The threat of a collapse in international trade on Monday morning sparked a panic sell-off in Asian stock markets, with investors rushing to sell stocks and calling for a rate cut from the Federal Reserve.

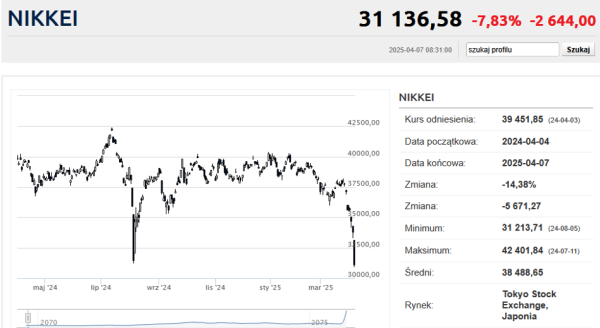

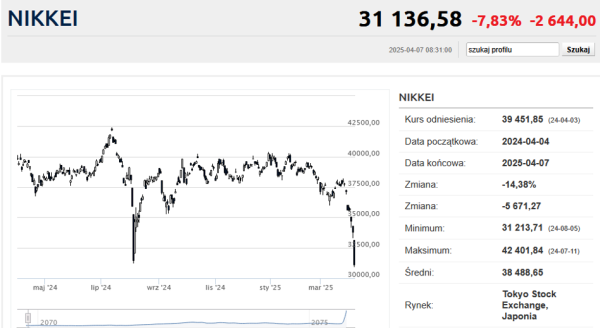

Japan’s Nikkei 225 ended Monday trading down 7.83%, matching lows set during last year’s August crash. Singapore fell 7.6%, erasing gains over the past six months and heading for its sixth straight session of declines. Hong Kong’s main index fell nearly 12%. In Taiwan, the TAIEX index plunged 9.7% to its lowest point in more than a year.

It is the export-oriented countries of East Asia that may suffer the most from the prohibitive tariffs proposed by President Donald Trump’s administration. Over the weekend, the White House signaled that he intends to maintain the new course in tariff policy, imposing tariffs of several dozen percent on goods imported from Korea and Japan, not to mention China (in the case of the People’s Republic of China, the rate is expected to reach 54%).

Read also

Tariff War Becomes Real. Massive Stock Selloff on Wall Street

The introduction of such high tariffs threatens to disrupt international trade and paralyze the world economy, economists warn. And in the best-case scenario, a sharp but temporary recession. “The scale and devastating impact of U.S. trade policy, if maintained, could be enough to push the American and global economies into recession,” said Bruce Kasman, chief economist at JP Morgan. He estimated the chances of recession at 60%.

After China’s response on Friday, we have in practice a global tariff war, which reminds the more pessimistic people of the situation preceding the Great Depression of the 1930s. That was also when the Americans started, introducing the disastrous Smoot-Hawley Act. This act introducing prohibitive import tariffs in the US – not the Wall Street crash – gave birth to the Great Depression.

Investors are growing concerned about Donald Trump’s policies, which are effectively trying to tax global trade. Global corporations are changing their business plans, and strategists are lowering their economic forecasts, fearing the effects of retaliatory tariffs imposed by countries around the world. There is huge uncertainty in both business and financial markets. After all, no one can guarantee that President Trump will not change his mind in a day or two.

– Donald Trump administration officials have signaled that no policy changes are planned to address the massive sell-off in markets, Win Thin, managing director of Brown Brothers Harriman & Co, told PAP. – Given this news, the sell-off in stock markets is likely to continue, Win Thin warned.

Monday’s “massacre” in Asia followed very sharp declines on Wall Street and in Europe on Thursday and Friday. As usual in such situations, speculation about Federal Reserve intervention immediately began to appear on the world’s financial markets. Over the past three decades, the Fed has accustomed large capital holders to the idea that it will do everything to prevent the prices of financial assets from falling too much. Now the futures market is betting that the FOMC will cut the federal funds rate by 25 basis points in a month. Just a few days ago, such a reduction was expected in June at the earliest.

Asian slumps have reached the Vistula River

Monday’s session in Europe also began with deep declines. In Germany, the DAX fell by over 10%. The economy of our western neighbor is focused on the export of industrial products and American tariffs may ruin this business model. In London, the FTSE100 lost over 5% after opening, and in Paris, the CAC40 went down by 5.7%.

WIG20 also fell by less than 6.3% after half an hour of trading to below 2,300 points, after falling by as much as 6.4% on Friday and by 4.1% on Thursday. The previous two sessions on Książęca were the worst since February 2022. All WIG 20 components started the day in the red. But again, banks fell the most. Alior’s quotations fell by 10%, PZU by 8.4%, and Sandander and Pekao by over 7%. The relatively strongest were Żabka and Kęty, which were the only ones to lose less than 4%.

Since the March bull market peak, WIG20 has been discounted by almost 19% and was on the verge of entering a technical bear market, understood as a distance from the last peak by over 20%. However, the sell-off continued across the broad market, where after 30 minutes of trading only 5.6% of shares were growing, and as many as 89% (!) were in the red. Annual minimums in prices at the beginning of the session were reached by 29 companies, including companies such as KGHM, Bogdanka, JSW, Amrest, Autopartner, and Vercom. The lowest in history was the price of Pepco, which for the first time was below PLN 14 per share.

The turnover was noteworthy, which after 50 minutes of trading amounted to almost PLN 800 million on the broad GPW market and over PLN 640 million on WIG20 companies. The largest exchanges concerned Orlen shares, where the turnover at that time exceeded PLN 130 million. PKO (PLN 88 million) and KGHM (PLN 67 million) were also eagerly traded. Their prices lost around 5-6%.

Futures on US indices were in deep red. At 9:15 a.m., S&P 500 futures were trading 4.5% below Friday’s close. Nasdaq futures were down 5.2%.

On the commodity markets, the further decline in crude oil was visible. Brent crude fell by 4.4% and cost USD 63.06 per barrel. These are the lowest prices for this commodity in over 4 years. After a huge drop of almost 1% on Friday, the price of silver was rising. Gold futures fell by 0.5% and were valued at USD 3042.24/oz.

The cryptocurrency market was no different, losing money throughout the weekend, due to the fact that trading in them takes place non-stop throughout the week. The price of bitcoin was around $75,000, which meant a drop of over 4%. Over the week, the price of the first cryptocurrency fell by 9%, but from the historical peak in January, it has already fallen by over 31%. Altcoins did even worse. The price of ethereum lost over 7% and was below $1,500. Solana was paid less than $98 after a drop of 7.3%, the price of ripple fell by 13% and was below $1.70. The capitalization of the entire crypto market fell below $2.4 trillion according to coinmarketcap.com, which means a drop from the record January capitalization of $1.35 trillion.

We plan to continue this topic.