The seemingly sudden onslaught of recession alarm bells in the United States and around the globe lately might make it easy to panic — but try not to.

Economists, investors, and market observers have started to sound a little extra gloomy when it comes to their economic predictions in recent days. Bank of America and Goldman Sachs have warned of a rising risk of recession, and the infamous yield curve (more on that later) is signaling things might soon get dark. The Dow Jones Industrial Average fell by 800 points on Wednesday, marking its worst day of 2019 and prompting CNBC to declare, in an ominously red graphic, “markets in turmoil.”

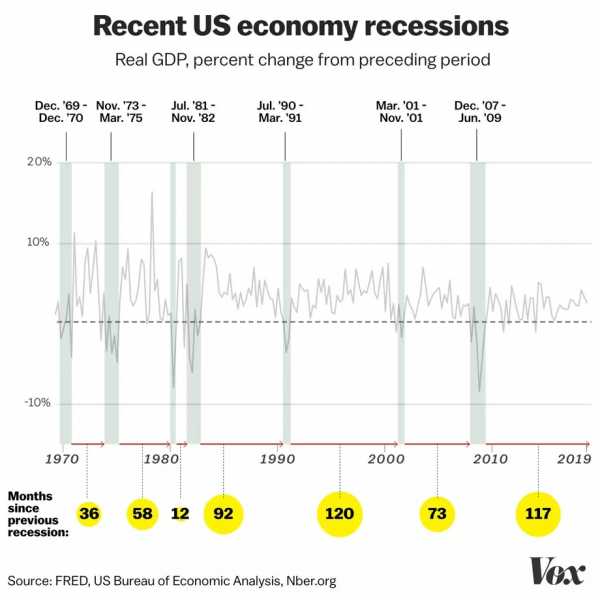

The US economy is in the midst of its longest expansion ever, so why the sudden worry about a recession?

The Great Recession continues to loom large in people’s minds, and millennials who entered the working world in its aftermath still fall behind Gen Xers and baby boomers in terms of homeownership and having children. It makes fears of a recession easy to stir up, especially when there are a few signs of contraction.

The good news is that just because it’s been a while since we’ve had a recession doesn’t mean the US economy is about to take an enormous dive. An old adage among economists is that expansions don’t die of old age; something has to happen to cause them.

And even though certain factors signal a recession might be coming, that doesn’t mean it’s a foregone conclusion — the stock market got extra rocky at the end of 2018, partly because of fears of a recession, and here we are more than six months later and it hasn’t happened yet.

While recessions certainly aren’t great, they’re not usually as bad as the last one. Prior to the recession that started in late 2007, the previous one was in 2001. It lasted for eight months and was so mild that we didn’t know that it was happening until it was basically over.

More on what recessions are, why there’s worry about one now, and what you can do about it (not much, but maybe stay away from your 401(k) for a second), below.

Recessions, briefly explained

A recession essentially means that the economy, instead of growing, gets smaller. Vox explained the more formal definition of it earlier this year:

The manufacturing sector, which declined for two straight quarters this year, is currently, technically, in a recession.

The US economy has seen dozens of cycles of expansions and recessions throughout history — in fact, they used to happen a lot more often, but in the late 20th century they slowed down as periods of growth grew longer. The reason is that “we’re much less of an industrial economy,” Richard Sylla, professor emeritus of economics at New York University, told me earlier this year.

Since about the 1980s, with the exception of the Great Recession, business cycle fluctuations have been a lot less volatile. The ups haven’t been as up, and the downs haven’t been as down. It’s generally been referred to as the Great Moderation. That means recessions aren’t as drastic, but periods of growth that make up for them aren’t as great, either.

Why people are more nervous about a recession now

Recessions don’t just pop up out of thin air — something has to cause one. And right now, there are a handful of factors experts say could do it.

One big issue: President Donald Trump’s trade war with China. Tensions between the US and China have been escalating, and a resolution is looking increasingly unlikely in the near term. At the start of the month, Trump announced he would put a 10 percent tariff on $300 billion of Chinese goods, and China retaliated by stopping buying agricultural goods from the US and allowing its currency to weaken. Amid market turmoil this week, the Trump administration said it would delay its latest round of tariffs from their September 1 start date to December 15, but China shrugged it off.

Goldman Sachs analysts said in a note to clients over the weekend that they “no longer expect a trade deal before the 2020 election” and increased their estimates for how much they think the trade war will affect the economy.

Economists and investors also worry that business investment is slowing — despite the tax cuts that were supposed to juice it — and that the Federal Reserve, which just cut interest rates in July, won’t do it again. The German economy is also showing signs of slowing. Sen. Elizabeth Warren (D-MA) in July warned that she sees “serious warning signs” of an economic crash, including ballooning household debt and potential shocks to the system, such as the debt ceiling and Brexit.

And then there is the “yield curve,” a wonky concept that is often taken as a signal of what’s to come. As Robert Samuelson recently explained at the Washington Post, the yield curve refers to the relationship between short-term and long-term interest rates, generally on Treasury notes. Normally, long-term interest rates are higher than short-term rates because it’s riskier for investors to lend money for longer periods of time. When short-term rates get higher than long-term rates, the yield curve becomes “inverted,” and that’s often a bad indicator. Every US recession for the past 60 years was preceded by an inverted yield curve.

This week, the yield curve inverted.

Vox’s Matt Yglesias explained what it means and why it potentially matters but why it’s not a sign of imminent doom, either:

Former Fed Chair Janet Yellen, in an appearance on Fox Business News on Wednesday, urged caution around the yield curve hullabaloo. “Historically, it’s been a pretty good signal of recession, and I think that’s why the markets pay attention to it, but I would really urge that on this occasion it may be a less good signal,” she said. “And the reason for that is that there are a number of factors other than the market’s expectations about the future path of interest rates that are pushing down long-term yields.”

What you can do (spoiler: not much)

There’s not a whole lot you, personally, can do to prevent a recession, or to prepare for one. Obviously, it’s always good to save and have a rainy day fund in case of emergencies. But that’s not easy for everyone — only 40 percent of Americans have enough savings to cover a $1,000 unexpected expense, according to the personal finance website Bankrate.

Part of the issue with economic and market downturns is that the panic around them can result in self-fulfilling prophecies. People worry something bad is about to happen, so consumers stop spending, investors pull their money out of the markets, or businesses don’t make the investments they were going to, and then that makes things worse.

And if and when the recession hits, a lot of people stick in a holding pattern. They get nervous to change jobs and put off making big life decisions, such as buying a home.

If you do invest in the stock market, now might not be the time to panic and sell everything, and beware that trying to play the market is always tricky. As Yglesias put it:

The bad news is that recessions are pretty inevitable, meaning sooner or later, one will land. The good news is that the economy eventually recovers. The same goes for the stock market. (Honestly, stock market dips are often a good time to buy.)

One person who’s rooting against a recession: Trump, who has tethered his success in office to the economy and the stock market. But if one does come, he already has a plan for whom to blame — the Fed. And, basically, anyone but himself.

Sourse: vox.com