The New York Fed president is the second most important economic policymaker in the country — a person whose views have vast influence over the unemployment rate and the wages and bargaining power of tens of millions of employed Americans.

The bank’s board of directors has, according to the Wall Street Journal, decided to recommend John Williams to the permanent position. Williams, on the one hand, is a seasoned monetary economist with a long history in academia and public service. But he also has a track record of extremely poor judgment on the crucial issues he’d handle in the post.

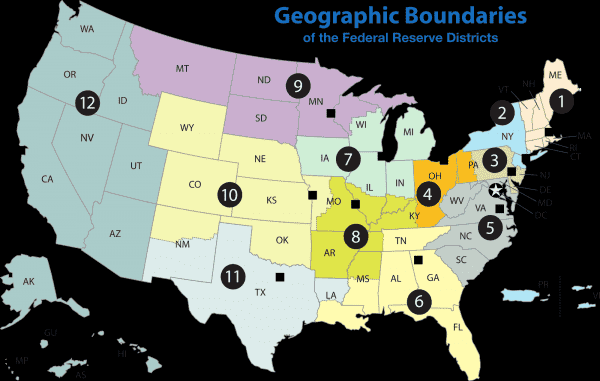

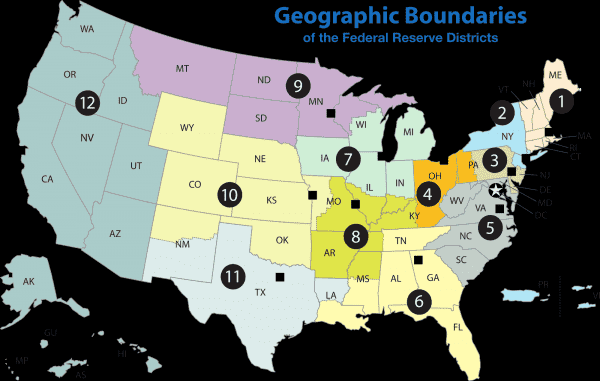

The Federal Reserve Bank of New York is first among equals in the 12-region system that makes up the overall Federal Reserve. Since its domain includes New York City, it has specific regulatory authority over many of the most significant financial institutions in the country and serves as the Fed’s eyes and ears on Wall Street.

It’s also the bank that actually conducts the open market operations through which the Fed conducts monetary policy. And because of that, unlike the other regional Fed banks, the New York Fed’s president gets a permanent seat on the Open Market Committee that votes to decide when to raise and lower interest rates.

Williams has a troubling history on this specific front and others. If the Fed had agreed with his stated position in 2015 and 2016, the unemployment rate would be higher today than it is. He also regulated Wells Fargo when the bank perpetrated massive fraud. So while on paper Williams is an ideal candidate, his actual performance is a red flag.

Williams keeps wanting to pull the plug on recovery

Over the course of 2008 and 2009, the United States fell into a nearly unprecedented hole of job losses. At the time, many expert analysts expected the severe recession to be met by an equally sharp bounce-back, producing an extremely rapid “V-shaped” economic recovery. That didn’t happen. With the Fed unwilling to push interest rates below zero or engage in other forms of outside-the-box activism and Congress limited in the amount of fiscal stimulus it was willing to pass, the actual pace of recovery proved painfully slow.

This led many observers, Williams included, to believe that, in effect, the recovery would never come and the sharp drop in labor force participation associated with the long recession was a permanent feature of the American economy.

- In February 2015, Williams predicted we’d be at full employment by the end of the year.

- He said it again the next month.

- By March 2016, he was so convinced that the economy had no more room to grow that he was calling for more and faster interest rate increases.

- Then in May 2016, he confidently proclaimed, “We’re basically at full employment — or very near it.”

That month the unemployment rate was, indeed, pretty low, at 4.7 percent. But it’s fallen even further to 4.1 percent since then — and with the labor force participation rate rising as well, the economy has managed to add 4 million jobs since Williams was ready to declare victory.

Williams’s thinking on this topic was by no means crazy or far outside the mainstream. But it was incorrect. And, critically, the strength the American economy has demonstrated since Election Day is fundamentally built upon the fact that former Chair Janet Yellen rejected this viewpoint and chose to press ahead with demand-led recovery.

Had Williams’s views prevailed, we would not only have a million or two fewer people working, but all employed Americans would have less bargaining power, lower wages, and dimmer prospects for securing a raise. And his record on the Fed’s other responsibility, bank regulation, is no better.

Williams oversaw the failed regulation of Wells Fargo

If the New York Fed is the most important of the regional banks, the Federal Reserve Bank of San Francisco, which Williams currently runs, is almost certainly No. 2. Because the national system was set up more than 100 years ago, the 12th District run out of San Francisco is just incredibly large compared to the others and contains far and away the largest share of the nation’s population and economic activity.

The San Francisco Fed’s vast territory covers a huge array of financial institutions, but the biggest of them by far is Wells Fargo, one of the largest banks in the country.

That means, of course, that it was under Williams’ watch that Wells Fargo perpetrated a massive fraud scandal involving the creation of millions of accounts that customers didn’t ask for. During this period, Williams appointed and then reappointed Wells Fargo CEO John Stumpf to be the San Francisco Fed’s official representative on the central Fed board’s advisory council — with Stumpf only stepping down as a result of pressure from the US Senate.

Williams’s appointment is not quite a done deal

The way the Federal Reserve System works is that the New York Fed’s board of directors merely recommends a candidate, who must then be confirmed by the full Federal Reserve Board of Governors based in Washington.

That board is supposed to have seven members, but due to vacancies, it currently has just three — Jay Powell, who was recently tapped by Trump to serve as the board’s chair; Randy Quarles, whom Trump appointed to lead the Fed’s regulatory efforts; and Lael Brainard, an Obama appointee who almost certainly would have played a prominent role in a Hillary Clinton administration.

And activists are running for Williams. Shawn Sebastian, who runs the Center for Popular Democracy’s work on Federal Reserve issues, notes in a statement that the New York Fed vacancy doesn’t actually arise until 2019, and consequently, “there is no reason the New York Federal Reserve Board can’t restart this process to choose the right candidate.”

And Sen. Cory Booker (D-NJ), whose state lies mostly within the New York Fed’s purview, released a Bloomberg op-ed Monday calling for the Fed to offer more diversity — in terms of both demographics and professional background — in its regional bank selections, a test that Williams clearly fails.

Realistically, though, Williams is perfectly well-qualified — a background of service leading the second most influential regional bank is great preparation for leading the most important one — so it’s extremely difficult to imagine the Fed Board rejecting him. The Fed prides itself on its institutional independence and an image as being above politics, which makes it exactly the kind of place where a solid résumé is absolutely the credential that a person needs. A track record of sound policy judgment hasn’t traditionally been a major consideration.

Sourse: vox.com