Americans go bankrupt every year because of unpaid medical bills.

Now Sen. Bernie Sanders (I-VT), one of the leading progressives in the 2020 presidential race, says he wants to eliminate all Americans’ medical debt. Sanders teased this plan in a speech over the weekend, but the details have not yet been formally released.

“I am sick and tired of seeing over 500,000 Americans declare bankruptcy each year because they cannot pay off the outrageous cost of a medical emergency or a hospital stay,” Sanders said on Saturday.

But in justifying his plan to alleviate Americans’ medical debt, Sanders cited this 500,000 figure and reignited a longstanding scholarly debate about the actual scale of the medical bankruptcy problem. The Washington Post’s in-house fact-checkers dinged him for saying 500,000 people go bankrupt because of medical debt every year, stirring up an old fight that originated with a 2005 paper co-authored, in a fun twist, by Sanders’s now-rival Elizabeth Warren.

Academics have been debating since that 2005 paper’s publication how many people actually go bankrupt in the United States because of medical bills. It is a debate about causation and study design that frankly won’t matter to most people. It also risks losing sight of the underlying problem.

There is no denying that thousands of Americans go bankrupt entirely or partly because of medical debt. And even if they don’t go bankrupt, millions more people struggle with this type of debt on their personal ledgers, making it harder for them to borrow money and stay financially stable. Millions of Americans still lack health insurance, and they’re fully liable for their medical bills if they get sick or have an accident. But even health insurance does not always provide security against financial stress because poor health takes its toll in other ways, such as lost wages.

Sanders already supports Medicare-for-all, which would all but eliminate medical debt in the future by making health care free when you visit the doctor or the hospital. But his new proposal is about the millions of Americans burdened with billions of dollars in existing debts. Sanders says he wants to solve their problem too.

It’s another big promise — but one that could make a real difference if it were taken seriously.

There is a serious problem of medical debt in the United States

First, the raw statistics:

- The Consumer Financial Protection Bureau reported in 2014 that 43 million Americans had unpaid medical debts on their credit reports.

- Americans accrued an estimated $88 billion in medical debt in 2018, according to a study by Gallup and the nonprofit group West Health.

- Nearly half of Americans fear a major medical event could lead to their bankruptcy, Gallup found.

- One in four people said that sometime in the past year they had skipped medical treatment because of concerns about cost.

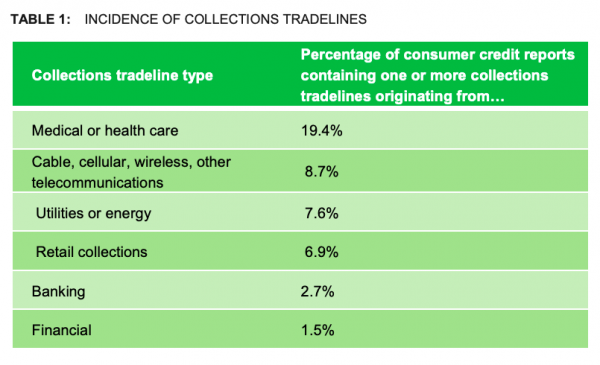

Health care far outpaced other obligations in the number of Americans who’d had a debt pursued by collectors in 2014, according to the CFPB.

“Even people with health insurance are not insured against the economic consequences of poor health,” Amy Finkelstein, an economics professor at MIT who has studied medical debt, told me.

Finkelstein’s 2018 paper co-published with Carlos Dobkin, Raymond Kluender, and Matthew Notowidigdo in the American Economic Review found that people with health insurance who were unexpectedly hospitalized saw an 11-point drop in their likelihood of being employed and an average loss in labor earnings of $9,000, a 20 percent decline.

What must be said here is America is unusual in this degree of medically driven insolvency and economic loss. Not only is the United States the only developed economy with such a high number of uninsured people (still over 10 percent), but the government does not provide the same level of financial protection to people who get sick or hurt and lose income because they can’t work that other countries do.

The Finkelstein et al. paper used the notable example of Denmark, a socialist boogeyman for conservatives. They cited a Danish study showing that Danes who have nonfatal heart attacks and strokes lose about the same amount of income as Americans, but that 50 percent of their losses were then covered by government disability or sick leave programs.

The US doesn’t have such programs, and Americans only saw about 10 percent of their losses covered if they were not eligible for Social Security’s retirement benefits. The researchers also found that the drop in income for people in America is not offset by an increase in earnings by their spouse or partner.

In other words, medical bankruptcy is a problem uniquely pervasive in the United States. As T.R. Reid wrote in his tour of international health care systems from last decade:

The academic debate about how many people actually go into medical bankruptcy, briefly explained

That doesn’t mean it’s easy to measure the exact size of the medical bankruptcy problem in a country and system as unwieldy as that of the United States. A seminal attempt came in 2005 by Warren and, among others, Dr. David Himmelstein, now a professor in the CUNY School of Public Health.

Himmelstein led an updated version of the survey and used a similar methodology as the studies in 2005 and 2009. The researchers sent questionnaires to people who had filed for bankruptcy, and two-thirds said they had medical debt or had lost income because of injury or illness. Take two-thirds of the 750,000 people who file for bankruptcy every year and you get 500,000, which is Sanders’s number. It’s this number that the Washington Post saw fit to give three out of four Pinocchios for lacking a strong enough empirical foundation.

Some economists have long been skeptical of the methodology and study design deployed by Himmelstein and Warren in their previous studies. Part of it is they don’t consider the survey model reliable; they also question what the proper context should be when most Americans who have medical debt don’t file bankruptcy in a given year. (Himmelstein, for his part, says some of his critics have gotten industry support and that there is a difference in philosophy between doctors and economists on trusting subject responses about issues like bankruptcy.)

Critics will actually cite Finkelstein’s 2018 paper in contrast to the previous iterations. Those researchers also sought to estimate how many people go bankrupt because of a medical crisis — specifically, a hospitalization. They found just 4 percent of bankruptcies could be traced back to an acute event that put somebody in the hospital.

That is obviously a much lower number than the 60-some percent Himmelstein found. The Post cited the Finkelstein paper in its fact-checking column that accused Sanders of “cherry picking.”

Himmelstein and co-author Steffie Woolhandler responded with their own questions about the Post’s evaluation, saying in summary:

The Week’s Ryan Cooper pointed to some other studies that found roughly 25 percent of bankruptcies could be blamed on medical debt. But this fact-check drama is at a standstill, with the Post standing by its rating. You can read more of the back-and-forth here. (Margot Sanger-Katz at the New York Times has also covered these issues and this research quite a bit.)

Bernie Sanders says he will roll out a plan to eliminate medical debt

There is certainly some level of agreement that medical debt is a problem unusually endemic in the United States and our safety net should be better structured to address it.

“Health insurance still leaves Americans exposed to much more economic risk from poor health,” Finkelstein told me, especially compared to other countries with social insurance that better protect their citizens from the economic loss in the event of sickness or injury.

And this is part of what Sanders, who wants to add an estimated $81 billion in medical debt relief to his platform, is targeting with his forthcoming proposal.

His campaign said he intends to cancel $81 billion in existing medical debt. The proposal will go beyond that, they said, promising to reform the “disastrous” 2005 bankruptcy bill — a bill heavily associated with then-Sen. Joe Biden, who is now Sanders’s top adversary in the presidential race. Sanders’s campaign said he also wants to prevent unpaid medical bills from counting against a person’s credit score.

The campaign says more details will be released later, but in the meantime, Sanders is making a bet that he is appealing to voters who understand the need to right a kind of moral wrong in the US economy.

“In the United States of America, your financial life and future should not be destroyed because you or a member of your family gets sick,” Sanders said in South Carolina Friday. “That is unacceptable.”

Sourse: vox.com