The silver anniversary of the end of the Nasdaq internet bull market is an opportunity to recall those times and ask whether the AI boom could cause history to repeat itself. The experts we spoke to do not see such a threat. For now. “What we are seeing now is more of an analogy to 1998, not 2000,” one of them reassures.

On Friday, March 10, 2000, the tech-heavy Nasdaq Composite Index hit its all-time high of 5,048.62 points. It had doubled in value in a year and increased more than sixfold in five years. It was the end of one of the greatest bull markets in American history. Fueled by the madness of the Internet, which had begun to develop rapidly in the second half of the 1990s.

Questions about AI and high valuations

Then came a severe bear market that lasted until the fall of 2002. The Nasdaq Composite lost 78 percent of its value, giving back basically everything it had previously gained. Investors, it is estimated, lost as much as $5 trillion, and the American economy fell into crisis. Many companies that were supposed to ride the wave of the developing Internet quickly furled their sails.

The Nasdaq Composite waited until 2015 to erase the rest of its losses and set new all-time highs. But then it quickly began breaking through barriers, reaching 10,000 points in 2020, 15,000 points in 2021, and finally 20,000 points at the end of 2024. It is already four times higher than it was a decade earlier (and a dozen times higher than in 2009), and questions about whether the Nasdaq and other major US indices have already gone too high have begun to arise more and more often.

Yahoo Finance

The latest rally began in the fall of 2022, coinciding with the unveiling of OpenAI’s ChatGPT language model. Since then, AI has been a hot topic for US investors, almost as much as the internet once was.

Cisco has not yet made any reference to the records

We asked specialists from domestic investment firms how the current AI-related bull market compares to the Internet bull market and bubble.

– The fact is that we do have some similarities in the form of a strong increase in the prices of technology companies in the US. Currently, valuations, although high, are not as far removed from fundamentals as they were in 2000 – emphasizes Michał Krajczewski, manager of the investment advisory team at the Brokerage House of Bank BNP Paribas.

The expert’s words may be confirmed by data. According to Reuters, the P/E ratio for future earnings of companies from the Nasdaq index reached 48 at the peak of the dot-com bubble, while during the current bull market it did not approach such values, and currently, after the correction of quotations and the publication of new forecasts for companies, it has fallen to around 26. Valuations are “challenging”, as analysts usually call them, but not from the ceiling.

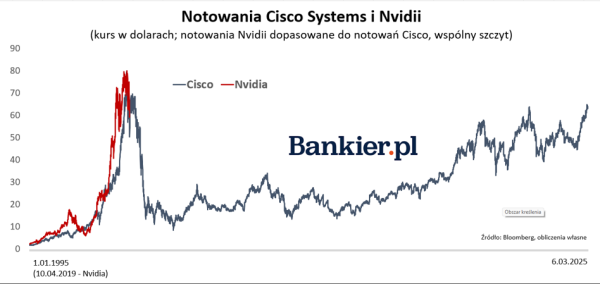

A good example is also the comparison of Cisco and Nvidia. The former, a manufacturer of networking equipment, was a market star during the Internet boom, just like Nvidia is today, its shares gained over 3,800 percent, and its capitalization exceeded $550 billion. It can be said that hopes for Cisco were much higher than for Nvidia today – the P/E ratio for Cisco reached 130 at the end of the boom, while for Nvidia it recently fell below 40.

Bankier.pl

Let us add that Cisco’s valuation was at such a level that to this day, although the company is still developing and has a leading position in its industry, its securities have not managed to come close to the peak from 25 years ago.

I’ll buy dot-com shares

– During the Internet boom, we were dealing with the culmination of many years of speculation, strong increases in unprofitable and small companies, and numerous IPOs bringing hundreds of percent returns in a short period – recalls Michał Krajczewski.

As for the IPO, it started with the IPO of Netscape, which created the most popular web browser at the time. On the first day of trading, which fell on August 9, 1995, its shares rose from $28, which was paid in the IPO, to over $58. Other companies followed. It is not surprising, since investors were willing to buy shares of companies, especially those with “.com” in their names, at any price. The best example is the stock market debut of TheGlobe.com, a social networking site founded by three students in 1995. After only three years, it went public, and during the first session, the shares went up in price by over 10 times. Traditional valuation indicators, such as price/earnings or price/sales, were not looked at, because they were often not reliable in the absence of profits or low revenues, but, for example, at the amount of traffic a given website generates on the Internet and what its prospects are in this respect.

Like in 1998, not at the peak of the bubble

Kamil Cisowski, director of the analysis and investment consulting department at Xelion Investment House, also does not see any threats related to an overly optimistic approach of investors.

– The situation in the American technology sector has slowly begun to resemble that of the dot-com bubble, but rather in its middle stage, and not in the final moments before it burst. Using this analogy, it is much more likely that we are in a situation similar to August 1998, when the Nasdaq fell by almost 20%, and then continued to grow for a long time, and not like in 2000 – says the specialist, noting that in his opinion the current correction, for which the turbulent start of Donald Trump’s term is a pretext, will be shallower than that of 1998.

Kamil Cisowski points out that currently investors are not jumping at everything that has AI in the name, but only at shares of companies that have a real chance of being the winners of this revolution.

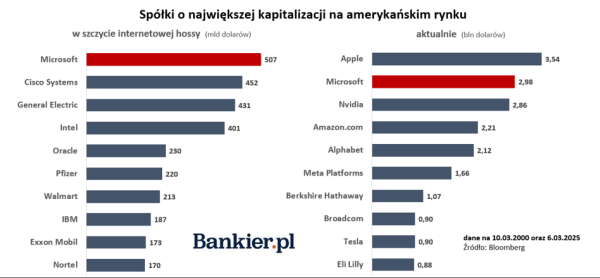

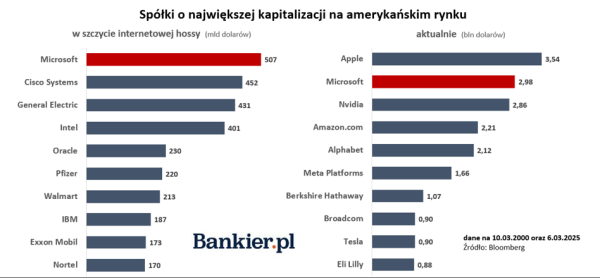

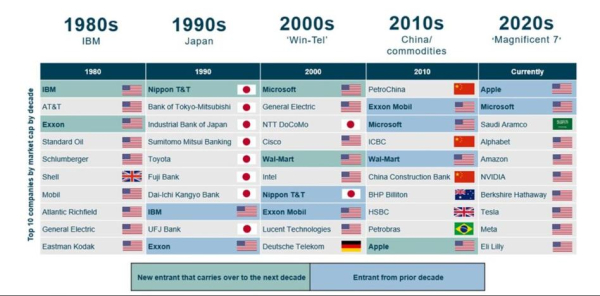

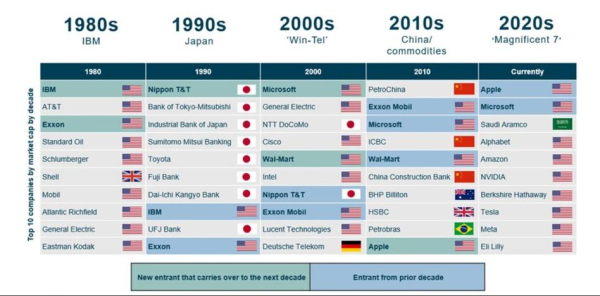

What is characteristic is that investors have been focusing on the so-called Magnificent 7 for a long time, i.e. companies that have been on the market for a long time and whose business models have had a chance to prove themselves in different economic conditions. The youngest of this group, Meta, was founded (as Facebook) in 2004, and Tesla is a year older. Both have therefore been in business for over two decades, and the other five even longer.

Bankier.pl

In turn, AI-only companies such as OpenAI (from ChataGPT) or Anthropic, which has developed a competing language model called Claude, are not eager to go public. They prefer to raise capital from Magnificent 7 companies (Microsoft, Amazon, and Google) or investment funds.

Amazon, for example, did not have such comfort. It was founded in 1994 and went to the stock exchange to raise capital in 1997. Its shares soared during the bull market at the time, but after it ended, it had to face a decline of as much as 95 percent.

The foundations are much healthier

Daniel Kostecki, an analyst at CMC Markets, also points out the significant differences between the current bull market and the one from a quarter of a century ago. – In 1999-2000, investors ignored the lack of profits of companies and were blinded by the pursuit of rising stocks without any basis in their activity – he emphasizes. – Currently, although valuations are high, they are not as high as they were then, and most of the leaders of the Nasdaq index generate solid profits and cash flows. The fundamentals of the companies are much healthier – emphasizes Daniel Kostecki.

– Currently, the rapidly growing AI market segment (for example, the so-called Magnificent 7) consists mainly of large companies with well-established businesses around the world and generating very high cash flows, which are allocated to investments in AI infrastructure. Of course, we may be dealing with a situation in a few years that it will turn out that these companies have overinvested, which may lead to a correction in their valuations, but this should not shake their business models. Meanwhile, a significant part of investments in telecommunications infrastructure in the 1990s and early 2000s was financed by issuing shares or debt, which was a riskier model – emphasizes Michał Krajczewski.

It is worth mentioning here that, alongside technology companies, it was telecommunications companies that became investors’ favorites a quarter of a century ago. It was expected that they would soon start earning a fortune on the development of mobile telephony and offering customers access to the Internet. Among the companies with the highest capitalization in the world were the Japanese NTT DoCoMo, the German Deutsche Telekom and the British Vodafone. However, it turned out that the corporations actually overdid it with their investments (including in licenses for 3G mobile services) and did much worse than investors expected. Their stock prices crashed in 2001, later than the dot-coms.

X

Lower Returns Possible, But AI Is Not Passé

– We are not currently dealing with a revaluation of other market segments in the US, such as the small cap market, or other markets in the world – for example, valuations in Europe in 2000 were as high as in the US, while now we are dealing with record discount levels. We also do not have an IPO boom or secondary share issues. Until we see a significant increase in optimism on the broad market (not only in the narrow group of companies related to AI and Magnificent 7), it will be difficult to talk about the occurrence of a speculative bubble – adds Michał Krajczewski.

In his opinion, however, the risk of lower rates of return in the area of technology companies in the long term compared to other market segments may come true.

– We look with a pinch of salt at how quickly the theses that the technology sector is already passé are currently appearing. We still believe that AI will be the most important investment topic of this decade – adds Kamil Cisowski. However, he expects that this year and the next ones will interrupt the absolute dominance of Magnificent 7 companies on the global stock market, and the stars will be companies smaller by an order or several orders of magnitude.