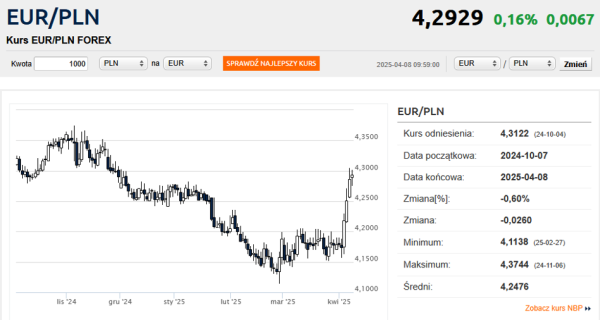

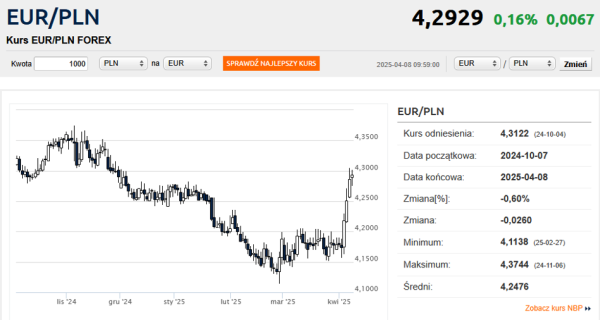

The repercussions of the global trade war and the prospect of interest rate cuts at the National Bank of Poland caused the złoty to squander its first-quarter profits over the previous four sessions. The euro exchange rate quickly reached the border of PLN 4.30.

The global trade war is now a fact of life. On Thursday, the US government imposed prohibitive import tariffs on all major trading partners. On Friday, China responded with similar tariffs. On Monday, President Trump threatened 50 percent tariffs on Chinese goods. And on Tuesday, leaks appeared about the European Union's tariff response to the US.

In such a situation, currencies of small and relatively open economies are exposed to strong turbulence resulting from panicky investor reactions. Additionally, the złoty was damaged by Thursday's conference (or rather its very ending) of the NBP president Adam Glapiński, who directly suggested a 100-point reduction in interest rates.

This “hundred-point bomb” hit the złoty on Thursday. But it was the global sell-off of risky assets that pushed the euro to its highest levels in 2025. On Tuesday at 9:50, the euro was trading at PLN 4.3013, 1.5 groszy higher than Monday's reference rate. However, yesterday, the euro was trading at PLN 4.3047, the most expensive since November.

Advertisement See alsoWe recommend: up to PLN 300 bonuses for a new account at Bank Pekao, with a multi-currency card

– We basically assume that in the medium term the złoty may continue to lose value against the euro and the dollar, with the relative stabilization of EUR/USD. The resistance band for EUR/PLN is around 4.33-4.36. Today at the opening, however, the złoty is slightly stronger, around 4.28, with the euro gaining against the dollar – wrote analysts at Bank Millennium.

– It seems that the initial, violent market reaction is already behind us, hence investors will be looking for signals in the market environment that would be conducive to generating at least a temporary rebound in already heavily discounted investment assets – economists from PKO BP noted in turn. – If such a move is initiated by global players, the EUR/PLN exchange rate has a chance to go down to the range of 4.25-4.28, in our opinion – they added.

There is also a lot of volatility in the world's most important currency pair. The EUR/USD exchange rate has been in the 1.0780-1.1150 range in recent days, making moves in a day that would normally take a month or two. On Tuesday morning, the euro was valued at 1.0939 USD.

In the domestic arena, this translated into the dollar at PLN 3.9233, slightly cheaper than on Monday evening. Paradoxically, the USD/PLN exchange rate is now more stable than the EUR/PLN. This is because the jumps in the “Eurodollar” quotes are dampening the rising quotes of the Euro-Zloty pair.

This mechanism does not work on the franc-zloty pair, where on Tuesday morning the Helvetian currency was more than a grosz higher, reaching a price of almost PLN 4.57. A day earlier, the Swiss franc cost PLN 4.6150 in gusts and was the most expensive since November.