The price of a Bitcoin reached a record high of $16,601.77 Thursday morning before falling to $15,500, in what has been a weeklong tear in a price that was $10,000 a month ago and just $1,000 in January.

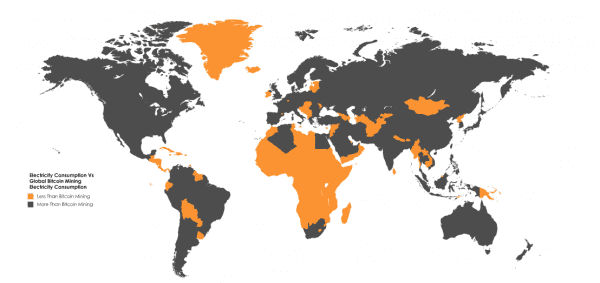

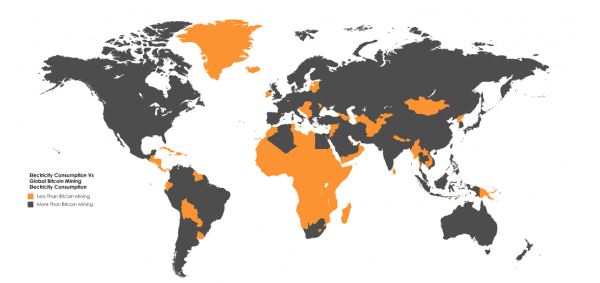

As the value of the digital currency has climbed, so has the amount of energy needed to keep this online economy running, which now exceeds the energy use of 159 individual countries, according to one controversial estimate.

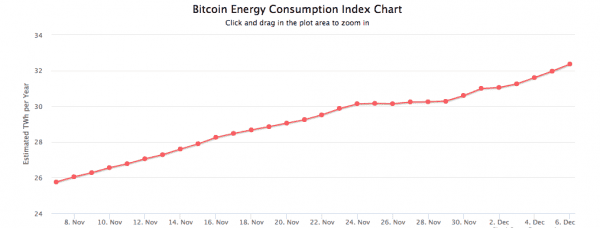

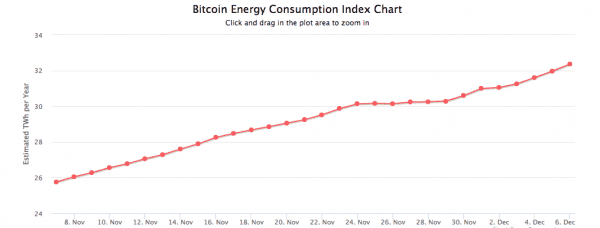

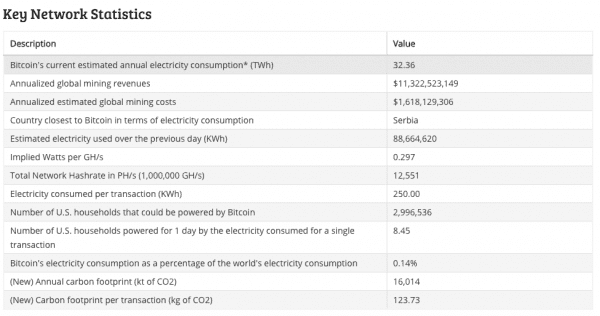

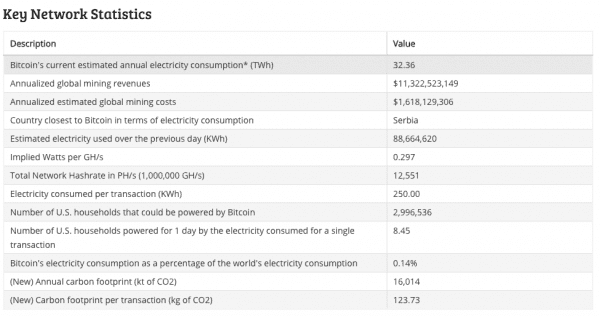

Over at Digiconomist, a Bitcoin blog and analysis site, owner Alex de Vries reported that the Bitcoin Energy Consumption Index, an measure of the energy used to mine the digital currency every year, was up to 32.36 terawatt-hours on December 6.

That’s on par with the energy use of the entire country of Serbia, more than 19 European countries, and roughly 0.8 percent of total energy demand in the United States, equal to 2.9 million US households. And it still leaves out electricity used by other parts of the Bitcoin pipeline, like ATMs, de Vries told me in an email.

While it doesn’t involve hard hats, drilling, and explosives, mining Bitcoin is a hugely energy-intensive process, even though the currency only exists digitally.

That’s because producing the online currency requires intense computational processing power, which in turn demands a huge amount of electricity.

Mining Bitcoins is like finding solutions to complicated math problems that become progressively more difficult. Coins are awarded to computers that verify transactions with an algorithm that gets more complex over time. In the early days of the currency in 2009 — with few computers, few transactions, and a price of $2 per coin — this was something you could do on your home computer.

Now with a global market cap of more than $167 billion, it requires specialized hardware called Application Specific Integrated Circuit miners, and mining operations now use tens of thousands of these power-hungry devices in expansive warehouses to extract more coins.

As a result, the largest mining operations are springing up in parts of the world with cheap electricity, like China. It also means Bitcoin mining is a growing contributor to climate change.

A study from the University of Cambridge earlier this year found that 58 percent of Bitcoin mining comes from China, describing “an arms race amongst miners to use the cheapest energy sources and the most efficient equipment to keep operators profitable.” Cheap power often means dirty power, and in China, miners draw on low-cost coal and hydroelectric generators. De Vries analyzed one mine in China whose carbon footprint was “simply shocking,” emitting carbon dioxide at the same rate as a Boeing 747.

However, figuring out exactly how much electricity Bitcoin mines use is tricky, since computing hardware is becoming more efficient all the time.

Marc Bevand, an investor and entrepreneur, was skeptical of de Vries’ tally of Bitcoin’s energy use and argued that the real global energy footprint of mining was likely closer to 15 terawatt-hours, which is still a huge amount of electricity, but half of the estimate on Digiconomist. The key difference between their numbers is that de Vries assumes that 60 percent of mining revenues goes toward energy costs in tabulating the total energy use. Bevand suspects it’s closer to 30 percent.

Both Bevand and de Vries expect mining computers to become more energy-efficient over time.

Bitcoin is just a small part of a global surge in energy demand from computers as our lives become more digital. Bevand estimated that data centers account for 1 percent of power demand around the world, while Bitcoin mining uses 0.15 percent of global power.

But with its soaring value, there’s a huge incentive to invest more in hardware that extracts the digital currency.

“As long as revenues increase, so will (electricity) costs (more machines will be added for as long as it’s profitable to do so),” de Vries wrote. “Right now the revenues are increasing fast, so I expect energy consumption to keep rising as well.”

If Bitcoin miners care about the environment a fraction as much as they care about profits, they should switch to cleaner electricity. (Some are already doing that.)

Read more

- Vox’s run-down of the basics behind Bitcoin

- The founder of Bitcoin remains an enigma

- How to launch a new cryptocurrency

Sourse: vox.com