Those who observed the sharp drop in crude oil prices had every right to expect a significant drop in fuel prices. However, this did not happen. Retail prices for diesel or petrol barely budged, despite the fact that the price of Brent crude oil was at its lowest point in over 4 years.

Since early April, Brent crude has fallen from around $75 to $63 a barrel. On Wednesday, it was priced below $60 a barrel for the first time since February 2021. This is, of course, the result of fears that President Trump's tariff wars will paralyze international trade and reduce fuel demand.

It would seem that in such a situation we would see significant price reductions at the pumps quite quickly. Nothing of the sort! Yes, some downward corrections could be seen, but so far they have been rather cosmetic. At the end of the past week, the average retail price of Pb95 petrol was PLN 5.98 and was only three groszy lower than a week earlier – according to data from BM Reflex.

Diesel fuel was refueled at an average of PLN 6.06/l , which is only 4 gr/l cheaper than a week ago. Both ON and Pb95 were the lowest average retail prices in half a year. The last time we saw average prices below PLN 6/l was at the turn of September and October last year. At that time, Brent oil cost USD 75-80 per barrel.

Bankier.pl based on BM Reflex data

It should be noted that we are refueling much cheaper than a year ago. The average retail price of Pb95 on April 10 was 69 gr/l lower than 12 months ago, while diesel fuel fell by 67 gr/l during that time. Only autogas prices remain at levels significantly (i.e. 26 gr/l) higher than in April 2024.

What do fuel prices depend on?

Let's start with the fact that fuels could be much cheaper if it weren't for the taxes imposed by the government. From every liter of petrol or diesel purchased, over 40% goes to the state . If, for example, the VAT rate was still 8%, petrol could cost around PLN 5.00/l, and diesel PLN 5.10/l. In addition, the government could abolish the “emission fee” introduced by its predecessors, which would allow for a further 10 groszy/l reduction in gross prices.

Secondly, global fuel trade is settled in US dollars. And here, in the last few dozen hours, we have also received very good news. On Friday before noon, the dollar cost just under PLN 3.76 and was the cheapest since June 2021. This is therefore another argument for the decline in retail fuel prices expressed in PLN.

However, taxes, oil and the dollar alone are not everything. After all, we do not fill up with oil, but with ready-made fuels. And the cost of the raw material is only a dozen or so percent of the price of gasoline. Here, fuel prices on world exchanges are decisive. At the end of the week, a gallon of gasoline in New York was valued at around $1.95. On Wednesday, it was even less than $1.90 and the lowest since September. However, these were still not low prices by the standards of what we had become accustomed to before the Russian invasion of Ukraine in February 2022.

Meanwhile, diesel prices have hit their lowest levels since 2021. The fuel for London's ICE was priced at just under $600 per tonne. That's over $100/t less than at the end of February.

Cheaper wholesale, cheaper retail?

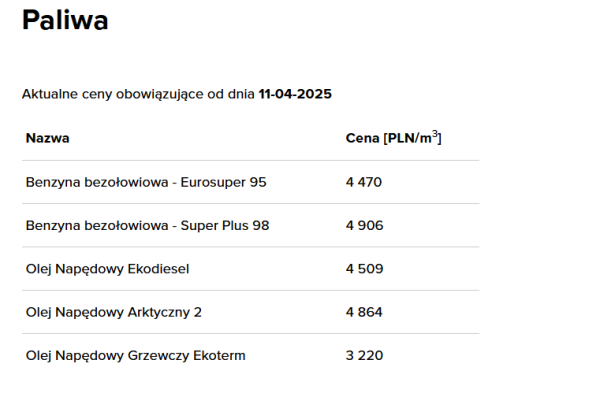

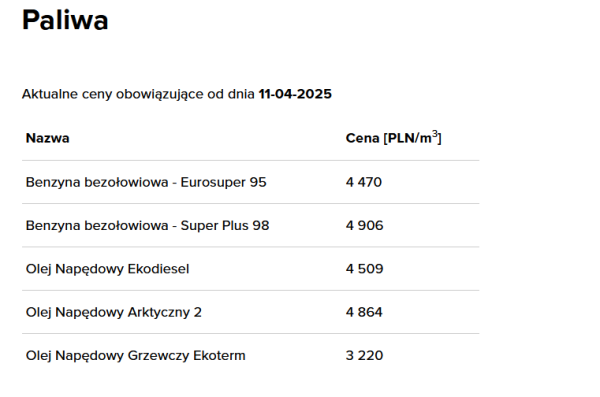

And only then are these prices transferred to the Polish wholesale market, and from there, with considerable delay, only then do they “percolate” to retail. On April 11, Orlen offered Eurosuper95 petrol at PLN 4,470/m3, which after adding 23% VAT translated to PLN 5.50/l. This is as much as 26 gr/l less than a week ago! If such wholesale prices were maintained in the following days , petrol at stations could easily cost less than PLN 5.80/l.

It is similar in the case of diesel oil, which in the Friday price list of Orlen was listed at PLN 4,509/m3, or about PLN 5.55/l after adding VAT. This is as much as 27 gr/l cheaper than a week ago . In such a situation, a liter of ON at stations may soon cost significantly less than PLN 6.

PKN Orlen

It is an open question what pricing policy the largest station operators, led by Orlen, will adopt. In the recent past, there have been more than one instances where prices on pylons have fallen very slowly and only to a small extent have reflected the situation on the wholesale market. Here, everything depends on the strength of competition on local (i.e. in individual cities or counties) markets and on the pricing policy of the largest players.