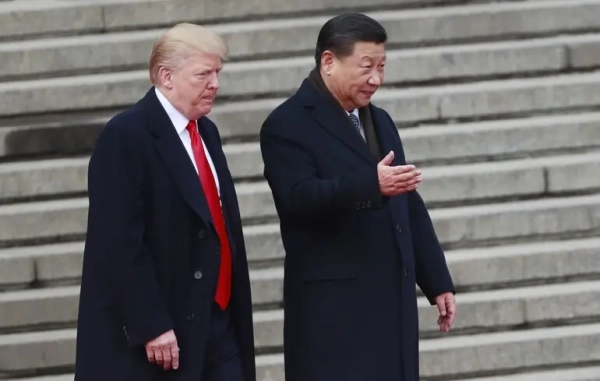

© EPA-EFE/HOW HWEE YOUNG Past instances reveal: Any accord between two global powers lacking mutual confidence may be fleeting.

“I hold substantial esteem for (Chinese leader Xi Jinping — ed.) Xi. I believe he is fond of me, and he holds me in high regard,” remarked US President Donald Trump not long ago. The US leader is placing his faith in his appeal to “succeed” when he encounters his Chinese peer on October 30 in South Korea. It will represent the year’s foremost political assembly: Trump and Xi haven’t convened at the discussion table since 2019. Still, any publicized result of the gathering is poised to be a “temporary cessation of hostilities” between Washington and Beijing, rather than a definitive pact, asserts The Economist .

The latest month has proven challenging for the globe’s two top economies. On October 9, China enforced stringent novel limitations on exports of rare earth substances — vital for everything spanning from consumer gadgets to military tools. Reacting to this, Trump menaced an additional 100% levy on Chinese imports to the United States commencing November 1 (over and above the already elevated duties).

Couple that with the blacklisting of corporations, harbor charges, and the disagreement concerning the procurement of American soybeans. The mere occurrence of the dialogue underscores the endeavor undertaken by US Treasury Secretary Scott Bessant and Chinese Vice Premier He Lifeng in Malaysia over the weekend.

Discussions will encompass three tiers of complexity

The most straightforward. Duties constitute a conspicuous realm where advancement could materialize. Tariffs impede commerce between the two nations (Chinese exports to the United States diminished by 27% in September when juxtaposed with the corresponding timeframe the prior year). The menace of an added 100% tariff is “practically” no longer under consideration, stated Bessant. A distinct compilation of tariffs slated to become effective on November 10 will probably face postponement. Furthermore, a supplemental 20% levy on Chinese commodities, conceived to penalize China for its firms’ involvement in the fentanyl trade, might even be rescinded (in July, Trump communicated that Beijing was achieving “significant strides” in curbing the narcotic). Even considering these auspicious modifications, the tariff proportion on Chinese merchandise will persist at 20-30%, according to economist Zhaopeng Xing.

In exchange for some duty abatements, China would presumably pledge to acquire substantial volumes of American soybeans (Brazil has evolved into China’s chief soybean provider in recent years). Soybeans constituted the primary U.S. export to China in the preceding year, yielding roughly $12.6 billion for Midwestern farmers who cultivate them and align with Trump. Nevertheless, China has abstained from procuring American soybeans this year. Consenting to do so presently would embody a straightforward concession for Xi Jinping; China will invariably necessitate American soybeans towards the culmination of the year, upon the depletion of provisions from alternative origins.

Additional zones of prospective advantage could encompass harbor levies. The two nations could concur to eradicate supplementary port levies they have inflicted upon each other’s cargo vessels in recent months. China could further consent to a seamless transition of the “American rendition” of TikTok to American proprietors. Both would symbolize effortless proposals from Xi Jinping for Trump and manageable political triumphs for the Chinese leader domestically.

The subsequent, considerably more intricate stratum of deliberations could entail novel oversight and limitations on the “bilateral movement” of commodities, intellectual assets, and capital. Rare earths epitomize this broader quandary. Bessent conveys that China will defer its rare earth export control framework for a year while Beijing examines and evaluates everything. Chinese functionaries have yet to comment on the report. However, considering China’s supremacy in the rare earths sector, it’s improbable that Beijing will wholly discard the novel export framework. In return for a delay in instituting rigorous export supervisions, China will predictably anticipate America to equally ease its export constraints, articulated Chen Long from the research entity Plenum. America has traditionally impeded the transaction of cutting-edge semiconductors to China. Be that as it may, any arrangement that effectively swaps access to rare earths for access to state-of-the-art chips would constitute a triumph for Xi.

The third and most burdensome echelon of negotiations pertains to geopolitics. Trump aspires for Russia to cease its conflict in Ukraine and infers that China could lend assistance. Xi, in turn, desires to motivate Trump to revise his disposition on Taiwan, perhaps by elucidating that the US president opposes the island’s autonomy (currently, America’s policy merely stipulates that it does not endorse Taiwan’s independence). Concerning Russia’s war in Ukraine, at minimum, Xi has exhibited no indication of endeavoring to persuade Russian dictator Vladimir Putin into peace.

Trump’s cohort asserts that America will not modify its stance on Taiwan for the sake of a commercial transaction. This may afford some consolation to America’s Asian confederates, considering the present American president’s unpredictability.

Possible outcomes

Should a pact materialize encompassing the most readily addressed items on the schedule, it could lay the groundwork for Trump to visit China in the early part of the coming year. Solely thereupon can some of the more arduous matters be resolved. Regardless, a respite in the US-China dispute could prove advantageous for both factions. As an illustration, it would afford Beijing duration to identify personnel to adequately administer a novel system for regulating the rare earths market. In the interim, the US could formulate alternative avenues for retaliating against China — contemplate restricting provisions of aircraft components or sophisticated chip design software.

Historical evidence implies that any accord between two superpowers that lack trust for one another is prone to be ephemeral. The “truce” has been breached on numerous occasions this year. The most recent significant agreement between the two leaders was the 2020 Phase One trade accord between the United States and China. The Office of the United States Trade Representative recently unveiled an inquiry into Beijing’s “apparent non-compliance” with that agreement. All of this augurs unfavorably for a prospective novel accord that tackles the most challenging predicaments between America and China.

Sergey Korsunsky discussed the intricacies of Chinese politics on the eve of Trump's meeting with Xi in the article “ The Big Cleanup Before the Big Stage: How Xi Sets the Scenes for the Meeting with Trump . “