You may have heard President Donald Trump say that the US economy is booming right now.

That’s an exaggeration, but the economy is definitely growing, as the latest economic indicators show.

But why doesn’t it feel like the economy is growing? The answer is pretty simple: Because economic growth is not really benefiting the average American worker.

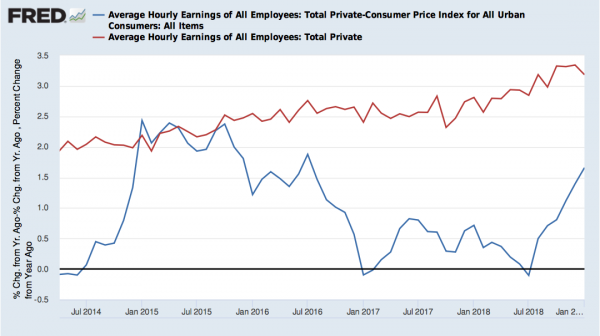

The chart below says it all. The red line shows that overall wages are growing faster than they have in a long time — about 3 percent per year. That’s great, right? Not really. Look at the blue line. That’s the actual wage growth when you factor in inflation and cost of living (based on the Consumer Price Index).

Real wages only grew 1.9 percent in 2018.

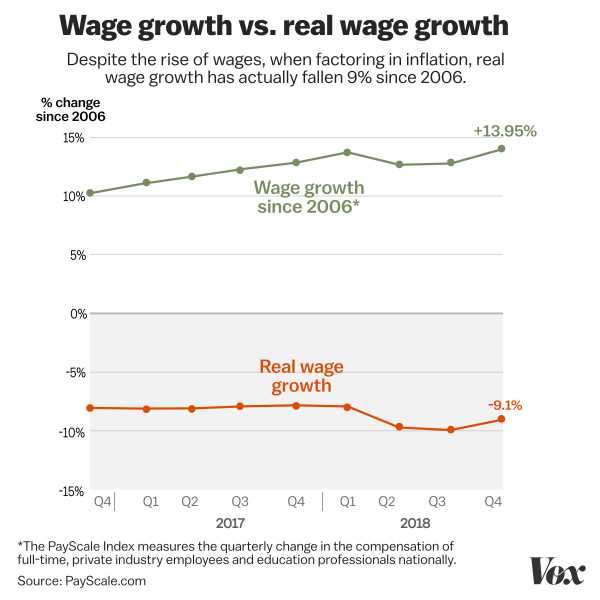

Here is another measure of income growth, which shows a similar trend. This shows that wage growth still hasn’t caught up to 2006 levels. The chart below is based on data from Payscale.com, which includes government statistics and business surveys.

Taking all this into account, it’s no surprise that many Americans aren’t experiencing an “economic miracle” under Trump. Nearly half — 48 percent — of Americans say they believe economic conditions are worsening. That’s up from 45 percent in December and 36 percent in November, according to a January Gallup poll.

The slow wage growth problem probably has a lot to do with that.

Economists don’t understand why pay is barely rising

Slow income growth has been the most persistent problem afflicting the US economy since the recession ended, around 2010. Wages have barely kept up with the cost of living, even as the unemployment rate dropped and the economy expanded.

Mainstream economists have been baffled by this. Free-market economics revolves around a simple theory: When unemployment is low, employers will be forced to raise wages to keep and attract workers. That has happened in past economic expansions, but low unemployment has not boosted wages much in the past two years —at least not fast enough to keep up with the cost of living.

In January, private sector workers (excluding farmworkers) got an average 3-cent hourly raise, adding up to an average hourly pay of $27.56. In the past 12 months, average hourly earnings have only increased 85 cents, or 3.2 percent, and that doesn’t even take inflation into account.

January’s 3-cent average hourly wage hike suggests that the trend has not really shifted.

It’s true that wages are rising faster than they have in a decade, but that’s only because the US economy collapsed 10 years ago. Comparing current wage growth to recession-era wage growth sets a pretty low standard.

And over the past year, prices rose, so paychecks had to stretch further. When the 1.5 percent inflation rate is taken into account (based on the Consumer Price Index), workers’ wages only grew about 1.7 percent within the past year — a pathetic amount compared to the sky-high payouts to corporate CEOs.

Frustration over stagnant wages is also the major underlying factor behind widespread worker strikes across the country in places like California, Oklahoma, and West Virginia. Congressional Republicans had promised that their massive corporate tax cuts would help the average worker, but the gains have been meager.

The tax cuts did more harm than good

GOP’s signature economic policy achievement, the Tax Cuts and Jobs Act, did little to boost wages and business investment.

In November 2017, the president assured Americans that slashing taxes on corporations and private businesses would provide the “rocket fuel our economy needs to soar higher than ever before.” And when Trump signed the tax bill on December 22, 2017, in the Oval Office, he also promised that businesses would invest those tax savings in their businesses and give “billions and billions of dollars away to their workers.” He pointed to a handful of big companies that promised to raise wages and give employees $1,000 cash bonuses — among them Walmart, Bank of America, and Comcast.

More than a year later, economic data shows that the tax bill’s benefit to workers never materialized.

The left-leaning Economic Policy Institute recently crunched compensation data from the Bureau of Labor Statistics, showing that the much-touted bonuses did little to boost workers’ paychecks. In the past 12 months, cash bonuses only gave workers an extra 2 cents in average hourly compensation, adjusted for inflation. (This does not include bonuses tied to productivity goals.)

Instead, US companies have spent a record amount of money this year buying back shares of company stock, an effort to inflate their value for shareholders. US corporations have announced spending $1 trillion on stock buybacks so far this year. That’s a 64 percent increase from 2017, according to CNN Business. So it’s no mystery why the savings from the GOP tax bill didn’t trickle down to workers. Only a handful of companies (34 from the Fortune 500) said they are using the tax savings to invest in US operations.

Economists do believe the tax bill helped boost overall economic growth — for a little while, at least. The economy was growing at about 2.2 percent a year since the end of the recession in 2009, and then hit 2.9 percent last year.

Economists expect growth to slow more in 2019, then fall even further in 2020.

Wall Street banks are already preparing for the US economy to slow down. The International Monetary Fund also expects the global economy to cool down this year, partly because of the trade dispute between the world’s two largest economies: the United States and China.

So to recap, instead of rocket fuel, the tax cuts ended up being more like a sugar high. They gave the US economy a brief jolt while triggering an $800 billion hole in the federal budget.

The average American worker is still waiting for the promised economic boom.

Sourse: vox.com