According to the latest data from the World Gold Council, gold ETFs have recorded their largest purchases of the royal metal in over 3 years. Street demand is picking up, and according to investment bank forecasts, support from gold ETFs could push the price of gold to over $4,000. On the other hand, the cost of maintaining mining is soaring, approaching $2,000.

Gold is holding its price and in the first week of May it was valued even above USD 3,400 per ounce. A temporary correction, bringing the rate below USD 3,300 from the record above USD 3,500, was quickly made up for as a result of growing tensions between India and Pakistan.

Following the Fed’s decision not to cut interest rates in the US and the easing of trade tensions on the tariff war front (planned and signed bilateral agreements), gold prices are starting to stabilize above USD 3,300, which means a rate of return since the beginning of the year of around 27%.

Demand from central banks has not weakened in the past four months, and the largest buyers in recent years, the National Bank of Poland and the People’s Bank of China, added tons to their vaults in April. As the latest data from the World Gold Council showed, purchases from gold ETFs accelerated in April.

See alsoTake your first steps towards safe investments – read our guide to Treasury Bonds!

It doesn’t matter that they’re paper, the important thing is that they’re gold

We recently reported that combined purchases by central banks and funds in Q1 were the largest since the pandemic. Q2 is off to an even better start, especially from gold ETFs. buying the metal as physical collateral for “paper gold,” or shares of gold funds. The price of an ETF unit is linked to the market price of gold. As more investors buy ETF units, the fund issues new ones to meet demand. They hedge those by buying additional physical gold.

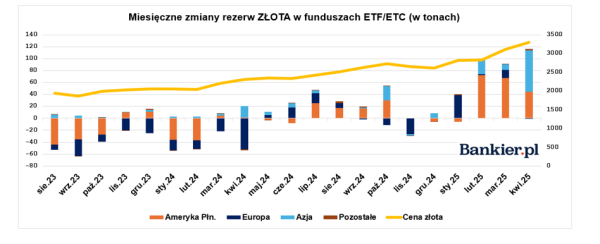

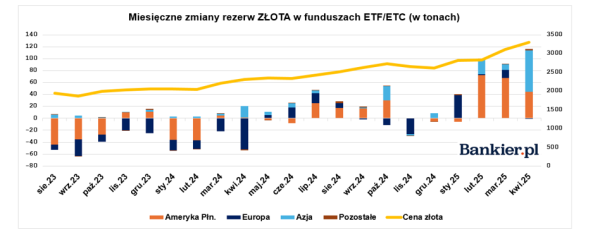

In this way, increased purchases of gold by funds indicate increasing demand from investors interested in so-called paper gold, providing exposure to the price of the metal. This demand was still poor throughout 2024, although gold was just ending its second year of significant growth (13.1% in 2023 and 27.2% in 2024). 2025 will clearly see purchases from ETFs every month.

In January, they amounted to 34.5 tons net, in February it was 100 tons, in March 92 tons, and according to the latest data, April purchases exceeded 115.3 tons. These are the largest purchases since March 2022, when investors rushed to the metal after Russia’s attack on Ukraine. In April, the largest purchases were made by ETFs from Asia (69.6 tons) and North America (44.2 tons). Europe recorded an outflow of no more than 1 ton (-0.7 tons), while funds from regions categorized as “other” bought 2.2 tons.

It is worth recalling that in the investment banks’ scenarios, increased demand from ETF funds is a significant factor supporting the “bullish” forecast for the price of the precious metal at the end of the year. According to Goldman Sachs, if the inflow of gold into ETF funds accelerates – which we are starting to see – the optimistic scenario even speaks of a price of USD 4,500 per ounce in 2025.

And optimistic, as in the pandemic, when in 2020 the average net inflows of gold to ETF funds amounted to over 74.3 tons per month. In turn, UBS, forecasting USD 3,500 per ounce in 2025, based its estimates on the assumption that the ETF would buy 450 tons of gold in the whole year. Currently, there are almost 342 tons on the counter (of course, the following months may bring both purchases and sales). On the other hand, the interest of the so-called “street” often heralded the peak of the bull market. There are also voices that the price of gold will not fall below USD 2,000, which is, however, as much as 40 percent below current prices. There is another important level even lower.

Prices are rising, but so are costs

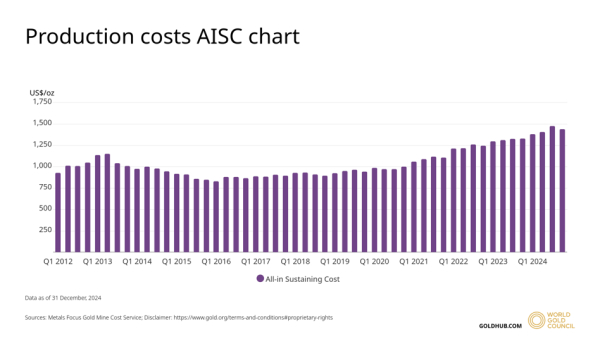

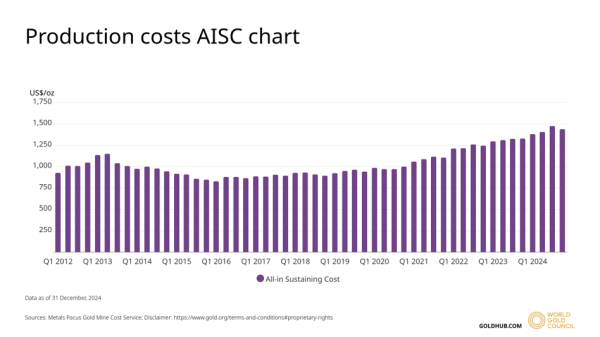

Another aspect of the gold market is worth noting, which is the total cost of maintaining the extraction of one ounce of gold that the mine incurs. This is the AISC (All-In Sustaining Cost) indicator, which is key in assessing the profitability of mining companies, illustrating their cost efficiency. It represents the minimum price at which an ounce of gold must be sold on the market so that producers cover all costs and do not incur losses.

According to data from the World Gold Council, AISC at the end of 2024 averaged just under USD 1,500 per ounce for the entire gold mining industry. These costs include operating costs (e.g. mining, ore processing), exploration, maintenance and development of existing mines, administrative costs, and costs related to mine reclamation and closure.

Average AISC for the gold industry 2012-2024. As of end of Q4 2024 (WGC/ Gold Demand)

In general, miners have the same expenses, but costs may vary depending on the location of the mines, the supply chain built, the equipment, the energy sources the mines use, etc. As shown by the first-quarter results of the world’s largest mining companies, AISC costs are rising in most cases.

Newmont reported this indicator at the level of USD 1,651, which is USD 135 and 9 percent higher quarter-on-quarter, in the case of Barrick Gold it was as much as USD 1,775 per ounce, which is USD 324 and 22.3 percent more than the previous quarter. On the other hand, Agnico Eagle, thanks to cost discipline, showed ASIC at the level of USD 1,183, which is even lower by USD 133 and 10 percent than in Q4 last year.

Barrick Gold, Q1/25 Update: Another record high in AISC – cost inflation continues. 🪙🔺

Barrick Gold (i.e. “Barrick Mining” 🙃) is the second largest gold producer after Newmont. It reported its AISC (All-in Sustaining Gold Costs) for the first three months of the year at $1.775… pic.twitter.com/ynzMkvfdCN— Oliver Groß (@minenergybiz) May 8, 2025

However, the industry average is expected to move higher. This is important because AISC acts as a kind of “anchor” for the gold price from the supply side. If the gold price falls too close to or below the industry average AISC, production becomes less attractive, which can lead to a reduction in supply and, consequently, a rebound in the price of the metal. The price, which, in addition to covering AISC, must provide a minimum profit to encourage mine operators to invest in the exploration and exploitation of new deposits, is even higher.

Michal Kubicki