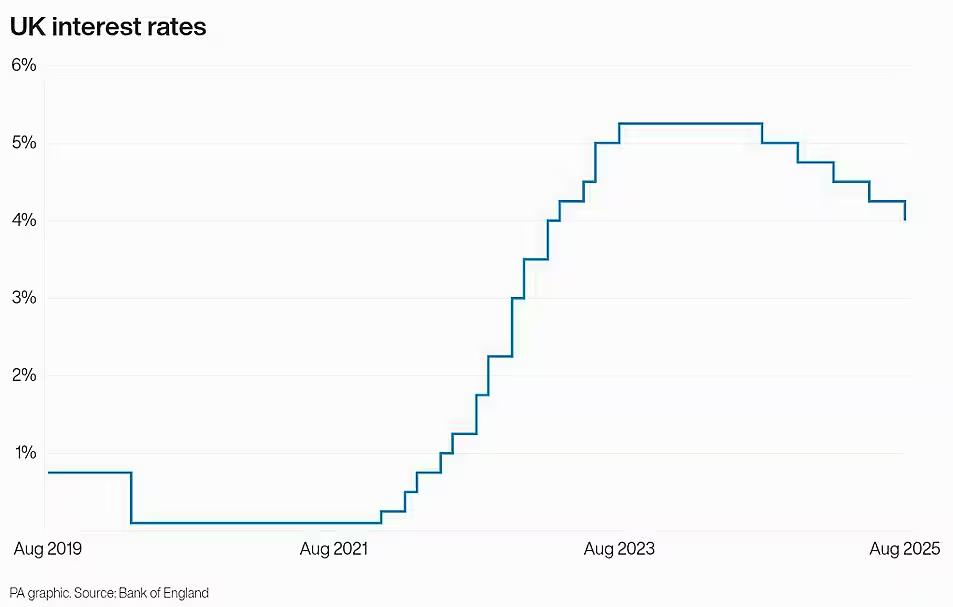

UK interest rates have been cut to their lowest since March 2023 despite the Bank of England's forecasts of a sharp rise in inflation due to rising food prices.

The central bank decided to cut interest rates to 4% from 4.25%, citing a recent decline in wage inflation and reduced uncertainty over US tariffs.

The cut came after the Bank's nine-member committee held a second vote on interest rates for the first time in its history.

The Bank of America's Monetary Policy Committee (MPC) initially voted to cut rates by 0.25 percentage points, with four members voting to keep rates at 4.25% and one, Alan Taylor, voting to cut by 0.5 percentage points.

Governor Andrew Bailey then led a second vote, in which Mr. Taylor backed cutting the rate to 4%, securing a five-to-four majority.

Mr Bailey said: “We cut interest rates today, but it was a carefully considered decision.

“Interest rates continue to fall, but any further reductions must be done carefully and gradually.”

Budget Chancellor Rachel Reeves welcomed the interest rate cuts, a move that is likely to reduce the government's debt servicing costs.

It comes after warnings from think tank NIESR that the Chancellor may have to find an extra £40bn through tax rises or spending cuts in his autumn Budget to balance the public finances.

In April, after Ms Reeves' first budget was passed, businesses were already facing significant increases in taxes and wage costs.

In a new report, the Bank of England warned that UK companies reported that rising National Insurance contributions and uncertainty over tax rises were “putting pressure on growth”.

However, the Bank raised its economic growth forecast for the current year, projecting that GDP (gross domestic product) will grow by 1.25% in 2025, up from its previous estimate of 1%.

This comes despite recent data from the Office for National Statistics showing the economy contracted in both April and May.

Bank officials said the economy likely still grew 0.1% from the second quarter and predicted that growth would continue throughout the year amid expectations that lower interest rates would spur spending.

Meanwhile, inflation is expected to accelerate in the coming months, putting further pressure on household budgets.

Consumer price index (CPI) inflation is now on track to peak at 4% in September, above the previous forecast of 3.5%.

According to the Bank, the rise in the cost of living is largely due to the increase in energy and food prices.

Food prices have risen sharply in recent months, with beef, chocolate and coffee rising particularly fast.

The September inflation figure could also have an impact, as it is typically used to determine how much

Sourse: breakingnews.ie