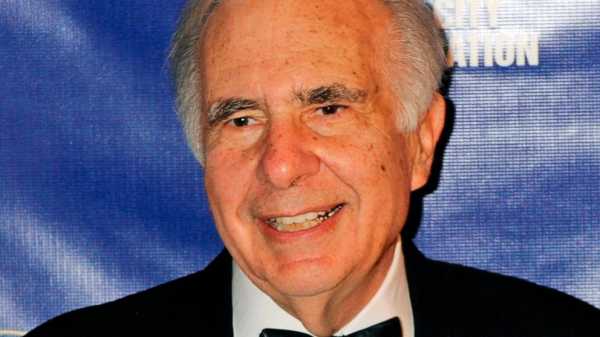

WASHINGTON — The business empire of corporate raider and activist investor Carl Icahn continues to tumble amid the fallout following a recent report from short-selling firm Hindenburg Research — and losses are accelerating as a longtime rival echoes the firm's allegations.

In the report, published on May 2, Hindenburg claimed that Icahn Enterprises has been using inflated asset valuations. The report also pointed to “ponzi-like economic structures” at the holding company — alleging that Icahn has used money from new investors to pay out dividends to old ones. Based in Sunny Isles Beach, Florida, Icahn Enterprises has stakes in businesses ranging from food packaging and automotive to real estate and pharmaceuticals.

Since Hindenburg released its short position, the market value and stock for Icahn Enterprises (IEP) has plummented. The company's market cap was cut by more than half this month — from about $18 billion on May 1 to $7.01 billion Thursday — and IEP's stock has fallen almost 63% since the start of May.

Hindenburg is well known for short-selling. That involves borrowing a stock one expects to lose value and selling it at its current market price with the plan to buy the same number of shares back later at a lower price.

Icahn has pushed back against Hindenburg, with the billionaire calling the firm's report “self-serving" and “intended solely to generate profits on Hindenburg’s short position at the expense of IEP’s long-term unitholders.”

In a following May 10 statement, Icahn promised that the company would “take all appropriate steps to protect our unitholders and fight back.”

But some critics of Icahn, a Wall Street legend who is well-known to target weak companies and sell them for parts, say the report's findings feel like a full-circle moment.

"There is a karmic quality to (Hindenburg's) short report that reinforces the notion of a circle of life and death," Bill Ackman, CEO of Pershing Square Capital Management and longtime rival of Icahn, wrote on Twitter on May 2.

Ackman double-downed this week — sharing a longer Wednesday tweet that touched on multiple factors surrounding the Icahn Enterprises fallout, including a questioning of why Icahn has not diclosed the terms of his market loans and market lenders' potential concerns over the situation, pointing to the recent involvement of the Justice Department.

The U.S. Attorney’s office for the Southern District of New York contacted Icahn Enterprises on May 3 to seek information related to the company and its financial, according to a company SEC filing on May 10 — one week after Hindenburg published its report. Icahn Enterprises said it was cooperating with the request.

“The U.S. Attorney’s office has not made any claims or allegations against us or Mr. Icahn with respect to the foregoing inquiry,” Icahn Enterprises said in the filing at the time. “We do not currently believe this inquiry will have a material impact on our business, financial condition, results of operations or cash flows.”

On Thursday, one day after Ackman’s most recent tweet, Icahn Enterprises’ stock had fallen more than 20%.

“Icahn’s favorite Wall Street saying 'If you want a friend, get a dog.' Over his storied career, Icahn has made many enemies. I don’t know that he has any real friends. He could use one here,” Ackman wrote on Wednesday.

Ackman and Icahn's feud dates back decades, including a 2003 deal involving Hallwood Realty that led into a yearslong business dispute.

The feud reached its peak in 2013, when Ackman denounced Herbalife as a pyramid scheme and bet heavily against the nutrition supplements company by using short trades — Icahn, however, vehemently disagreed and increased his stake in Herbalife. The two later got into a shouting match on live television.

Sourse: abcnews.go.com