Two months after Republicans passed sweeping tax legislation, just a quarter of Americans report seeing a change in their paychecks. Unsurprisingly, those on the higher end of the pay scale are likelier to have noticed an increase in their take-home pay, compared to those at the lower end.

A Politico/Morning Consult poll released on Wednesday found that 25 percent of registered voters say they have noticed an increase in their paycheck under the new tax law; 51 percent say they haven’t seen any change, and 24 percent aren’t sure. Republicans are likelier to say they’ve seen a difference, though the number isn’t incredibly high: 32 percent of self-identified GOP voters say they have seen a larger paycheck, compared to 21 percent of Democrats, and 22 percent of independents.

Thirty-seven percent of employed voters say they have seen an uptick in their pay, but 53 percent say they haven’t. The highest earners are likeliest to say they’ve noticed a difference: 40 percent of those making over $100,000 a year say their paychecks have increased, compared to 33 percent of those in the $50,000 to $100,000 range and just 16 percent of those making under $50,000 annually.

That the tax bill would make a more notable difference for high-income Americans is not surprising — that’s largely how the legislation is designed. It is most beneficial to corporations and the wealthy, particularly the ultra-wealthy.

According to the Tax Policy Center’s analysis of the legislation, the lowest 20 percent of earners (with an income of $25,000 or less) should see an average tax cut of $60 this year, and those in the second-lowest 20 percent should see a reduction or $380. Spread those across 24 paystubs, assuming a bimonthly payment scheme, and that results in about $2.50 per paycheck for the lowest earners and $16 for the second-lowest.

The top 20 percent of earners, on the other hand, should expect an average cut of $7,640, or about $320 per paycheck. And the top 1 percent of earners should receive an average $51,000 cut, which comes out to about an extra $2,100 every two weeks.

To be sure, anything extra in people’s paychecks is a good thing. But it also makes sense that high earners are likelier to notice a difference than lower earners, given the scale of the differences the tax bill is making in their pay. An extra couple of dollars in your bank account isn’t easy to spot if you’re not looking for it — and it’s hardly something to write home about.

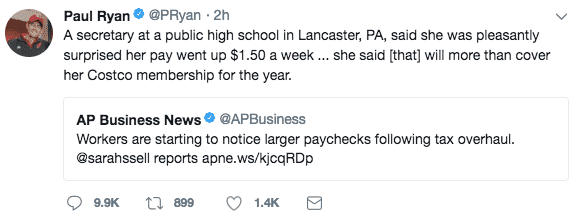

House Speaker Paul Ryan (R-WI) was hammered earlier this month when he tweeted an item about a public school employee, thanks to the GOP tax bill, seeing an extra $1.50 in her weekly paycheck that would cover the cost of her annual Costco membership. He later deleted the tweet.

The tax bill is getting more popular, little by little

Even though many Americans might not perceive a difference in their own personal finances because of the tax bill, the legislation does appear to be creeping up in popularity.

A poll released Monday by the New York Times conducted by SurveyMonkey found that 51 percent of Americans approve of the tax law now, compared to 46 percent in January and 37 percent in December, when the law was passed.

A late January Monmouth University poll found that 44 percent of voters approved of the tax plan and 44 percent disapproved. In December, 26 percent of those surveyed said they approved of the bill and 47 percent disapproved.

Wednesday’s Politico/Morning Consult poll found that support is more stagnate, with 45 percent of voters viewing the tax bill favorably and 35 percent opposing it, the same result as a poll from January.

Republicans have held that their tax plan will become more popular over time and help buoy them in the 2018 midterms. “Results are going to be what makes this popular,” Ryan said in an interview with CNBC in December. While some voters appear to be warming up to the bill, that most of them aren’t noticing it might not be the best of signs for the GOP, either.

Sourse: vox.com