President Donald Trump propelled himself to the White House in part by promising to revive American manufacturing and deliver high-paying jobs to that industry’s workers. One plank of his plan for accomplishing that goal was the $1.5 trillion tax cut bill Republicans passed in December. That legislation, however, is on track to be much more beneficial to shareholders than it is workers across all sectors — and perhaps especially in manufacturing.

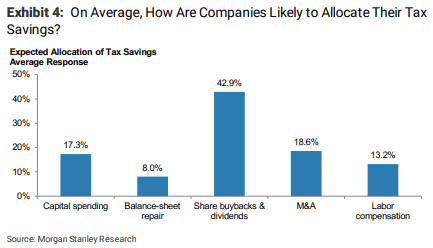

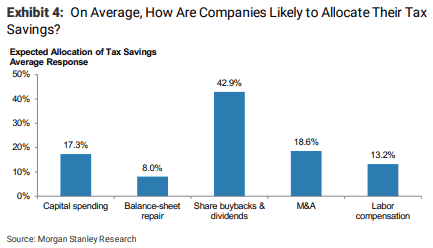

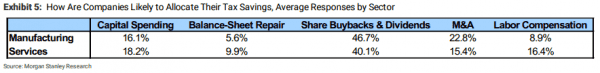

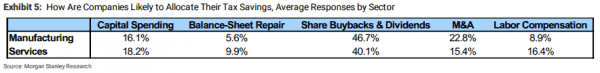

On Thursday, Morgan Stanley analysts said they expect companies in general to pass just 13.2 percent of tax cut savings directly to workers, while 42.9 percent will go to share buybacks and dividends, which largely benefit shareholders and executives who hold large amounts of their companies’s shares. In manufacturing, the split is even more drastic: Analysts think 46.7 percent of tax savings will go to buybacks and dividends, while just 8.9 percent will go to worker pay. (New York Times tax and economics reporter Jim Tankersley flagged the split on Twitter.)

Wages in the manufacturing industry are going up, but not as quickly as they are across all sectors. According to the latest jobs report from the Bureau of Labor Statistics, they increased by 2.9 percent across all industries from January 2017 to January 2018. During the same period, wages in the manufacturing industry increased by 1.9 percent.

That’s not to say the industry isn’t improving. Manufacturing added 18,000 jobs in January alone, and has added 186,000 jobs over the past year. Trump brought it up in his State of the Union address, calling the job growth “tremendous.” It’s not entirely attributable to Trump, though. (A weaker dollar — which makes it easier for American companies to sell products abroad — and a growing global economy have helped.) In terms of worker wage increases, what happened in January was more likely a result of a tightening labor market than it was the tax bill, given the tax measure went into effect at the very end of 2017.

The tax bill could certainly help workers — but it’s probably going to help corporations and shareholders a lot more.

That American corporations would be inclined to use their new tax savings to benefit shareholders isn’t exactly a surprise. In November, at an exclusive event for CEOs before the tax cut was passed, National Economic Council Director Gary Cohn had an awkward moment: When John Bussey, an associate editor at the Wall Street Journal, asked whether the bill would lead executives to increase capital investment, only a few hands went up. “Why aren’t the other hands up?” Cohn asked. (As a former Goldman Sachs president and chief operating officer, Cohn probably well aware that companies are inclined to reward their shareholders more than their workers when they get a fresh infusion of cash from the government.)

Following the tax bill’s passage, a number of corporations announced bonuses, wage increases, and investments — Apple, Walmart, and AT&T among them — largely, it seemed, for PR purposes.

Bonuses and higher wages are very good for workers, obviously, and in the long run the tax bill could help with that. But that’s not its main purpose. The Republican tax bill is designed to disproportionately benefit corporations and their shareholders. The GOP just doesn’t want to admit that.

Sourse: vox.com