If Saudi Arabia is acting a little nutty lately, it’s easy to see why: the Kingdom all the troubles Ayyub, known in the Qur’an. Its economy is in recession due to a 50 percent drop in oil prices. It is in bad relations with almost all its neighbors after the bombing of Yemen by sending troops to Bahrain to suppress democratic protests, funding Sunni terrorism in Syria and Iraq, the blockade of Qatar, and to arrest the Prime Minister of Lebanon. In an effort to lure foreign investors, crown Prince Mohammed bin Salman has rounded hundreds of princes and local entrepreneurs, said in an attempt to shake them down for $ 100 billion or more, there is hardly confidence-boosting measure.

“Half of my Rolodex is at the Ritz right now,” said one Western investor in er luxury hotel, which in November was transformed into a makeshift prison. “And they want me to invest now? In any case”. Added Richard Parsons, former CEO of time Warner and former Chairman of Citigroup: “it is unclear why or what the cause. If you are an investor or businessman, you are going to depart from the starting line and say, ‘I’m just going to keep my money in my pocket.’” Instead of raising capital, Prince Muhammad encourages it to flee.

So what is this all about? The media seems confused. But for those with a sense of history, there is a growing sense that I had seen him before. And in General in Spain in 1500-ies, when the power in the country was in full swing. The fact that Spain had in common with today’s Saudi Arabia Nedra—a lot of it is not oil, but the precious metals from the new colonies in Mexico and Peru. Gold and silver in Spain rich for a while. But then they did it to the poor, plunging her into war and debt, turning it from a ball of cross-border supply the sick man of Europe within only three or four generations.

The “oil curse,” as economists, landed at the other places in the Netherlands where a major natural gas find in the late 1950s led to a significant decline in production; in Equatorial Guinea, in Massachusetts, the size, the countries in West Africa, which is now one of the most corrupt and unjust societies on earth thanks to its massive oil strikes in the mid-1990s; and so on.

But Spain and Saudi Arabia, one at the beginning of the modern era and others are textbook examples. In fact, the resource curse describes the harmful effects of the gold or silver strike or other such windfall. While sudden wealth can solve problems in the short term, they ultimately create a lot more to separate the labor from wealth creation and feeds the illusion that people have more money not because of, but because of God’s will or some special attribute. As wealth pours seemingly from the heavens, disappearing frugality, the work ethic is compressed, and politics is becoming more unpredictable and extreme.

“The mines of Potosi, brought the country untold wealth,” summed up one historian, referring to the famous “mountain of silver” in Bolivia:

If the money was today, she would be rich again tomorrow when the fleet reached the Seville. Why plan, why save, why work? Around the corner will be a miracle—or perhaps disaster. Prices may rise, savings will be lost, the crop will be. There is no sense demeaning himself with manual labour, when, as often happens, the idle flourished and workers remained without awards.

Historians have traced the process in Spain in minute detail. Not unlike Tudor England, the newly joined kingdoms of Aragon and Castile was caught in a tug of war between parliamentary institutions and the crown. Where is the house in England communities were able to use their control of taxation to impose their will, the Spanish Cortes was acquitted. In 1519, he tried to rein in the headstrong young king Charles V by refusing him funds to travel to Germany to claim the title of Holy Roman Emperor as heir of the Habsburg dynasty. But Charles was able to use the treasure that is his conquistadors conquered the Aztecs, to work around the limitation and the bill himself.

It was a victory for the Spanish absolutism, the first of many. As the inflow of silver rose, the young king threw himself into one military adventure after another. He went to war with France over control of Northern Italy in 1521 and 1526. He attacked Tunis in 1535, went to war in Italy in 1536, and then battle with the German Protestants in 1546-47.

Financial difficulties in 1550-ies threatened to cease such activities. But when a Mexican settler named Bartolome de Medina developed a cheap method with the use of mercury to extract silver from ore, the production growth and Imperial ambitions again took flight. In 1580-ies, when the import of silver has reached its climax, the son of Carl Philip II had 40,000 troops trying to quell major Protestant uprising in the Netherlands and equipment 130-ship Armada with which to invade Protestant England. When the fleet limped home after a thorough thrashing at the hands of sir Francis Drake, he plunged into another war, this time with the France of Henry IV. But then, after the financial crises in 1557 and 1575, bankruptcy struck in 1596, 1607, 1627 and 1647.

The consequences were disastrous. The arrival of an unprecedented number of gold and silver led to inflation wave, which is four times the price of grain and brought most of Spain is on the brink of starvation. A plague struck the weakened population in 1599-1600, taking with them as many as one person in three. The colony has suffered even more. The population of Mexico could fall by as much as 80%, after the plague outbreak in 1545-46 and 1576-79, while Latin America as a whole has entered the age of depression Economics and immigration was quiet.

Instead of rolling up our sleeves and get back to work, the Spaniards deeper into despair. Vagrancy and begging increased, as people flocked to Church in search of either a job or alms. Anonymous picaresque novel, known as lazarillo de Tormes is observed in 1550-ies that “no-good bastard will die of starvation before he will take a trade”, and a prominent reformer by the name of Gonzalez de Cellorigo complained in 1600 that Castile contains “thirty parasites for every man who did an honest job”. It was a morality tale that especially appealed to the Calvinist Adam Smith. “Spain and Portugal were manufacturing countries before they had any considerable colonies”, – he wrote in “the wealth of Nations”, published in the momentous year of 1776. But with the acquisition of the richest colonies in the world, he said, “they both ceased to be so.” Spain went bankrupt for gold and silver in the UK has been enriched by the colonies, containing little more than timber, cod, and fur. One country has forgotten how to work, and the other—at least the part that managed to remain aloof from the slave trade—have learned to work not only harder but more efficiently.

♦♦♦

Fast forward to today’s middle East, and it is clear that little has changed except the numbers. Where in Spain gold and silver earnings on average per year approximately $ 100 million from 1503 to 1660, Saudi Arabia is three times less than a day. Where silver never constituted more than 29 percent of the Spanish state revenue, Saudi oil is more than three times—91% to be exact. But instead of changing the “paradox of wealth”, the only effect to make her even more dangerous.

These Parallels are striking. If Philip II was a classic absolutist, Saudi Arabia is one of the most autocratic States in the history, a country which has no formal Constitution, no parliamentary institutions, and almost nothing in the way of legal and political rights. Where the Spanish Inquisition should have at least a semblance of a legal procedure under the Habsburgs, the anti-corruption Committee, who made hundreds of arrests as part of Prince Mohammed is clearly exempt from all “laws, regulations, directives, orders and decisions.” When Philip II prompted the Spanish military spending to the limit, the Saudis, the escalation of military spending to a level that is now the highest in the world relative to GDP. Airfields filled with f-15S, Tornado and the Eurofighter Typhoon, they are constantly looking for new countries to attack, assuming that is that their goals are too weak to strike back.

As with Charles V, the drive mechanism of the autocracy is an independent source of income. Because of oil, the al Saud do not need to beg while people’s incomes don’t have to provide it in taxes. Glorious as it may seem, there is a problem: without taxes, people are not interested in the government and controls. Instead, the state becomes the private property of the crown, which is why Saudi Arabia is the only country in the world named in honor of his own family—rather as if the United States were known as the trump card of America or the United Kingdom Windsor, United Kingdom. Karen Elliott house, former Publisher of the”wall Street Journal”noted: “in a country fundamentally is a family Corporation….Members of the family of al-Saud will hold all the key jobs, not just at the top, but up to the middle managers and even regional managers. (The governors of all thirteen Saudi provinces, the princes)”. House adds that ordinary employees are “underpaid and poorly trained because management doesn’t want an initiative that might threaten its control”.

If King Salman wants to take a vacation to $ 100 million in Morocco, it’s nobody’s business but his own. The same thing, if Prince Mohammed wants to purchase a 500 million Euro yacht that happens to catch his eye, in the South of France or a castle in $300 million a few miles from Paris. The fact that public funds does not matter. If it’s Saudi money, the house of Saud first rights to it.

Thus, the country is reduced to personal property. The resource curse fuels autocracy in other ways also to undermine the economy, hinders social development, and promoting religious extremism. After the expulsion of the Muslims conquering of the Aztecs and Incas, and then reaping a reward in the form of an avalanche of precious metal, who could doubt that Spain needs to continue their conquest in the name of Christ? As the Spanish troops rampaged throughout Europe in the name of the counter-reformation, the result was a form of Catholic Wahhabism is so dark and unforgiving that even the Pope was taken aback.

For the same reason that Saudi addressed the question of whether God wants the Kingdom to use their oil wealth to spread its religious militancy? When executed by the accused sorcerers, banning cinemas, and the arrest of Ethiopian immigrants for the “crime” in participating in underground Christian services, al-Saud spent $75 billion or more, starting in 1979, to build hundreds of mosques, madrassas, Islamic colleges in Europe, Asia and Africa to disseminate the same hard line abroad. Calling for more “moderate Islam”, Prince Muhammad at the same time strengthened anti-Shiite sectarian rhetoric, which suggests that instead of fighting against Wahhabi extremism, he’s just it in a slightly different direction.

In Spain, society was in a state of decay, crowds of Wanderers and vagrants took to the streets—“the students will escape into the wild and abandoning their Tutors to join the swelling ranks of picardía, adventurers of all stripes, beggars and cutpurses,” as the historian Fernand Braudel. Saudi highways are also filled not with the poor so much as bored young people who steal cars with which to race, spin, and perform high-speed aerobatics. This sport, known as “Saudi drift”, and it is so known that pop star M. I. A. has made it the subject of one of her music videos. If work ethic languished under Charles V and Philip II, it essentially disappeared under al-Saud. With Religion occupying half of the school day, employers complain that young Saudis lack basic skills of reading, writing, and the Saudis, in turn, say they would prefer to wait years for a state office to open than to take a private sector job that pays less and demands more. “How can you create jobs for Saudis,” ask the economists at one of the Saudi Bank, “if they do not want in the private sector, and the private sector doesn’t want?”

That is a broader economic collapse, which fuels the autocracy, spreading despair and malaise. Causing the price of silver fall and other commodities is growing, the influx of precious metals into Spain have helped the prices of local products on the market. Thus, Spanish production sagged under the influx of cheap imports. Similarly, despite the considerable price fluctuations in the 1970s and early 80s and again during the financial crisis of 2008, crude oil prices also weakened, how come more and more energy on the line in connection with a computerized “smart drills” and shale gas. The result: demand is shrinking, or at least rose less than expected, thanks to the maintenance and active growth in alternative energy.

The result of too much oil chasing too few customers. Yet there is little the Saudis can do in response. Not only oil reserves of the Kingdom among the largest in the world, they are also located close to the surface, concentrated in easily accessible fields, and therefore among the cheapest to tap. With production costs at $9 per barrel, a huge profit even with low prices. Consequently, there is little incentive to do anything other than sit back and watch the cash flow. With 60 percent of Saudis under the age of 20 years and 60 per cent of the unemployed aged 20 to 24 years, the government has no choice but to provide public sector jobs for people even more tired do not want to work. It is obvious that diversification is one of the ways out of the bind. But if the Saudis were talking about the expansion of the economy from 1970-ies, the Kingdom, according to some estimates, less diversified than 40 or 50 years ago.

Of course, there is also a shakedown or musadara, as he was known in the Middle ages, when tight emirs and military commanders, usually the arrest of the leading inhabitants and torture them to turn their hidden riches. Into practice was harder, artisans and manufacturers, whose money was tied up in warehouses and equipment, than on the merchants cleverly stashed treasures in the form of precious stones and gold. But Prince Mohammed, seeking a simple solution for the money troubles of the Kingdom, revived it, even if the result may be renewed only capital outflows.

Therefore, the more the Prince cracks down, the more the non-oil sector will continue to shrink. In the end, this gold-plated welfare syndrome, in which a super-abundance of oil makes it all but impossible for companies to do anything other than to live with the overflow. All parties find it easier to stick with the existing system is still remotely functional—all parties that, in addition to LIH and “al Qaeda”, who are just waiting until the Prince Mohammed brings his guard, and this is the time to strike.

It took the Spanish centuries to rid themselves of the curse of resources, so a quick problem solution in Saudi Arabia unlikely. Oil Kingdom in their hands and not let go. The words of Rashid bin Saeed al Maktoum, the late Emir of Dubai, worth listening to: “my grandfather rode a camel, my father rode a camel, I drive a Mercedes, my son drives a Land Rover, his son will drive a Land Rover, but his son will ride a camel.” Once the wealth runs out, in other words, there is little left. As in the 16th century, there is no way this story could end otherwise than in war, poverty, and debt.

Daniel Lazare is the author of the frozen Republic: how the Constitution is paralyzing democracy (Harcourt Brace, 1996) and other books about American politics. He has written for various publications, from the nation to “Le Monde Diplomatique”, and his articles about the middle East, terrorism, Eastern Europe, and other topics appear regularly on sites such as Jacobin and consortium news.

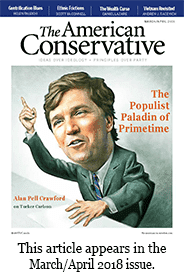

Sourse: theamericanconservative.com