California’s Pacific Gas & Electric (PG&E) is the nation’s largest electric utility. It is also, at the moment, the nation’s least favorite, as the state suffers through a relentless succession of wildfires and blackouts. The latest blackout is over for now. The fires continue.

In a series of posts on California’s mess, I have written about its many causes, some key steps the state can take to reduce its vulnerability, and what I think is the only durable long-term solution: a more localized, distributed energy system.

In this fourth and final post, I’m going to take a look at a way utilities like PG&E can be restructured to better serve the needs of California communities in the 21st century.

In a nutshell, the state needs utilities that partner with communities to maximize local resilience and self-sufficiency, and whose financial fortunes are tied to their performance in that pursuit.

Power utilities are a notoriously arcane and complex subject — be warned, there are lots of acronyms ahead — so to get our heads around why and how PG&E must be reformed, let’s start with a little background.

Investor-owned utilities were designed for the 20th century, which is (checks watch) over

The investor-owned utility (IOU) model was designed in the early 20th century to draw private capital into the project of electrifying the country, building out grid infrastructure to reach every American.

As I explained in detail in this post, IOUs make money for shareholders by investing in stuff, mostly grid infrastructure, and receiving a guaranteed rate of return on those investments. The more grid infrastructure is needed, the more they can invest, and the higher their returns.

It was an effective model (more or less) in the 20th century; electricity has reached everyone. But it is the 21st century now, the century of the climate change crisis, and the giant machine that was built to distribute electricity — a system of exposed overhead power lines that travel hundreds of miles over land — is more and more vulnerable to the rise in extreme weather.

The imperative now is to reduce dependence on that increasingly brittle system, to strengthen the resilience and independence of local communities by enabling them to generate, store, and manage more of their own power.

If IOUs make their money from investing in the grid, it follows that it is against the fiduciary obligations of IOU executives to do or approve anything that might result in less grid infrastructure. They can be forced by statute or regulation to invest in X amount of energy efficiency, energy storage, or microgrids, but as long as they are structured the way they are, they will never do more than X. They will not be true partners in decentralizing and decarbonizing the grid.

To put it simply, the public interest and the profit structure of IOUs have slipped out of sync and are now in conflict.

Until recently, most of the action in electricity was on the transmission side

In the 20th century model, electricity is generated at large power plants and fed into high-voltage transmission lines, which carry it over long distances. At various points along the way, power is dumped from the transmission system into local distribution areas via substations, where transformers lower the voltage. Local distribution grids then carry the electricity to customers.

In that model, distribution grids just aren’t that interesting. They, like the customers they serve, are largely passive recipients of energy. Once enough power to meet demand is dumped in and delivered, the utility’s job is largely taken care of. Most of the action in the electricity system has been on the transmission side.

In many states, including California, the transmission system was “deregulated” in the late 1990s, which meant that wholesale power generation became a competitive market. What were once “vertically integrated” utilities, responsible for power generation, transmission, and delivery, were broken apart into three separate functions.

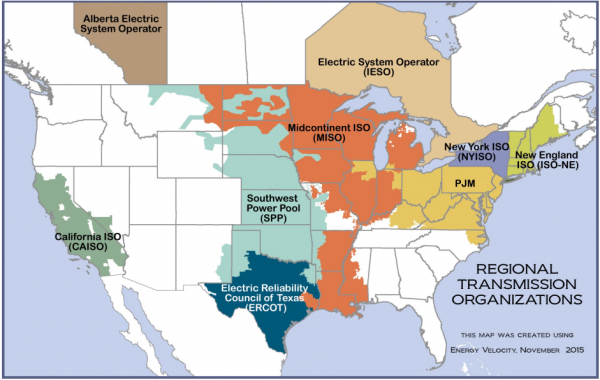

Distribution utilities (like PG&E) run distribution grids and deliver power to customers. Generation companies own power plants and sell into wholesale power markets. And transmission systems are run by regional transmission organizations and independent service operators — in California’s case, CAISO.

CAISO doesn’t own power plants. It doesn’t own transmission lines, either (PG&E still owns and operates the lines and towers in its territory). Its only function is to oversee wholesale power markets and operate the transmission system. Like all regional transmission organizations and independent service operators, it is required by law to provide “fair and open access” to wholesale markets, which theoretically means that any power generator, no matter the technology, can bid in. CAISO follows a “load order” that prioritizes energy efficiency and demand response first, then renewables, then everything else.

California’s process of electricity deregulation was notoriously disastrous, but over time and with some better rules, wholesale markets have worked out pretty well, in California and in other states. They remain contentious — many of the biggest fights in electricity are over the rules that govern them and the way different sources are compensated within them — but they are largely a known quantity.

These days, the coolest stuff is happening on the distribution side

Things have been changing recently in the electricity system, shifting more of the action to the distribution side — operations in local communities.

The most obvious change is the rise in distributed energy resources, most notably rooftop solar panels. In 2006, there were about 20,000 rooftop solar systems installed in California. This year, that number crossed 1,000,000, and to keep momentum going, the state has mandated that all new home construction include solar.

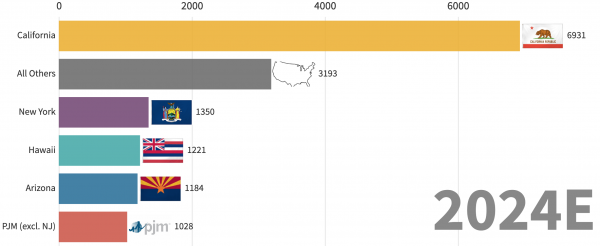

The growth of rooftop solar is kickstarting a similar cycle of growth in batteries meant to store grid power, either “behind the meter,” in customer buildings, or “in front of the meter,” in the form of community battery banks. A market report from Wood Mackenzie finds that in 2018, California took a decisive lead among US states in both behind-the-meter storage and in overall energy storage, and that lead is expected to grow for the next five years, yielding almost 7 GW total in 2024.

Some of that energy storage will be in the form of big, grid-scale battery banks hooked directly to power plants, on the transmission system. But the bulk of it will be on the distribution side of the grid.

Solar and batteries will be complemented by smart inverters that can “island” microgrids off from the larger grid, energy management controls and software that help coordinate onsite generation and consumption, “smart appliances” that can shift their energy usage based on circumstances, and electric vehicles that can exchange energy with the microgrid. (See my previous post for more on distributed energy.)

This is a lot of new energy generation and management at the distribution level, a phenomenon that is only going to expand, and right now it is poorly coordinated, if at all, with PG&E’s management of the larger grid. It is also poorly coordinated, if at all, with the larger social, economic, and environmental goals of the communities in which it is located. Utilities aren’t helping communities do that kind of planning, and they aren’t sharing the data and information necessary for communities to do it themselves.

Local communities need partners to help them plan around their distribution grids

What’s also important to keep in mind is that California has all kinds of ambitious targets: expanding renewable energy, expanding energy storage, increasing electric vehicles, electrifying heating and cooling, increasing housing density, building out public transportation, and above all, radically reducing greenhouse gas emissions.

All of these programs and mandates are going to play out at the local level; that’s where the rubber hits the road. Dealing with these multiple incentives, restrictions, and requirements requires integrated planning, so that all the varying goals and initiatives operating at the local level are working in harmony.

The imperative to electrify heating and transportation means that all these municipal systems are increasingly going to be interconnected by distribution grids. In order to plan properly around state and local goals, municipalities need a partner that can help them plan for, and around, their local distribution grids, ensuring that all these resources are coordinated.

PG&E has no regulatory incentive to be that partner. It is obliged by its charter to provide reliable, low-cost electricity to everyone, which in its eyes involves buying power from the bulk power system and delivering it to customers. Beyond that, it is focused on producing returns for shareholders by, as described earlier, maximizing investment in the grid.

As we’ve seen in the past month, PG&E is failing even at its core obligation of reliably delivering power. But even if it mostly restores service, it has no regulatory mandate (or financial incentive) to go beyond that and help with distribution-level planning. It has no mandate to provide differentiated services to local areas based on their individual circumstances.

This is the basic problem. PG&E has its eyes on the bulk power system — buying enough power, cheaply enough, and dumping it into local distribution areas. What’s needed is a utility invested in the health and resilience of distribution grids, working to build a bottom-up power system to complement (and relieve pressure on) the current top-down system.

That brings us to a radical plan to reform PG&E.

A distributed utility for a distributed energy system

Lorenzo Kristof, an energy analyst who spent years working at the California Public Utility Commission (CPUC), has a plan to restructure IOUs. I have written about it in some detail, if you want the full wonky details (and some cool illustrations). He, along with the Center for Energy Efficiency and Renewable Technologies, has submitted comments to the CPUC laying out why such a plan is necessary and feasible for PG&E.

Here, I’ll just offer the short version.

Before the transmission system was deregulated in California, utilities served two transmission functions. They managed the system itself, how and where electrons moved on it, and they provided the power that the system distributed.

Afterward, those functions were split. CAISO took over managing the transmission system, making sure it operated an effective, reliable, open-access platform for competitive wholesale power markets. Generation companies took over providing power to those markets.

At the distribution level, those same two functions exist. On one hand, there is the entity that manages the grid: the distribution system operator. On the other hand, there is the entity that sells power to customers: the load-serving entity, or LSE. (I told you to expect acronyms.)

For most customers in PG&E territory, one entity — namely PG&E — plays both those roles, though the roles are visible on electricity bills as separate grid and energy charges.

Kristov wants those functions formally split, just the way they were in the transmission system. The distribution system operator would manage distribution grids as open-access platforms for local energy markets (Kristov thus calls it an “OA-DSO”), but own no energy assets and play no role in selling energy to customers. Independent energy companies would take over the role of LSEs, competing to sell energy and energy services to customers.

To be clear, this would be a big, revolutionary change. It would require some serious foresight and planning by California legislators and regulators. (Kristov has some thoughts on safe, incremental ways these reforms could get started.) But the time to make that plan is now, while PG&E is in bankruptcy and fundamental reforms are possible. It is imperative that the company not emerge from bankruptcy with the same anachronistic structure.

We’ll get into the benefits of this new model in a moment, but first it’s important to note that, though it is a big change, something like this change is inevitable, because the current model is falling apart.

Developments afoot in California have already doomed the conventional utility model

When it deregulated its transmission system, California also briefly deregulated its distribution side. PG&E was to be the distribution system operator on all its distribution grids, but in theory, any customer could choose a different load-serving entity, purchasing power from a third-party electric service provider.

In practice, though, deregulation was poorly done: energy prices spiked, there were a bunch of scams at the retail level, Enron blew up in everyone’s faces, retail electricity re-regulated, and everyone got spooked by the whole idea of electricity deregulation for a decade. Many remain wary to this day.

Recently, though, things have started moving again on the distribution side, via Community Choice Aggregation (CCA), a law in California (and a few other states) that allows municipalities served by IOUs to become their own load-serving entities, thus taking over procuring and providing power for their citizens, while the utility retains the distribution system operator role. Two or more jurisdictions can also link together and create a Joint Powers Authority that runs a CCA on their collective behalf.

Municipalities typically opt for CCAs because they want cleaner and/or cheaper power than the utility provides, and they can often find both relatively easily. There will be almost 30 CCAs operating in California by 2020; the largest, the Clean Power Alliance, now serves more than 3 million people across 31 communities.

CCAs are becoming so popular in California that they are threatening the IOUs from which they are defecting. (That’s why IOUs are trying to hike up “exit fees” on communities that choose to form CCAs.)

Last year, the CPUC issued issued a report on CCAs in which it revealed that, between CCAs, rooftop solar, and participants in the state’s Direct Access program (which allows commercial customers to buy from independent power providers), “as much as 25% of IOU retail electric load will be effectively unbundled and served by a non-IOU source or provider sometime later this year. This share is expected to grow quickly over the coming decade.”

California’s IOUs could end up losing most of their load. Now that San Diego has announced its intention to form a CCA, San Diego Gas & Electric (SDG&E) is facing the loss of 40 percent of its total load, which could leave it stranded with big power contracts it no longer needs. (For complicated reasons, there is no way to neatly transfer those contracts to a CCA.)

PG&E expects CCAs to eat 46 percent of its demand this year. By the end of the decade, it could lose almost all its load, with the only communities left buying power directly from them the ones too poor or scattered to form a CCA.

There are complicated issues to work out around how to make this transition equitable, but it’s looking inevitable. SDG&E is already contemplating becoming a pure “wires” company, i.e., a pure distribution service operator. It has already asked state lawmakers for “legislation that would allow us to begin planning a glide path out the energy procurement space.” It even floated legislation to that effect.

PG&E faces the same decision and will likely end up on the same glide path. Already, it’s being pushed. In a filing to the CPUC, community-choice groups argued that the utility should become wires-only. In its own filing, PG&E expressed openness to considering the idea, though it said the proposal would “pose several challenges and take considerable time to implement.” One concern is that under the proposal, PG&E would no longer serve its role as energy provider of last resort, which could leave customers stranded if their energy providers go under (more on that later).

Kevin Stark has a great rundown on all this over at GTM, and he notes one aspect of the dynamic that is relevant to our discussion here:

This brings us back to the difficulty described in the previous section. Local communities increasingly want to take control of integrated energy planning, but they often lack the capacity to do so, and they do not have a willing partner in their electric utility.

Kristov’s reforms are designed to address precisely those problems, and as such, they are a spur to the spread of CCAs.

The benefits of an OA-DSO

Kristov’s model is a version of a wires-only utility, but a more sophisticated one that addresses some common concerns.

The idea is that PG&E’s responsibility for distribution grids would be separated, by regulation, from its role as energy service provider (which would be taken over by local distributed-energy markets) and its role as owner and operator of transmission assets. In each distribution grid, or local group of distribution grids, PG&E would create an open-access distribution service operator — an OA-DSO.

An OA-DSO would effectively be a local utility. But while it would plan and operate the local grid and deal with customer communication and billing, it would not own any energy assets or provide any energy services.

Instead, it would oversee local markets for energy services, from electricity to efficiency to resiliency (i.e., backup power in a blackout). Just as regional transmission organizations/independent service operators are required by regulation to provide fair and open access to the transmission system, an OA-DSO would be required to provide fair and open access to the distribution grid, for any third-party entity with energy services to sell.

Crucially, while OA-DSOs would still make money the way current distribution utilities do — by investing in grid infrastructure and receiving a guaranteed rate of return — that rate of return would be much lower, and much closer to the actual cost of capital. To make up the gap in revenue, an OA-DSO would receive variable compensation based on its achievement of performance metrics: system uptime, energy efficiency, percentage of renewable energy, electrification, customer satisfaction, etc. The metrics can be decided by regulators and local communities.

In the energy-nerd world, this is known as “performance-based regulation,” and, yes, they call it PBR. The core feature of performance-based regulation is that it ties IOU profits to quality of service rather than to quantity of investment. It brings the utility profit motive back into alignment with the social, environmental, and economic goals of California communities.

But there’s a catch: Even with an OA-DSO present to serve as a partner in distribution-grid planning, many communities don’t yet have a CCA, and still lack the information and capacity to engage meaningfully in that kind of planning.

To address that problem, Kristov is working with the Climate Center’s Clean Power Exchange to advance an initiative meant to help build local energy-planning capacity. Advanced Community Energy (ACE) would “establish, through legislation, a program to provide funding, technical expertise, best practices and local capacity building for all cities and counties to plan and implement local ACE systems, starting with community microgrids.”

The planning ACE envisions would bring together “local government agencies, local residents and stakeholders, especially vulnerable households and disadvantaged neighborhoods, electric distribution utilities [OA-DSOs], and clean energy developers and technology companies.”

That is the kind of integrated local planning CCA communities want, and ACE legislation would be an enormous boon to them. But the legislation is also meant to reach communities that don’t yet have CCAs and still need to do local distribution planning.

As I warned in my previous post, if the state doesn’t intervene, California is in danger of lurching into a distributed energy system in an unsafe, inequitable way — basically, wealthier people will get it first and leave poorer people stranded on a more expensive, less stable grid. ACE is meant to get out ahead of that, to provide every community with the tools to maximize its local resources and plan the future it wants.

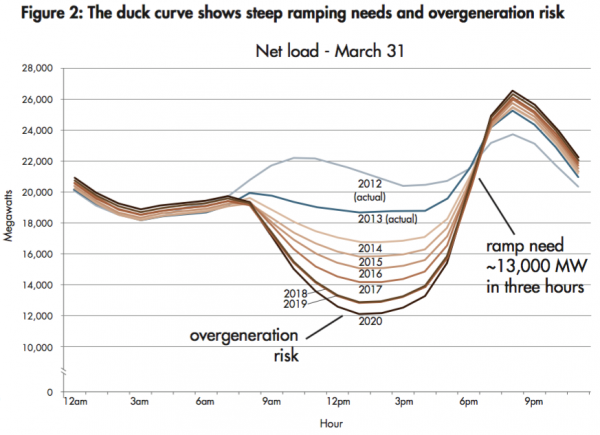

Good local planning, with a willing partner in an OA-DSO, can take into account multiple considerations, among them local needs and priorities, equity, state standards and mandates, and service to the larger grid system (local microgrids can help flatten out peaks and valleys in demand, the notorious “duck curve,” making for a more stable grid).

In effect, the OA-DSO + ACE model would encourage each local distribution grid to treat itself like a microgrid, to balance and maximize its own local resources before turning to power from the transmission grid. Just as CAISO must put clean resources first in its wholesale-market load order, the OA-DSO would put clean, local resources first in its retail-market load order. Grid power would be the last resort, not the first.

Notably, the way Kristov has structured his proposal to the CPUC avoids some of the problematic aspects of other wires-only proposals. It seeks to minimize the lift, to target its changes and leave other controversial issues aside.

He is open, for instance, to PG&E keeping its role as power provider of last resort, which would involve maintaining some power-procurement contracts for backup. Unlike some other reformers, his proposal would not require that PG&E divest itself of its transmission assets, only that it be separated by regulation from the DSO function. (The Clean Coalition, a state nonprofit that advocates for local energy, argues that “transmission divestment” is the only way to force PG&E to focus entirely on distribution grids.)

Finally, the OA-DSO model is agnostic on the question of ownership structure. It could work just as well if PG&E becomes a public utility or a collection of municipal utilities, but crucially, it need not wait on those reforms (which could take many years). It can be implemented now, no matter who ends up owning PG&E.

California can become a model of a more robust and resilient energy system

The best way for California communities to become more resilient in the face of wildfires, blackouts, and god-knows-what-else in the age of climate change is to maximize their local resources through coherent local planning that includes the increasingly important element of distribution-grid planning.

The OA-DSO + ACE model would provide for that kind of planning and spur the growth of a bottom-up energy system.

This distributed energy system would not replace the bulk power system, with its big power plants and long transmission lines. Long-distance grids are fantastically useful machines and will be much-needed for full decarbonization. There’s nothing wrong with being interdependent on a larger system, in electricity, trade, or anything else.

But as recent events in California have shown, it is also useful to be able to island off from those larger systems in times of emergency or breakdown — to operate independently, at least enough to provide for basic community needs.

Good distribution-level planning will create microgrids within microgrids, each able to island from the level above, so that the system is more modular and less vulnerable to single points of failure. It will tie together solar panels, batteries, heat pumps, electric vehicles, and electric vehicle chargers with smart controls and software. It will bring economic development, jobs, and innovation to local communities. And a bottom-up energy system will complement and ease the pressure on California’s increasingly shaky and vulnerable top-down system.

But it is only possible if utilities become partners in the effort. That will require fundamental change in the regulatory structure now governing PG&E, to bring its financial interests in sync with the social, environmental, and economic interests of California communities.

California legislators, regulators, and bankruptcy courts should not shy away from this kind of reform because it is bold. If the current apocalypse in California is not occasion for boldness, what could be? Now — while PG&E is bankrupt, exposed, and open to change — is the time to remake it for the 21st century.

Sourse: vox.com