If many average Americans aren’t noticing or loving the tax cut bill yet, it might be understandable — it benefits the wealthy by design. And a congressional report released this week shows that one specific new deduction for so-called “pass-through” companies is heavily benefiting the rich.

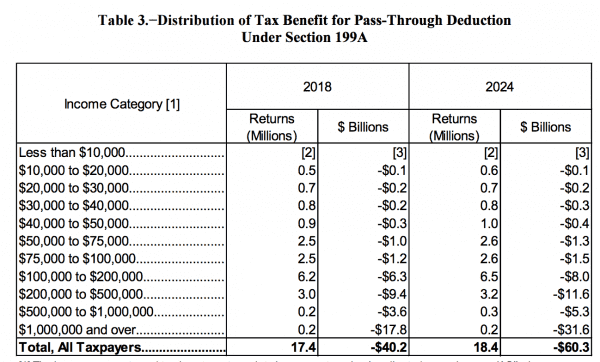

The Joint Committee on Taxation on Monday released a report outlining some of the initial effects of the tax law passed in December. (NBC News was first to report on it.) The committee estimates that the owners of pass-through entities — companies organized as sole proprietorships, partnerships, LLCs, or S corporations that don’t pay corporate income taxes — will save $40.2 billion in 2018 thanks to the tax bill.

Of that total, $17.4 billion will go to individuals and households making more than $1 million per year. (Revenue estimators are based on tax returns, so a married couple filing jointly is one taxpayer, and a married couple filing separately are two.)

By 2024, the committee estimates pass-throughs will save $60.3 billion on taxes via the new law. More than half of the benefit — $31.6 billion — will go to individuals and households earning more than $1 million.

How the new tax law benefits wealthy business owners

Pass-through companies have their income “passed through” to their owners to be taxed under the individual income tax rate instead of the corporate rate. The vast majority of US businesses are pass-throughs, including those owned by President Donald Trump — his Trump Organization is structured as a collection of pass-through entities.

Under the previous tax law, such companies could be taxed as much as 39.6 percent, the individual rate for the highest earners.

Under the new tax regime, pass-throughs get to deduct up to 20 percent from their income before they’re taxed. Aaron Krupkin and Howard Gleckman, analysts at the Tax Policy Center think tank, called the deduction “extremely generous” for those who qualify it, noting the law as it’s written is complicated to navigate. (So much for simplifying the tax code.)

The Joint Committee on Taxation’s Monday analysis showed just how generous the pass-through change is. Those making $1 million or more will reap $17.8 billion of the total $40.2 billion benefits of the law in 2018, or about 44.3 percent, and those making over $500,000 will get $3.6 billion. In other words, people making over $500,000 will get more than half of the entire benefit this year.

And by 2024, it will be even more skewed. Pass-through tax breaks will total $60.3 billion, with those making $1 million getting $31.6 billion and those making $500,000 getting $5.3 billion in tax benefits.

“Congress advertised the pass-through deduction as relief for ‘small-business,’ but in reality, it mainly benefits the one percent, as JCT’s table demonstrates,” said Steve Rosenthal, a senior fellow at the Tax Policy Center.

The GOP put in guardrails meant to curb some of the benefits for the pass-through deduction. The law restricts the ability of providers of “specified services” — for example, doctors, lawyers, and athletes — to claim the pass-through deduction if they make more than $157,500 a year, or double that for married couples. It also limits the deduction with a complicated formula based on the wages a business pays to employees.

“Those were intended to focus the benefits more on small business, but apparently it didn’t really disturb the fact that pass-throughs are overwhelmingly held by high earners,” Rosenthal said.

In December, Ari Glogower, an assistant professor of law at Ohio State University, outlined at Vox the multiple ways rich people can game the new Republican tax bill, and much of it focused — surprise — on pass-throughs. And he noted at the time the guardrails on the pass-through deductions are not hard to skirt:

The tax bill is great for corporations and rich people

The Republican tax bill cut the corporate tax rate to 21 percent from 35 percent and disproportionately benefits corporations and the wealthy. The Tax Policy Center last year estimated nearly 83 percent of the tax bill’s benefit goes to the richest 1 percent of Americans.

Which explains why the tax bill isn’t quite as popular as Republicans had hoped and is a complicated sell to 2018 midterm voters.

A recent Gallup poll found that 52 percent of Americans still disapprove of the tax bill, while 39 percent approve. That’s sort of a step up from December — when 56 percent said they disapproved of the bill, 29 percent said they approved, and more were undecided — but it’s still not great.

A February Politico/Morning Consult poll found that most voters say they haven’t seen any change in their paychecks, which isn’t to say that there have been no changes but rather that they’re just not that noticeable.

Remember when House Speaker Paul Ryan tweeted about that school worker who was getting an extra $1.50 in her check? Square that with the pass-through millionaires.

Sourse: vox.com