There comes a time in every recession when people, for reasons both sincere and cynical, start to get really worried about the federal budget deficit. Recessions lead to a collapse in tax revenue and increased use of safety net programs, and typically require extensive fiscal stimulus — all of which pushes up the deficit in the short run.

This last arose in early 2010, when unemployment was nearly 10 percent, and Barack Obama to his discredit encouraged the shift, having presided over the massive (and still inadequate) $787 billion recovery plan the previous year.

Now the shift is happening again, in the wake of the major $2 trillion stimulus bill signed by President Trump — and barely a month after mass unemployment began to set in due the Covid-19 crisis. “Record debt load poses risk of fiscal ‘tipping point’” blared a Washington Post headline, printed on the front page, above the fold, of the print edition.

More ominously, Senate Majority Leader Mitch McConnell forcefully rejected the idea of offering aid to states and local governments that are hundreds of billions of dollars underwater, saying, “given the extraordinary numbers that we’re racking up to the national debt … we need to be as cautious as we can be.”

“We can’t borrow enough money to solve the problem indefinitely,” he told reporters.

This is, to be frank, an outrageous time to give a shit about the federal budget deficit, or about the debt (the accumulated total of past deficits, plus interest). The US in the very early stages of the worst economic downturn since the Great Depression, and he true unemployment rate is likely around 15 to 20 percent. In Michigan alone, unemployment claims amount to over 35 percent of total employment.

Congress’s stimulus measures to date have been helpful, but clearly inadequate in the face of the crisis before us. The US needs investment on the scale of the New Deal or greater to meet this challenge, and worrying about deficits promises to strangle the recovery in the crib.

To be sure, there are times when worrying about the debt makes sense. Countries like the US that print their own currency can in principle always pay their debts, but there’s a risk that doing so would involve printing so much money that hyperinflation ensues. If that were a real danger, the US should be thinking twice about massively expanding the deficit.

But inflation, let alone hyperinflation, is not a real danger at this moment. According to the Fed’s preferred measure, inflation was well below its 2 percent target even before coronavirus hit. Inflation is thus too low to get unemployment to where we need it to be, as has been true for quite some time. The Fed’s preferred measure of inflation excludes food and energy, but oil prices have fallen to historic lows too.

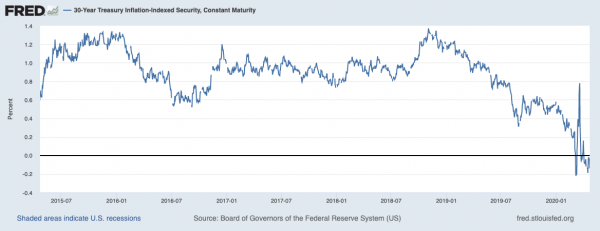

Another way to tell if the deficit is a problem is by checking Treasury yields, or the interest rate that investors earn on bonds they buy from the federal government. If the federal government had to pay, say, 10 percent annual interest (plus inflation) on new borrowing, that could quickly force it to either eat up much of its budget on interest payments, pay the debt off by printing money (thereby risking hyperinflation), or else cut spending/raise taxes to pay off the debt the traditional way.

But that is not happening with Treasury yield. For 30-year loans — the longest in term and thus riskiest of US government bonds, which force investors to predict what the federal government will be capable of paying back in 2050 — yields are now literally negative. That means the federal government could theoretically borrow $1 trillion entirely in its highest-yield bonds, to be paid back over three decades, and have to pay back less than $1 trillion.

Investors are literally paying the US governments to run deficit rights now. They are practically begging Congress to take out more and bigger loans.

McConnell’s refusal to oblige will likely mean that fiscal stimulus is much smaller than it should be, gravely endangering the recovery. This happened the last time around, too, and the consequence was an austerity-provoked slowdown in growth, with mass unemployment the consequence. The same happened across Europe, and some politicians, including former British finance official George Osborne, are already urging austerity measures.

Austerity is not just a bad strategy for the United States. It could — ironically — also be bad for Mitch McConnell and his party. A deep persistent depression would arguably be fatal for Trump’s and the Senate GOP’s reelection prospects. Big, ambitious stimulus could stave off that fate. Democrats are willing to work with them on it, so this really would be a self-inflicted wound if the Republicans insist on not doing more on the stimulus front.

By worrying about the deficit prematurely and not shoveling even more money to aid the recovery, McConnell and his fellow conservatives may end up hurting millions of Americans’ lives — and their own political future.

The last deficit turn, and this one

You can already see a turn toward deficit scolding emerging among the usual suspects.

Robert Samuelson, a Washington Post columnist and career deficit scold, has been railing against mainstream economists’ emerging consensus that sustained budget deficits aren’t particularly bad. The coronavirus makes him want to return to Gilded Age-era borrowing practices, where debt was only undertaken to fight wars and buy Alaska. “Except for the Great Depression, this consensus generally served the country reasonably well,” he concludes. Cool!

GOP senators are even blunter. “Our annual deficit this year will approach $4 trillion. We can’t continue on this course,” Rand Paul admonished. And a hard line was recently taken in a news analysis in the New York Times. “The spending surge has implications beyond the usual deficit tug of war,” wrote the Times’s Carl Hulse. “It could prompt inflation, and it also leaves the nation far less prepared in the event of another emergency.”

Some of DC’s most venerable deficit hawks are, to their credit, urging deficit spending is the near term. “Combating this public health crisis and preventing the economy from falling into a depression will require a tremendous amount of resources — and if ever there were a time to borrow those resources from the future, it is now,” Maya MacGuineas of the Committee for a Responsible Federal Budget (CRFB) admonished.

But groups like CRFB are already laying the groundwork for a pivot back to austerity, arguing, “just as World War II was followed by years of fiscal responsibility to restore debt to historic levels, it will be important after the crisis and recovery to ensure that debt and deficits return to more sustainable levels.” This kind of mentality, expressed so early in our economic crisis, can only threaten to cut short any recovery efforts much too soon.

This all feels very familiar. In late 2008, as the US was spiraling further into its worst economic downturn since the Great Depression, Christina Romer, the UC Berkeley economist whom Barack Obama had selected as his chief economist, prepared a memo of stimulus options for Obama to review.

To fully repair the economy by the first quarter of 2011, she estimated, would require a “combination of spending, taxes and transfers to states and localities … costing about $1.8 trillion over two years.”

The memo did not make it to Obama. According to Noam Scheiber’s book The Escape Artists, when Romer showed her estimate to fellow Obama adviser Larry Summers, he dismissed the number as too high. She then prepared a memo where the most expensive option was $1.2 trillion. Summers still thought it too high, telling her, per Scheiber, “$1.2 trillion is nonplanetary.” That was his way of saying “ridiculous” or “out of this world.” Congress eventually passed, and Obama signed, a $787 billion package.

Summers reportedly wanted the $1.8 trillion in stimulus as much as Romer did — he just thought Congress would reject it as a joke, and prevent the Obama administration from getting anything. This was his calculation when Democrats were set to have 59 out of 100 Senate seats and a big House majority.

And Summers was probably right about the political prospects of a $1.8 trillion bill. Obama’s much-too-small stimulus package was roughly $100 billion smaller than it was originally going to be because Republican Sens. Susan Collins (ME), Olympia Snowe (ME), and Arlen Specter (PA) demanded it be made smaller in exchange for their votes, out of concern about the deficit.

In the wake of the stimulus passing, the Obama administration went from being forced into austerity by Congress to acquiescing to austerity of its own volition. There was an internal battle between Romer and Summers, who urged Obama to focus on the recovery, and Treasury Secretary Tim Geithner and budget chief Peter Orszag, who urged him to pivot to austerity.

Geithner and Orszag won. In February 2010, Obama appointed centrist Democrat Erskine Bowles and former Republican Sen. Alan Simpson to run a commission meant to slash the deficit. The administration proposed a budget slashing deficits by $1.2 trillion over 10 years, including a freeze on domestic spending for three years.

“We simply cannot continue to spend as if deficits don’t have consequences; as if waste doesn’t matter; as if the hard-earned tax dollars of the American people can be treated like Monopoly money; as if we can ignore this challenge for another generation,” Obama admonished. “We can’t.”

Obama was wrong. The austerity regime augured by his budget proposal and further entrenched under pressure by the new Republican House majority in 2011 deeply hurt the economic recovery. In the third quarter of 2009, per the Hutchins Center at the Brookings Institution’s estimates, fiscal policy added 2.78 percentage points to GDP growth, fueling the recovery. All of that came from the federal government; states in the grip of austerity politics actually reduced growth.

But by the third quarter of 2011, with austerity politics ascendant at the federal level as well, fiscal policy was reducing growth by 2.15 points.

Put another way, in the third quarter of 2011, the economy grew at an annual rate of 0.9 percent. If it hadn’t been for austerity, it would’ve grown by 3 percent. The recovery would have proceeded much, much faster, and millions of people would have been spared the physical and mental suffering of unemployment, without an austerity regime.

We know what happens when we allow austerity to happen during a deep recession. There’s no excuse for Congress to allow this pattern to repeat itself, especially when Mitch McConnell and his party would stand to gain from additional stimulus.

In 2009, Republicans at least had the excuse of facing off against a Democratic administration — sabotaging the recovery would help them politically. That was a rational strategy to take then.

It’s not a rational strategy to take now. Forget the deficit, Republicans. The economy and the people who make it run need help now. Who knows — taking bold action now may even help you in November.

Support Vox’s explanatory journalism

Every day at Vox, we aim to answer your most important questions and provide you, and our audience around the world, with information that has the power to save lives. Our mission has never been more vital than it is in this moment: to empower you through understanding. Vox’s work is reaching more people than ever, but our distinctive brand of explanatory journalism takes resources — particularly during a pandemic and an economic downturn. Your financial contribution will not constitute a donation, but it will enable our staff to continue to offer free articles, videos, and podcasts at the quality and volume that this moment requires. Please consider making a contribution to Vox today.

Sourse: vox.com