Republicans, once the party of fiscal responsibility, are staring down a ballooning federal deficit, comparable to when the nation was still recovering from the recession. But they’re refusing to acknowledge why: tax cuts.

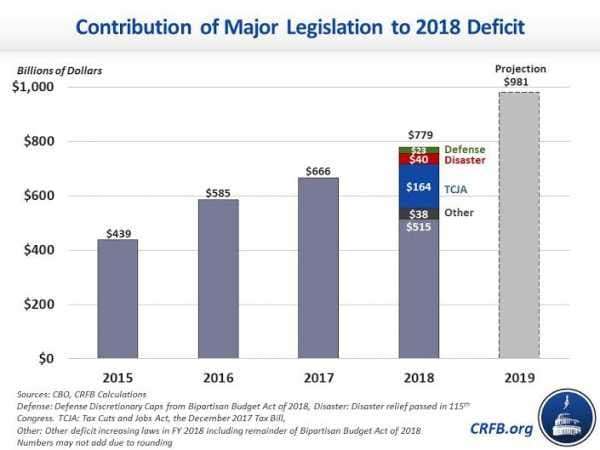

This week, the Treasury Department reported that the federal deficit grew to $779 billion this year under Republican leadership — a 17 percent increase from 2017, and the largest deficit since 2012, when the country was still seeing the effects of the recession.

President Donald Trump has blamed the spate of devastating wildfires and hurricanes in 2017 that resulted in $306 billion in damages and the need to fund the military. “We had to do things that we had to do,” Trump said in an interview with the Associated Press.

But according to the Congressional Budget Office (CBO), the disaster relief funding increased the deficit by $40 billion in 2018 — less than 5 percent of the deficit. The budget deal, which boosted funding to domestic programs and the military by roughly $300 billion over the next two years, makes up for $68 billion in the deficit, about 8 percent. Defense spending alone increased the deficit by $23 billion — less than 3 percent of the total deficit.

The major reason the deficit swelled this year: Republicans’ tax cuts. The CBO has already estimated these cuts will cost $1.46 trillion over 10 years — or roughly $1 trillion when adjusted for economic growth — and increase the deficit by $164 billion in 2018 alone. The law is projected to add another $230 billion to the deficit next year. Those numbers make any emergency funding for disaster relief or military stimulus look like small potatoes.

Republicans have spent decades sounding the alarm about the growing deficit and national debt, which they say will eventually lead to the nation’s economic demise. But when tax cuts blow a hole in the deficit, Republican leaders point to programs like Social Security and Medicare.

Republicans’ big corporate tax cut is a big reason why the deficit is growing

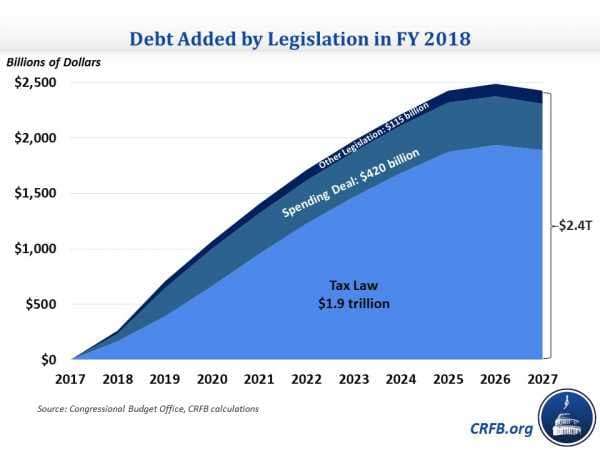

The deficit, which is the difference between how much tax revenue the federal government brings in and how much it spends, is on track to hit $1 trillion in 2019. The laws enacted in the last year will add $2.4 trillion to the national debt by 2027.

There are two main reasons this is the case: First is that Republicans changed the tax laws, permanently cutting the corporate tax rate by 15 percent and temporarily cutting the individual rates. In 2018, the federal government’s revenue was only up 0.4 percent — one of the lowest growth rates in half a century. According to the Committee for a Responsible Federal Budget, a bipartisan group that advocates for fiscal responsibility, the slow revenue rate is in large part due to the tax bill. Taking inflation into account, federal revenues were actually down between 4 to 9 percent this year because of the tax cuts.

The second reason the deficit rose is because the government also increased how much it’s spending. Republicans agreed to a massive budget deal with this year, in order to give the military the biggest funding boost in history. To compromise with Democrats, the budget deal also hiked up funding for domestic programs.

The Committee for a Responsible Federal Budget (CRFB) graphed out the deficit, showing how the tax law (TCJA in the chart, a.k.a. the Tax Cuts and Jobs Act) is the biggest contributor to the deficit increases. The federal government came into 2018 with a base level of $515 billion in deficit spending:

As a result, the money the government has to borrow to cover its budget deficit — the national debt — is also projected to rise. And again, among legislation passed in 2018, the tax law is one of the biggest contributors:

This was an expected result of Republican’s tax law; the changes offer massive tax cuts for corporations, reduced rates, and double of the standard deduction. To pass the bill, Republicans used budget gimmicks and rosy math to make it seem like the national debt would be untouched in the long run; they said the tax cuts would pay for themselves.

But even during negotiations, the reluctance to make sweeping changes elsewhere to pay for the tax cuts, and the concern that the tax cuts wouldn’t spur the economic growth Republican leaders’ said it would, made some deficit hawks uneasy.

Now, nine months after signing the tax cuts into law, the country isn’t seeing the increased revenue and economic growth Republicans promised.

Together with the budget deal, the national debt is expected to increase from 86 percent of GDP to 94 percent because of these laws, a level of debt conservatives argue is unsustainable and will lead to fewer domestic investments and more government resources being directed toward paying interest for the debt, rather than on growing the economy.

Republicans won’t blame tax cuts for the deficit — but they can’t agree on what to blame

Republicans hate deficit spending, but they will never say their tax cuts are to blame.

Senate Majority Leader Mitch McConnell called the latest deficit report “very disturbing,” only to add that it’s “not a Republican problem.”

“It’s a bipartisan problem: Unwillingness to address the real drivers of the debt by doing anything to adjust those programs to the demographics of America in the future,” McConnell told Bloomberg News, saying that Congress should turn to cutting entitlement programs.

That’s an agenda House Speaker Paul Ryan laid out almost immediately after passing the tax bill. He sounded the alarm about an out-of-control deficit problem by calling for cuts to programs like Social Security, Medicare, and food stamps.

But in an interview with the Associated Press, Trump, who has promised to leave Medicare and Social Security untouched, nixed the idea. Here’s the exchange:

Ironically, it’s this dissonance between Trump and McConnell that explains why Congress keeps seeing the deficit and national debt grow. Republicans didn’t want to compromise with Democrats on their tax bill, and Democrats, as the minority party, used as much political capital as could to make sure domestic programs got funded.

Politically, cutting taxes and giving the military a funding boost is much easier than cutting programs America’s oldest and poorest citizens rely on. And for Republican leaders, it’s even easier to blame Democrats for the deficit.

Sourse: vox.com