The US president changed his mind once again and postponed the previously introduced “reciprocal tariffs”. After this announcement, there was euphoria on the New York stock exchanges, and the Nasdaq had one of the best days in its history.

Unpredictable is an understatement. On Wednesday, the White House host made another tariff about-face, telling the world that the entire April tariff mess was just a tactical way to put pressure on China. President Trump has ordered a 90-day pause in the application of increased tariffs to all countries except China. On the latter, he has imposed prohibitive and essentially absurd tariffs of 125%. The remaining countries are to be subject to a rate of around 10%.

But earlier that same day, the Chinese government approved raising retaliatory tariffs on US imports from 34% to 84%. This was a response to the US administration's implementation of 104% tariffs on imports from China. The European Union also decided to retaliate with tariffs – albeit only moderately. The retaliatory tariffs are a response to the US imposing additional tariffs on steel and aluminium in March, not to the “reciprocal tariffs” imposed in April.

This welcome relief was enough to get investors excited about buying depressed stocks. The S&P500 rose 9.52% on Wednesday to close at 5,456.90 points. The Dow Jones Industrial Average gained 7.87% to close at 40,608.45 points. The Nasdaq gained an impressive 12.16% to end the day at 17,124.97 points.

In Polish conditions, such a session would border on accusations of market manipulation by President Trump. Because a few dozen minutes before the announcement of the revelation about the 90-day suspension of tariffs, Trump wrote that “it's a great time to buy”. Well, he was right. But only he knew when that time would come and when it was worth taking long positions. To make things even funnier, on Monday the rumor about a 90-day tariff moratorium was considered… fake news. Well, on Wednesday it was already very much true.

Let's be honest, this is not serious politics. And the world's largest stock market has been reminiscent of an Arab bazaar in its stability and honesty in recent days. In such conditions, investing has become an extreme sport. After all, no one can guarantee that President Trump will not change his mind tomorrow or the day after and the tariffs will come into effect. For now, however, the market has fallen into euphoria at the news of this accurate de-escalation.

But it’s possible that the milk has already been spilled, and the destabilization itself has upended the plans of both businesses and consumers. JP Morgan Chase CEO Jamie Dimon said Wednesday that he believes the U.S. economy is likely headed into recession as President Donald Trump’s tariffs create turmoil in financial markets. And Ray Dalio, the billionaire founder of Bridgewater Associates , warned of a “non-repeatable” collapse in monetary, political and geopolitical order due to the trade war. The comments came before President Trump announced a 90-day tariff freeze.

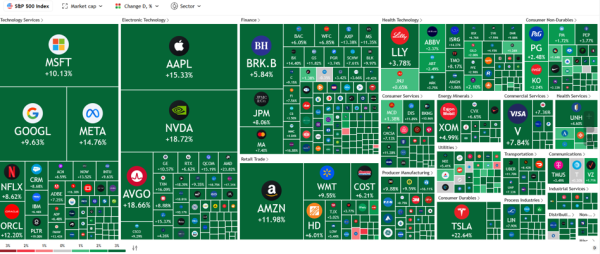

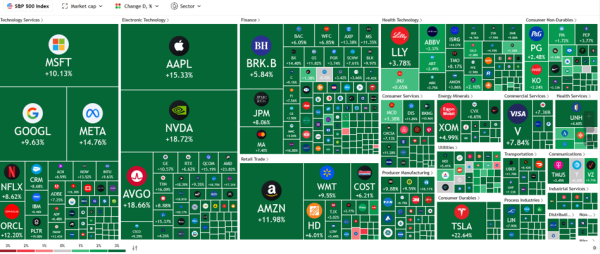

TradingView

It was a day that almost the entire American stock market ended in the green. In the S&P500 index, only 9 securities were in the red. On the entire NYSE, almost 90% of securities recorded increases. Double-digit increases by the largest American technology companies were practically the norm. Alphabet and Microsoft shares gained about 10% each, Meta by almost 15%, Apple by over 15%, and Nvidia and Broadcom by over 18%. Tesla's price increased by 22%.

Other markets were also wildly changing. The yield on the 10-year US government bond first jumped from 4.3% to 4.5%, before falling to 4.35%. Gold rose 3.7%, gaining over a hundred dollars an ounce! Brent crude ended the day up 6.5% after previously falling below $60 a barrel for the first time in four years.