The gaps between perception of the economy and the reality, explained.

Then-President Donald Trump and former Vice President Joe Biden during the final presidential debate at Belmont University in Nashville, Tennessee, on October 22, 2020. Brendan Smialowski and Jim Watson/AFP via Getty Images Nicole Narea covers politics and society for Vox. She first joined Vox in 2019, and her work has also appeared in Politico, Washington Monthly, and the New Republic.

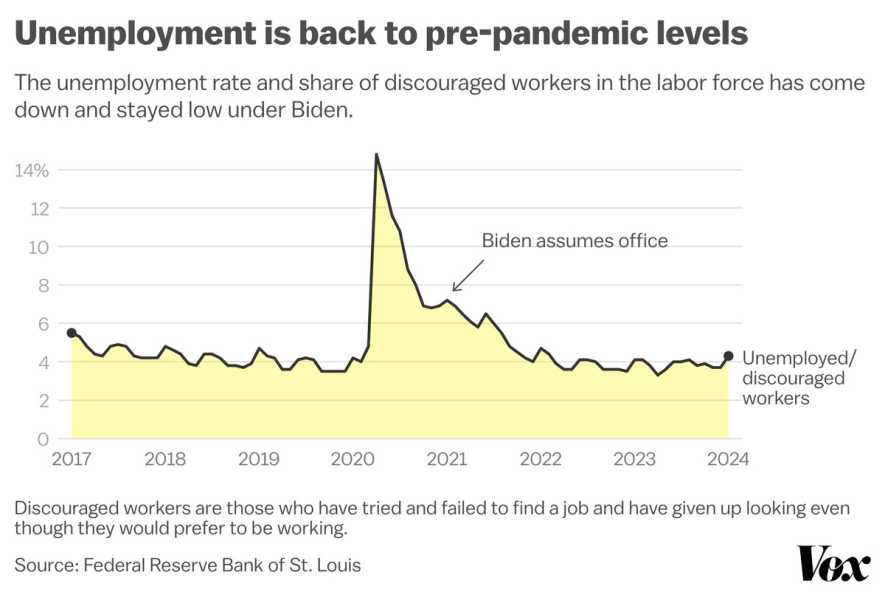

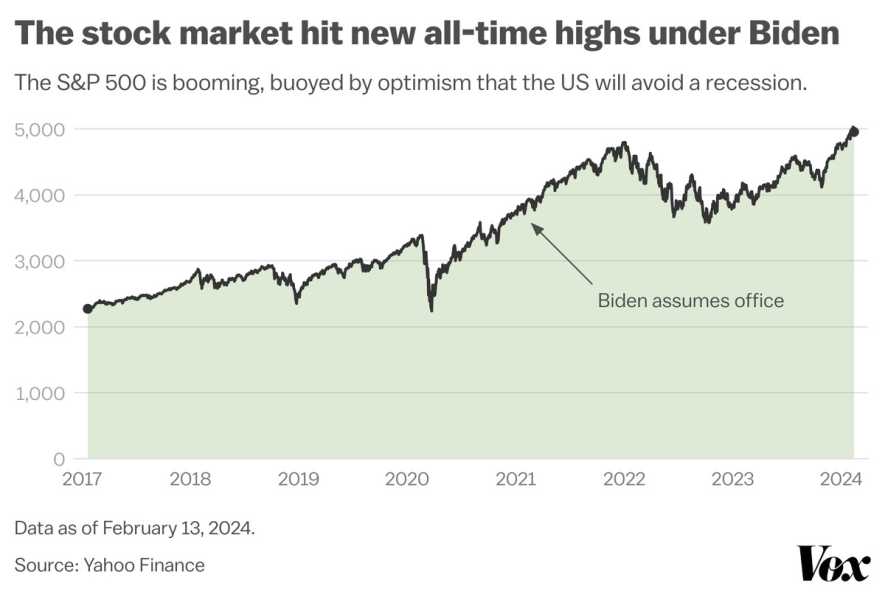

American economic pessimism has been bafflingly persistent despite major indicators showing that the economy is actually strong. Unemployment is low, inflation is down (if sticky), wages are up, the stock market is hitting new all-time highs, and it looks like the Federal Reserve might be able to keep the US out of a recession.

Surveys are beginning to capture growing consumer confidence — but for President Joe Biden, the question is whether it’s rising quickly enough for him to avoid being penalized in the 2024 election.

He had no control over the pandemic-rattled economy he inherited, but voters may nevertheless blame him for it, as they have (rightly or wrongly) blamed their presidents for the country’s economic troubles in the past.

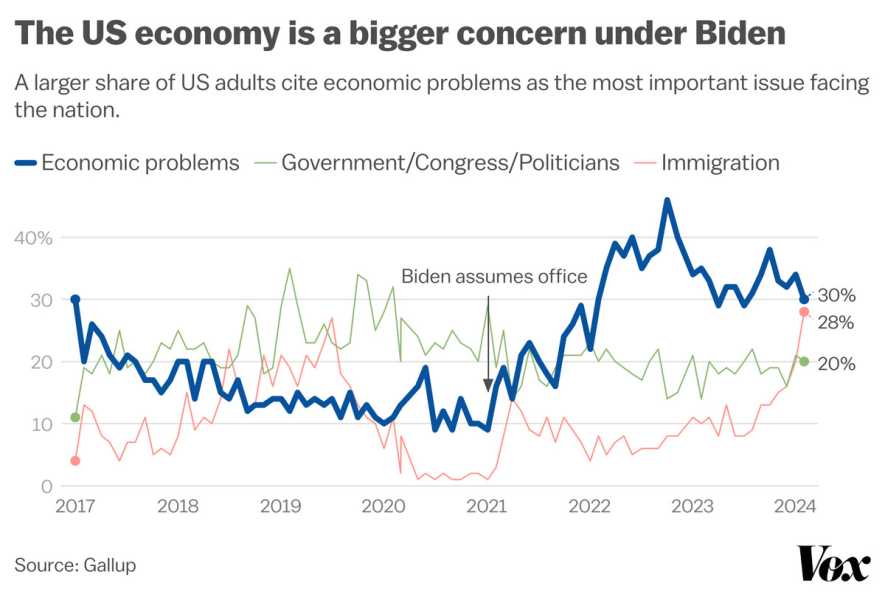

Voters have mentioned economic issues (think: inflation, jobs, and more) as their greatest concern since 2022 in a long-running and ongoing Gallup survey. Another February Morning Consult/Bloomberg survey of voters in swing states also found that the economy is the most important issue — and could therefore decide the outcome of the election.

Recent polls show Trump with an 11- to 20-point edge over Biden on which candidate would better handle the economy. In some ways, this isn’t a surprise: The economy was generally good under Trump, except for the Covid-induced recession; under Biden, high inflation has been the biggest economic story. If Biden is to turn his fortunes around, he’ll have to convince the American public that the economy is in fact better than it feels — and better than they remember under Trump.

“The fundamental problem for Biden and the Democrats is that while the rate of inflation is down, it’s not going backwards,” GOP pollster Whit Ayres said. “It’s hard to persuade people that things are better.”

Americans think the economy is worse under Biden

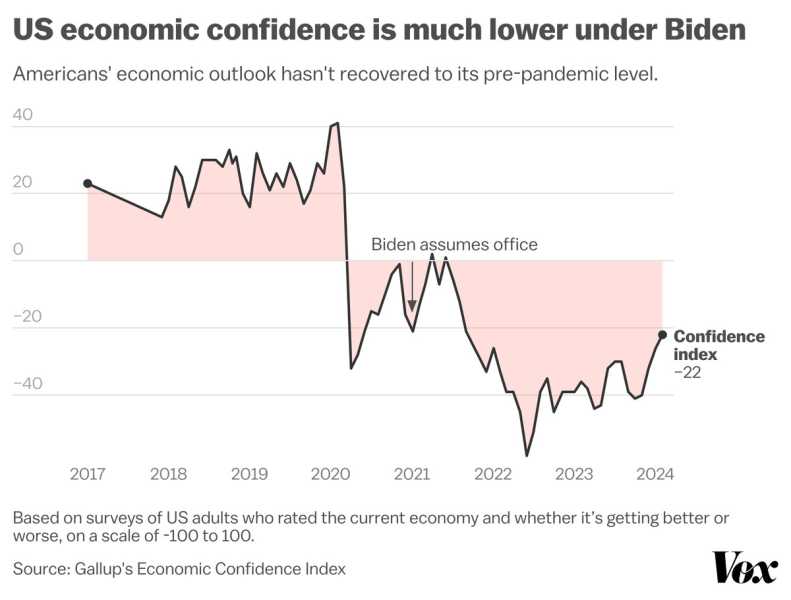

Americans have been stubbornly downbeat about the economy under Biden, with Gallup’s Economic Confidence Index hovering between -20 and -40 for months on a scale of -100 to 100.

That number is derived from monthly surveys of US adults in which they are asked to rate national economic conditions, with 100 signifying that all respondents “say the economy is excellent or good and that it is getting better” and -100 signifying that they all “say it is poor and getting worse,” according to Gallup.

The data suggests that the more economic confidence has plummeted, the more the economy has become an issue in the presidential race. About 30 percent of Americans cited the economy as the most important problem facing the country in the most recent results from Gallup’s running survey (although it’s worth noting that immigration is now climbing fast on this chart).

To be sure, there’s evidence the link between the economy and presidents’ approval might be weakening as partisan loyalties shift — but it doesn’t appear to be gone entirely.

It does seem like things might be finally turning a corner for Biden. Surveys including Gallup’s have shown a marked uptick in economic confidence in recent months, even if the figures are still overall well below what Biden would like to see.

“There has been substantial empirical progress made,” Democratic pollster Fernand Amandi said. “I think if they continue making that case, the public, slowly and surely, will come around by the time they start voting in October and November for president.”

The Biden and Trump economies were both pretty good — but only one president has gotten credit

There’s no denying that the economy was good under Trump, and the 2019 pre-pandemic economy is now seen as a baseline against which Biden’s economy is being judged.

But Trump arrived in office when the economy was already pretty strong. He was “just riding on the coattails of a 10-year-long economic recovery,” said Alí R. Bustamante, deputy director of worker power and economic security at the progressive Roosevelt Institute.

The economy continued to grow modestly on his watch until the pandemic hit in 2020, and after that, his stimulus checks kept it buoyant for a while. The stock market saw significant growth under Trump (and at least for the last year, under Biden, too — more on that later).

But some of Trump’s signature economic policies have also been found to have had little to no measurable effect on the economy — and a few might have even hurt. Multiple studies have shown that the Trump tariffs had at best a neutral effect on the economy and at worst cost America hundreds of thousands of jobs and higher prices for consumers. And his 2017 tax cuts, which increased investment in the economy and contributed to modest wage growth in the short-term, fell far short of Republicans’ promise that they would pay for themselves and are projected to significantly raise federal debt and increase income inequality.

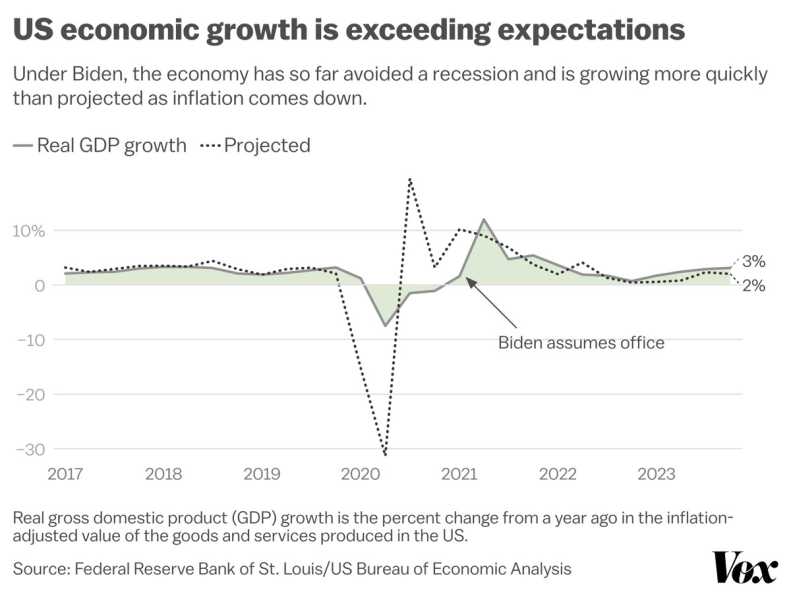

Biden, on the other hand, faced the immediate task upon assuming office of heading off a recession as the country started to bounce back from the pandemic. The US did recover from that pandemic economic slump. But there is evidence that his policies, including the stimulus checks he issued, contributed to an inflationary spiral.

The US did, however, manage to curb inflation faster than other economically developed countries, while also maintaining much lower levels of unemployment and higher wage growth.

The Federal Reserve might deserve most of the credit for that, given its carefully timed interest rate hikes. But Biden also had a very successful legislative record, including the bipartisan infrastructure law and the CHIPS Act — laws that experts say can help bolster the economy. And he took steps to reduce pandemic-induced pressure on supply chains, making it easier for truck drivers to become licensed and allowing some major ports to operate nonstop.

The US economy is growing faster than projected, driven largely by consumer spending and the Federal Reserve’s successful efforts to get inflation under control without triggering a recession.

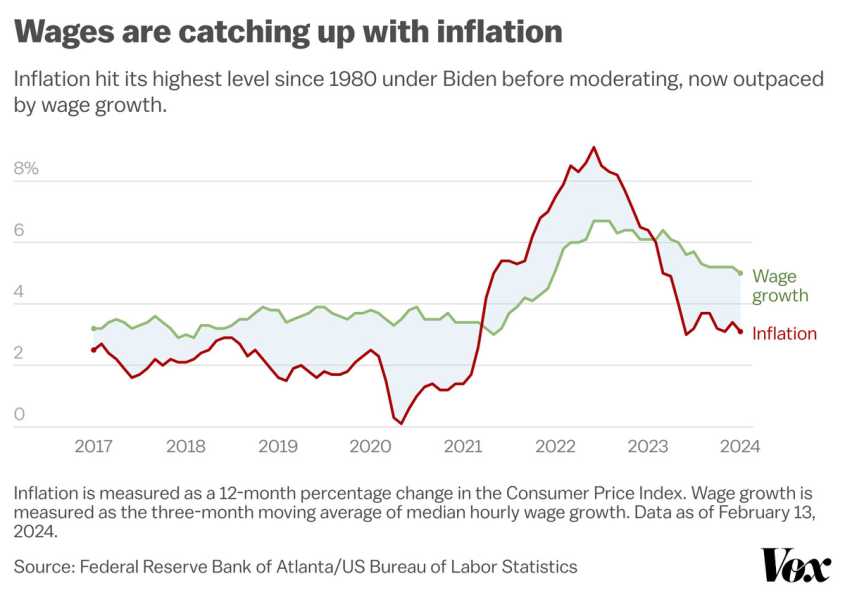

While inflation has come down substantially from its 9.1 percent peak in June 2022, it still remains above the Fed’s 2-percent target rate. But Americans’ wages are now growing faster than inflation, which should relieve some of the pressure of higher prices.

The problem for Biden is that the memory of peak inflation is still fresh, and not everyone has experienced wage growth equally. Bustamante said that younger workers and low earners account for the lion’s share of wage growth in the current economy.

The president should speak to these challenges, acknowledging that “some people are suffering and things are not exactly where they want it to be” without selling short what’s working, Amandi said.

What is working is Biden’s strategy on jobs.

Unemployment reached its lowest level since 1969 under Biden, and the US gained a record 7.27 million new jobs in 2021, fueled by a recovery in the labor market as vaccines became available and the country opened up. Job creation has remained strong in the years since, but slowed to 2.7 million jobs added in 2023.

The stock market has also been setting new record highs after growing a whopping 24 percent last year — driven by optimism that the Fed will soon cut rates and that companies in the tech and energy sectors have outperformed expectations.

This means that Trump no longer has the only claim to a strong stock market during the last few years. Instead, he’s had to resort to claiming credit (unconvincingly) for the current market. For instance, he recently posted on Truth Social that the US was experiencing a “TRUMP STOCK MARKET” in anticipation of him winning the 2024 election.

Biden’s challenge is speaking to Americans who are still hurting

The picture of the economy isn’t entirely rosy.

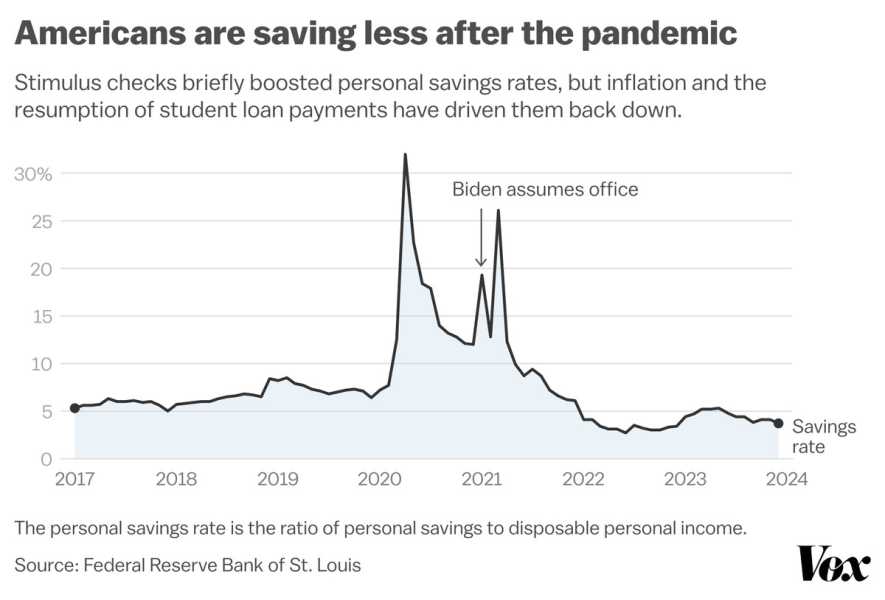

After a brief spike in savings rates during the pandemic due to a series of stimulus checks, Americans are now saving less than they were pre-pandemic. There are a few reasons for this: Of course, everything costs more, but interest rates are also higher, meaning that it’s now more expensive to borrow. And higher borrowing costs have eaten into Americans’ savings.

In spite of all of that, Americans are still buying stuff in droves, and not just necessities: Restaurants, airlines, and hotels have been some of the biggest beneficiaries.

There’s a question, however, of how long this can last before the money dries up.

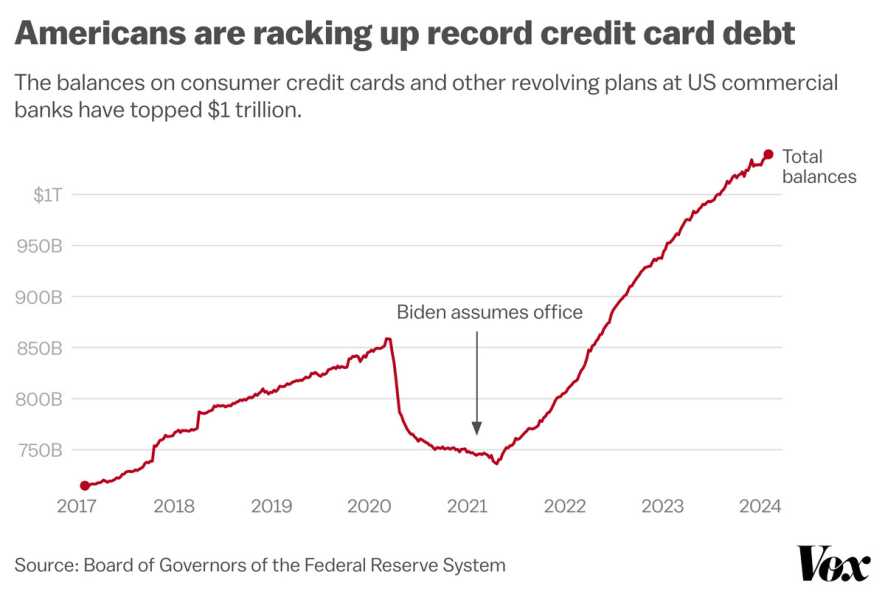

Americans are pulling from their now-depleted savings and amassing record-high debt on credit cards and other revolving plans in which consumers can repeatedly borrow money up to a set limit and repay in installments. Young adults in particular, many of whom are also struggling with high student loan debt, are increasingly falling behind on their credit card payments. At some point, something has to give.

This might be part of the reason why many Americans still yearn for the economy in 2019, when they had more cash on hand and didn’t have to resort to putting purchases on a credit card.

Still, Bustamante isn’t too worried about the long-term economic impacts, given that the Fed is expected to cut interest rates this year, which should provide relief to households carrying large balances and make it easier for them to pay off debt. But if the Fed waits much longer, Americans might not feel the effects before the November election.

So while most of the economic indicators spell good news for Biden and for America, the question is whether he can persuade voters who feel otherwise and remain nostalgic for Trump’s economy.

“The general perception is that the economy was better before the pandemic than it is now,” said Ayres, the GOP pollster. “And that perception is powerful politically.”

Sourse: vox.com