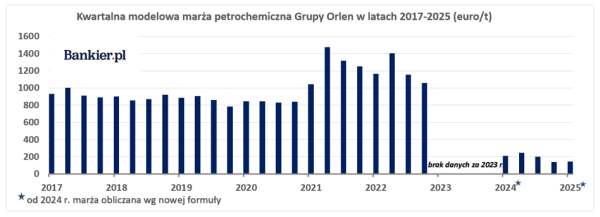

Orlen has returned to publishing a model petrochemical margin, but in a modified formula. It now includes a wider range of the Group’s products and CO2 emission costs. From over a thousand euros per ton, it has become 100-200 euros. Meanwhile, the industry is struggling with a huge slowdown, and the largest companies are even considering completely phasing out production in Europe, among other reasons due to energy prices.

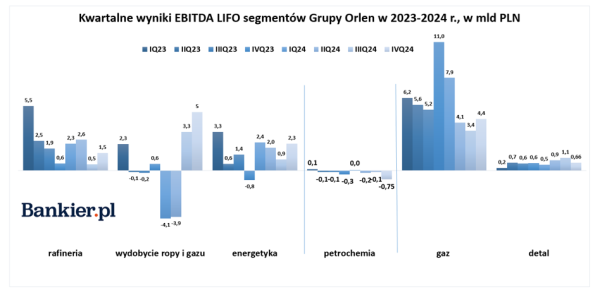

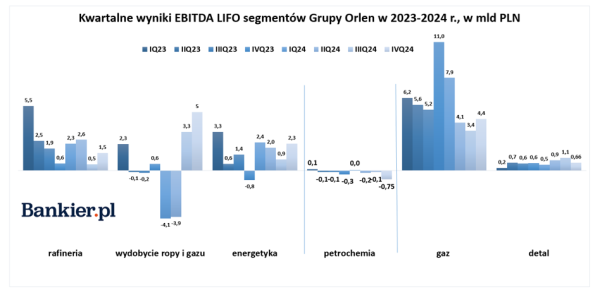

At the beginning of the year, when discussing the Orlen Group’s model refining margin, we informed that the company still does not publish an indicator for its petrochemical business. It has been recording losses for several quarters. It is the only business segment in the Group that has been unprofitable at the EBITDA LIFO level in almost every quarter in the last two years.

The lack of publication of the petrochemical margin model began at the beginning of 2023, along with the concealment of the refining margin. The latter began to be shown in March last year, but the former was not shown until spring 2025. The company’s successive management explained it by updating the formula for its calculation. The formula has already been changed, and the company has started showing the indicator, also for the past 2024. However, there is no data for 2023.

Estimated profitability

The model petrochemical margin is, as in the case of the refining margin, an indicator used to estimate profitability. It should be emphasized that here too it is a hypothetical value, and not an actually achieved result, which is intended to illustrate the difference between the market prices of a specific basket of petrochemical products and the market prices of raw materials used to produce them.

Until the end of 2022, the formula for calculating the model margin was as follows:

- model petrochemical margin = revenues (98% Products = 44% HDPE + 7% LDPE + 35% PP Homo + 12% PP Copo) – costs (100% input = 75% naphtha + 25% LS VGO),

the prices taken into account for the calculation of the revenue side were based on futures contract quotations (contract), and the costs side on current prices (spot).

The abbreviations used are the names of materials from which packaging often encountered in everyday life (bottles, bags), composite elements, tools, car parts, seals, tapes, pipes, etc. are made. LS VGO on the cost side is low-sulfur vacuum diesel oil, i.e. a key feedstock for the chemical industry for the production of light olefins.

From 2024, the formula looks like this:

- model petrochemical margin = revenues (25% HDPE [Spot] + 16% PP Homo [Spot] + 9% Ethylene [contract] + 7% Toluene [contract] + 14% Benzene [contract]) – costs (75% Naphtha + 13% COO + 13% LPG [Spot]) – 6% CO2 costs.

At first glance, you can see a larger number of products that make up the generated revenue. The new formula includes a smaller share of polyolefins in favor of basic petrochemical products such as ethylene, toluene and benzene. Liquefied petroleum gas (LPG) has appeared as a feedstock, and the costs also include the costs of CO2 emissions.

“The previous formula of the petrochemical model margin was based on the production of polyolefins and reflected only macro trends in petrochemistry. The new formula takes into account a wide range of petrochemical products produced by the Orlen Group (monomers, polymers and aromatics) and CO2 costs, thanks to which it better reflects the real profitability of the business,” commented the Orlen press team for Bankier.pl.

Significant change in margins and petrochemical business

As it turns out, the profitability estimated by the model margin is much lower than the previous formula suggested. According to the new formula, the model margin in petrochemicals averaged EUR 145/t in the first quarter of this year, compared to EUR 1,166/t in the same quarter of 2022, when margins were still calculated using the old formula. The deterioration is also visible on the basis of the already changed data. The margin in Q1 of this year fell by 30.6% from EUR 209/t in Q1 of the previous year.

Of course, the macroeconomic environment has changed significantly since 2022. Petrochemical companies continued the trend of record revenues and profits from 2021. This was driven by a strong recovery in demand after the COVID-19 pandemic. Now the situation is different, and the prospects are demanding. The most important reason for the slowdown is China, where the aging and shrinking population, as well as attempts to switch the economy to services and high technologies, contribute to weakening demand. The current problems are shown, among others, by the results of such giants as Arab Sabica, the world’s largest petrochemical company.

In January, we reported its massive loss for 2024, counted in the hundreds of millions of dollars, which was supposedly caused by market conditions such as oversupply and weak demand growth. There were also fears that global economic growth would slow down further and that there would be a collapse in oil prices, which due to trade tensions caused by the US materializes in 2025. The effect? According to the results presented on May 3, Sabic had losses of around $320 million in the first quarter of this year. “The oversupply of petrochemical products continues to put pressure on product prices and, consequently, profit margins,” Abdulrahman Al-Fageeh, CEO of SABIC , said at the results conference.

Evacuation of business from Europe?

In addition to the results, this week there was a significant report from the Financial Times about the world’s largest petrochemical company. According to the British daily, Sabic, controlled by Saudi Aramco, is said to be considering options for selling its European petrochemical assets. LyondellBasell, Shell and BP are also said to be considering options for assets in the region, according to people familiar with the matter.

One reason for the moves is said to be high energy costs. The European Chemical Industry Council warned in January that 11 million tonnes of capacity had been reported to have been closed in the past two years. It added that with gas prices four to five times higher than in the US, the sector’s competitiveness was “under pressure” and urged EU authorities to take urgent action.

“New production capacities are simply created where production costs are lower and the investment process is simpler, i.e. in China, India and the Middle East, and they are disappearing from Europe,” said Tomasz Zieliński, president of the Polish Chamber of Chemical Industry, as quoted by PAP.

“Slowing demand, overcapacity and increased competition will be significant features of the petrochemical industry over the next decade. By our calculations, returning utilization rates to historical averages requires the removal of between 20 and 45 million tons per year of capacity—primarily ethylene, propylene and paraxylene—mostly in China and Europe, but also in Northeast Asia,” Boston Consulting Group wrote in “Petrochemical Growth Slows.”

Meanwhile, Orlen is expanding its petrochemical business by investing in the Nowa Chemia project (formerly Olefiny III), the estimated costs of which are to amount to around PLN 34 billion . Talks are also underway to take over the Polimery Police project from Grupa Azoty. This is a legacy from the previous management, which strongly focused on the petrochemical industry when it decided to start investing in Olefiny III.

Michal Kubicki