America’s monopoly problem, explained by your internet bill

We should be asking the government and corporate America how we got here. Instead, we just keep handing over our money.

By

Emily Stewart

Feb 18, 2020, 7:00am EST

Share this story

-

Share this on Facebook

-

Share this on Twitter

-

Share

All sharing options

Share

All sharing options for:

America’s monopoly problem, explained by your internet bill

-

Reddit

-

Pocket

-

Flipboard

-

Email

This story is part of a group of stories called

In the summer of 2017, I decided it was time to put on my big-girl pants and try to talk to my internet provider about my bill. It had been gradually ticking up over the past several months without explanation — let alone better service — and I wanted to know what was up. When I called the company’s customer service line, the woman on the phone knew something I did not: I didn’t really have other service options available in my area. So, no, my bill would not be reduced.

More than two years later, I’m still mad about it. And yes, that could seem a little petty. But that monthly annoyance speaks to a broader trend that all Americans should be aware of — and angry about. Across industry after industry, sector after sector, power and market share have been consolidated into the hands of a handful of players.

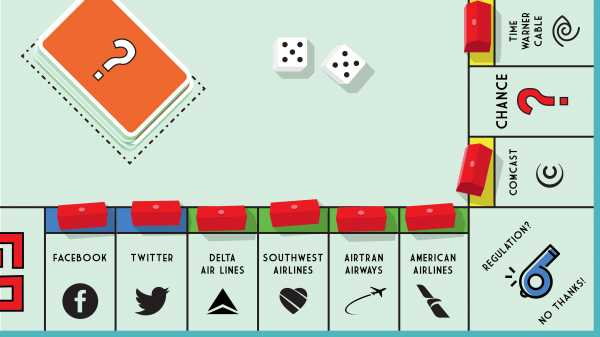

Lately, you’ve probably heard a lot of complaints about the size and scope of big tech companies: Facebook, Google, Amazon, and Apple. But competition is lacking across countless industries, including airlines, telecommunications, lightbulbs, funeral caskets, hospitals, mattresses, baby formula, agriculture, candy, chocolate, beer, porn, and even cheerleading, just to name some examples. When you look, monopolies and oligopolies (meaning instead of one dominant company, there are a few) are everywhere. They’re a systemic feature of the economy.

When you look, monopolies and oligopolies are everywhere. They’re a systemic feature of the economy.

There’s little denying that since the 1970s, the way antitrust has been approached in the United States has led to a landscape where a smaller number of big players dominate the economy. Incumbents — companies that already exist — are growing their market shares and becoming more stable, and they’re getting harder and harder to compete with. That has affected consumers, communities, competitors, and workers in a variety of ways.

Proponents of the laissez-faire, free market thinking of recent decades will say that the markets have basically worked themselves out — if an entity grows big enough to be a mega-corporation, it deserves its status, and just a handful of players in a given space is enough to keep prices down and everyone happy. A growing group of vocal critics of various political stripes, however, are increasingly warning that we’ve gone too far. Growth and success at the top often doesn’t translate to success for everyone, and there’s an argument to be made that strong antitrust policies and other measures that curb concentration, combined with government investments that target job-creating technology, could spur redistribution and potentially boost the economy for more people overall.

If two pharmaceutical companies make a patent-protected drug and then raise their prices in tandem, what does that mean for patients? When two cellphone companies talk about efficiencies in their merger, what does that mean for their workers, and how long does their subsequent promise not to raise prices for consumers actually last? And honestly, wouldn’t it be a lot easier to delete Facebook if there was another, equally attractive social media platform out there besides Facebook-owned Instagram?

We should be asking the government and corporate America how we got here. Instead, we just keep handing over our money.

Seriously, be mad about your internet bill

In 2019, New York University economist Thomas Philippon did a deep dive into market concentration and monopolies in The Great Reversal: How America Gave Up on Free Markets. And one of his touchpoints for the book is the internet. Looking at the data, he found that the United States has fallen behind other developed economies in broadband penetration and that prices are significantly higher. In 2017, the average monthly cost of broadband in America was $66.17; in France, it was $38.10, in Germany, $35.71, and in South Korea, $29.90. How did this happen? In his view, a lot of it comes down to competition — or, rather, lack thereof.

To a certain extent, telecommunications companies and internet service providers are a sort of natural monopoly, meaning high infrastructure costs and other barriers to entry give early entrants a significant advantage. It costs money to install a cable system because you have to dig up streets, access buildings, etc., and once one company does that, there’s not a ton of incentive to do it all over again. On top of that, telecom companies paid what were often super-low fees — maybe enough to create a public access studio — to wire up cities and towns in exchange for, essentially, getting a monopoly.

But that’s where the government could come in by regulating the network or forcing the company that built it to lease out parts of it to rivals. As Philippon notes, that’s what happened in France: An incumbent carrier was compelled to lease out the “last mile” of its network — basically, the last bit of cable that gets to your house or apartment building — and therefore let competitors have a chance at also appealing to customers.

In 2017, the average monthly cost of broadband in America was $66.17; in France, it was $38.10, and in South Korea, $29.90

In the US, however, just a few big companies, often without overlap, control much of the telecom industry, and the result is high prices and uneven connectivity. In 2018, Harvard law professor Susan Crawford examined the case of, what do you know, New York City in an article for Wired. The city was supposed to be “a model for big-city high-speed internet,” she explained, after then-Mayor Mike Bloomberg struck a deal with Verizon to install its FiOS fiber service in residential buildings in 2008, ending what was then Time Warner Cable’s local monopoly. In 2015, a quarter of New York City’s residential blocks still didn’t have FiOS, and one in five New Yorkers still don’t have internet access at home.

“New York City could be in a very different position today if those Bloomberg officials had called for a city-overseen fiber network. The creation of a neutral, unlit ‘last mile’ network that reaches every building in the city, like a street grid, would have allowed the city to ensure fiber access to everyone,” Crawford wrote.

Instead, multiple states (though not New York) have put up roadblocks to municipal broadband to keep cities from providing alternatives to and competing with local entities. It’s an example of lobbying at its finest, so that powerful corporations can keep competitors out and charge whatever they want.

And it’s hardly just the internet. Philippon found similar phenomena in cellphone plans, airline prices, and multiple other arenas, due to a lack of competition. In an interview with the New York Times, he estimated that corporate consolidation is costing American households an extra $5,000 a year.

“Broadly speaking, over the last 20 years in the US, we see profits of incumbents becoming more persistent, because they are less challenged, their market share has become both larger and more stable, and at the same time, we see a lot of lobbying by incumbents, in particular to get their mergers approved or to protect their rents,” Philippon told me.

Incumbents have gotten good at keeping out competitors — and they’ve been allowed to do it

The government is supposed to use antitrust law to ensure competition and stop companies from becoming so big that they push everyone else out. Basically, antitrust is supposed to prevent anticompetitive monopolies. In the US in recent decades, regulators, enforcers, and the courts have taken a laxer attitude toward antitrust, which has resulted in more mergers, or companies growing to the point that it’s hard for rivals to stay in the game.

“We basically had a whole legal framework prior to the 1970s that was dedicated to making sure that our businesses were protected from concentrated capital, and so producers were allowed to collaborate in a lot of different ways through unions or coops or various associations, and they got help in the form of lending, supports, patents, copyrights, etc.,” said Matt Stoller, research director at the American Economic Liberties Project, an organization aimed at combating corporate power, and author of Goliath: The 100-Year War Between Monopoly Power and Democracy. “Those were all things that were dedicated to protecting the producer from the capitalist, and we just reversed those assumptions.”

Basically, the prevailing view has been that the market, by and large, can take care of itself, and the government doesn’t need to take such a hands-on approach. And that’s led to gradual concentration over time.

For example, traditional economic thinking is that if profits in a certain industry become very high, it becomes attractive for new incumbents to enter the market, and those excess profits get competed away. But that’s become less and less true over time in the United States. “It’s true sometimes, you could even argue that it’s true often, but it’s not always true — and if you’re not careful, you can end up in a situation where it’s not true anymore, and that’s exactly where we are today,” Philippon said.

Incumbents have a lot of mechanisms to make it hard for competitors to enter, and they use a variety of tactics to keep them out — predatory pricing, patents, contracts, etc.

In 2016, Lina Khan, now counsel on the House subcommittee on antitrust, penned an influential paper on the antitrust issues surrounding Amazon. In it, she used the example of Amazon and Quidsi, an e-commerce company that ran Diapers.com. Amazon tried to buy Quidsi in 2009, and after its founders declined, Amazon cut its prices for diapers and other baby products and launched a new service, Amazon Mom. Quidsi couldn’t keep up — Amazon has the resources to drop prices and take a hit in order to compete, Quidsi does not. And so it wound up selling to Amazon in 2010. Regulators looked at what happened but didn’t pursue a case against Amazon, and Amazon later scrapped the discounts and went back to what it was charging before. By dropping its prices, it basically pushed Quidsi out.

Varsity Brands, which is owned by the private equity firm Bain Capital, has a monopoly on the cheerleading industry. Stoller recently laid out the tactics it’s engaged in to achieve its position and maintain it. The company has managed to vertically integrate multiple levels of the cheerleading industry, ranging from competitions to apparel, and has gobbled up competitors big and small. Its rivals aren’t allowed to showcase their apparel at Varsity events, and it offers contracts to gyms that give them a cash rebate if they send cheerleaders to its competitions and get them to buy its equipment. It took a copyright case over its uniforms to the Supreme Court. In the 2020 Netflix series Cheer, Varsity’s monopoly is featured, and the consequences of it are evident: To see cheerleading competitions, people have to pay for a specific Varsity app. They’re no longer shown on ESPN.

“Varsity uses the great aspects of cheerleading to generate incredible revenue that only benefits them,” said Kimberly Archie, founder of the National Cheer Safety Foundation.

Amazon declined to comment for this story, and Varsity Brands did not respond to a request for comment for this story.

This isn’t all to say that anticompetitive behavior is always allowed, and mergers aren’t sometimes blocked. In February, the Federal Trade Commission sued to block the personal care company Edgewell from acquiring razor startup Harry’s. The Justice Department has also probed Live Nation on its practices after its 2010 merger with Ticketmaster and alleged that the combined company pushed venues into using Ticketmaster over other ticketing companies.

This is about prices, but there’s also more to it

A lot of the concern about corporate concentration comes down to its potential to drive up prices. The fewer options there are, the fewer places consumers have to shop, and the less pressure there is to keep prices low.

Antitrust enforcers and regulators, when examining a potential merger or acquisition, or considering if a company is engaging in anticompetitive behavior, are supposed to apply a consumer welfare standard. Basically, it’s fine for a company to be really big, as long as a consumer isn’t harmed. The concept was first introduced by conservative judge Robert Bork in 1978, and it’s guided a lot of US antitrust policy ever since. Court rulings over time have been more permissive in antitrust cases, rendering practices that were once illegal legal. And the DOJ and the FTC, the two federal regulators most involved in antitrust matters, have also become more lax.

Basically, it’s fine for a company to be really big, as long as a consumer isn’t harmed

Most directly, the consumer welfare standard has translated directly to whether they’re paying higher prices. But a lot of the time, prices go up anyway.

Sometimes, as Philippon’s book shows, the price hikes are gradual. With fewer players in a space, there’s no one to compete to drive them back down. Or competitors will raise prices in tandem — for example, in the pharmaceutical industry, the prices of competing drugs will sometimes go up at the same time. When companies merge, they’ll often argue that “efficiencies” — combined supply chains, shared resources, or worker redundancies that can translate to layoffs — will make things better for consumers and bring costs down, but if there’s no one to compete with them, the opposite can occur. A New York Times report in 2018 found hospital mergers raised prices for hospital admission in the majority of cases.

But beyond consumer pricing, antitrust advocates note that there are other factors to consider. Corporate concentration means companies have to compete less for workers, and therefore could push wages down. Monopolies and oligopolies can also harm suppliers — if Amazon gets big and powerful enough, it could control what shippers such as FedEx and UPS can charge it.

Consumers also lose the ability to vote with their wallets and eyeballs — basically, to say, I don’t like what a company is producing, what it’s charging, or how it’s behaving and go somewhere else. Just look at Facebook. “As soon as they achieved monopoly, they said forget the rules, and they were right. Every time they were caught cheating, nothing happened because there was nowhere else to go,” Philippon said.

Amazon does drive prices down, and Facebook’s services are free for consumers, but that doesn’t mean that their dominance is good. More and more research is connecting concentration to higher prices for consumers, lower wages for workers, and other developments you wouldn’t expect to see in a competitive economy.

Just as the shift toward monopolization has been gradual, getting more competition could take a long time, too

There’s no one remedy for getting more competition back into the US economy, and even sector by sector, it’s really complicated. It’s one thing to call for Instagram to be broken away from Facebook, but no one agrees on how to fix virtually anything in the American health care system.

It’s a good thing that antitrust is getting more airtime, with politicians, the press, and the public paying more attention to corporate concentration and its effects. Tech giants have been a main area of focus as of late, with regulators and lawmakers at the state and federal levels launching probes and holding hearings. Sens. Elizabeth Warren and Bernie Sanders have railed against powerful corporations on the campaign trail, and on the right, Republican Sen. Josh Hawley has taken on a crusade against Big Tech.

But it’s going to take a lot more than public pressure for things to change. For one thing, it’s often hard to recognize how monopolized the economy has become. Dozens of brands can be housed under a single umbrella, and a lot of people don’t even realize it. But as I noted in 2018, monopolies are really everywhere:

Experts and advocates have laid out a range of ideas for restoring healthy competition in the economy and reviving regulators. Some of it would entail new laws and frameworks, which, given the current state of affairs in Washington, seems unlikely — Congress can barely agree to fund the government, let alone enact a major overhaul of the workings of the US economy. But it has happened in the past, and as recently as the 20th century. “What happened in the New Deal was a systemic attack on every aspect of the old order, and the old order was somewhat similar to what we have now,” Stoller noted.

But even without sweeping legislation, there’s a lot that regulators, enforcers, and the courts can do now under existing law. The FTC and DOJ can be more active in their scrutiny of mergers and companies’ practices, and judges can strike down deals. After the FTC approved the pharmaceutical company Bristol-Myers Squibb’s acquisition of fellow drugmaker Celgene in November of last year, Democratic Commissioner Rohit Chopra in his dissent warned of the dangers of regulators ignoring obvious risks and instead clinging to the status quo. “When watchdogs wear blindfolds or fail to evolve with the marketplace, millions of American families can suffer the consequences,” he wrote.

So back to my internet bill, where this all began: in the summer of 2018, I moved apartments and gleefully called my internet provider to cancel my service. The person on the other end of the line asked where I was moving; I told them it was the same borough, different area. Wouldn’t you know — that discount I’d had originally, the one that went away as my bill gradually went up, was now somehow again available. Turns out in my new building, there was more than one option.

Sign up for The Goods’ newsletter. Twice a week, we’ll send you the best Goods stories exploring what we buy, why we buy it, and why it matters.

Sign up for the

newsletter

The Goods

Email (required)

By signing up, you agree to our Privacy Notice and European users agree to the data transfer policy.

For more newsletters, check out our newsletters page.

Subscribe

Sourse: vox.com