PZU has announced that it will be offering a fund replicating the rate of return on bitcoin. This means that Poland's largest insurer is (albeit indirectly) entering the cryptocurrency market, offering clients exposure to the most popular digital asset without having to use exchange offices or cryptocurrency exchanges.

– The development of crypto funds around the world, combined with the growing interest in digital currencies among Poles, influenced TFI PZU's decision to establish the inPZU Bitcoin fund – the company's press release stated – This is the first investment fund in Poland aimed at a wide group of investors providing “pure” exposure to bitcoin – we read on the PZU website.

PZU emphasized that the new product will currently be the only fund on the Polish market compliant with the EU UCITS regulation, which imposes a number of requirements on managing institutions aimed at increasing investor protection.

To invest in the TFI PZU fund, the investor does not need to have a brokerage account. The minimum first deposit is PLN 100. The management fee for the bitcoin fund will be 0.5% per annum, as in the case of other inPZU funds. Valuation in PLN will provide currency security.

In terms of technical details, inPZU Bitcoin will be an index fund tracking the Bloomberg Bitcoin Index, which aims to reflect the price of bitcoin in US dollars (USD). At least 80% of the fund's portfolio will be invested in ETCs and ETPs whose underlying asset is bitcoin.

The new fund will go on sale on August 28, 2025, replacing inPZU Sustainable Water Management Sector Shares.

PZU on the cryptocurrency market

In a press release about the new product, PZU outlined the history of bitcoin, dating back to the financial crisis of 2007–2009. In response to the events surrounding it, the concept of a decentralized digital currency emerged, independent of states and central banks, which over time began to develop at an increasingly rapid pace.

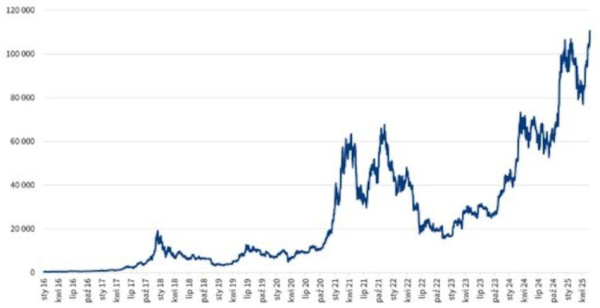

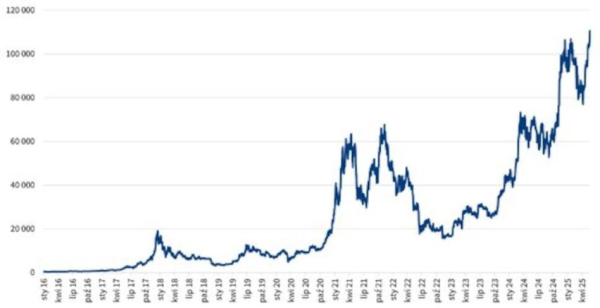

Bitcoin quotes chart (TFI PZU)

The announcement about the new PZU product emphasized that “for many years, professional investors were skeptical about cryptocurrencies due to their susceptibility to speculation (lack of intrinsic value), hacker attacks aimed at stealing digital assets, and regulatory uncertainty,” but in recent years “the perception of cryptocurrencies has clearly improved” and “barriers to the development of this market have begun to disappear.”

– A milestone in this process was the approval in January 2024 by the US Securities and Exchange Commission (SEC) of ETF exchange-traded funds tracking the price of bitcoin. This decision translated into a dynamic growth of their assets under management. Currently, in global funds investing in bitcoin – with a dominant share of asset managers from the US – investors have accumulated assets worth over USD 150 billion at the end of May,” PZU said in a press release.

– The changing perception of cryptocurrencies is also evidenced by the growing interest in them from governments and central banks. In March 2025, President Donald Trump announced plans for the US to create a strategic cryptocurrency reserve, and earlier the Czech National Bank (CNB) announced that it was considering allocating up to 5% of its currency reserves to bitcoin. Additionally, the MiCA (Markets in Crypto-Assets) regulation was adopted in Europe, which increases the security and transparency of this market – which is supposed to increase trust in crypto-assets over time – we read in the release.

A Phrase for the Brave

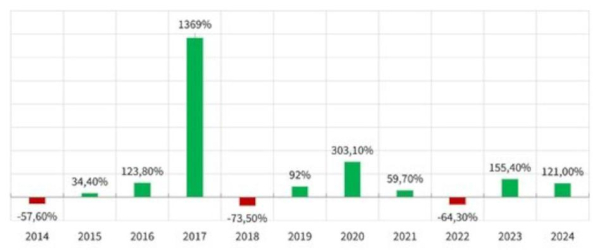

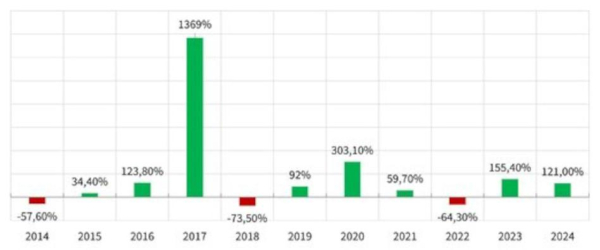

PZU pointed out that the average annual return on investment in bitcoin for the last 10 years was about 85%, while in the same period the technological Nasdaq-100 index achieved an average annual rate of return of 17%. However, the price for a high return is a higher risk. In the announcement of the new product, PZU drew attention to the high volatility that characterizes the cryptocurrency market. inPZU Bitcoin will be the riskiest fund in PZU's offer with a rating of 7/7 on the SRI (Synthetic Risk Indicator) scale.

TFI PZU

M.M.