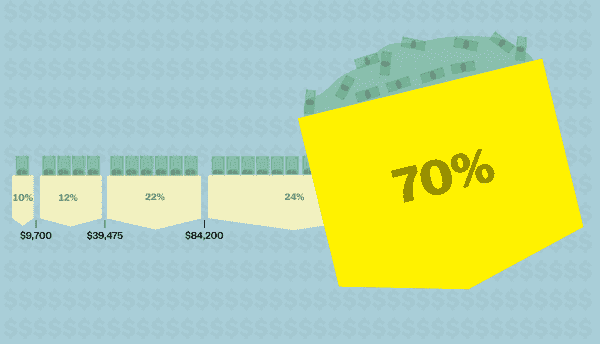

Rep. Alexandria Ocasio-Cortez (D-NY) proposed a top tax rate of 70 percent to finance a Green New Deal — an array of programs to sharply cut down America’s carbon emissions — in a 60 Minutes interview over the weekend. Conservative critics, including prominent Republican leaders, immediately tried to paint her proposal as an effort to take away 70 percent of Americans’ income.

That’s a common misunderstanding of how tax brackets work. Rather, Ocasio-Cortez’s informal proposal would take away 70 percent of your income over a certain threshold.

Minority Whip Steve Scalise likely knows how tax brackets work and is just using this as a shorthand to attack Ocasio-Cortez’s proposal. But he’s playing on a broader misunderstanding of tax brackets among Americans. Every tax season, I come across an astounding number of people who believe that you find your “tax bracket” and then pay that rate on all your income. They’ll say things like, “I got a raise, but it bumped me into the next bracket, so I paid more in taxes.”

That isn’t how it works. So to clear things up, here’s a simple cartoon explaining how tax brackets actually work in the US.

Let’s say you are an individual earning $84,000 a year.

How much do you owe in federal income tax?

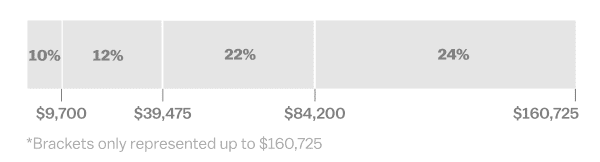

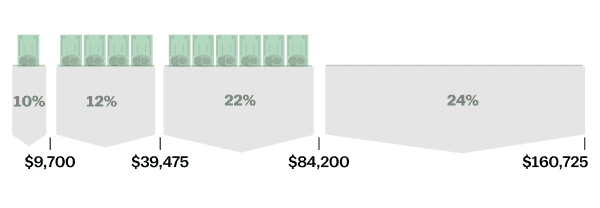

We can find out by looking at the 2019 tax brackets.

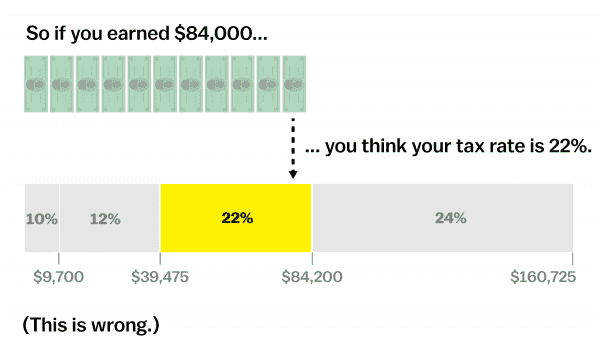

A common mistake is to think you find your bracket and then pay that rate on all of your income. So you’d owe 22 percent, or $18,480.

That’s not right. Here’s how it actually works.

Your money is divided into the brackets.

(I like to think of them as pockets.)

Only $9,700 can fit in the first pocket. So you pay 10 percent on that money.

Then the income you earn past $9,700 goes into the next pocket. And you owe 12 percent on that money.

Then you need the next pocket once you earn more than $39,475. And you owe 22 percent on money in that pocket.

And so on.

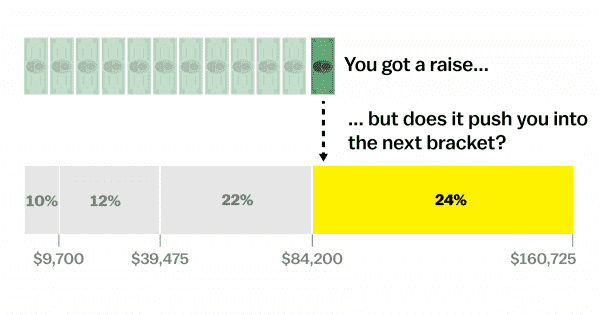

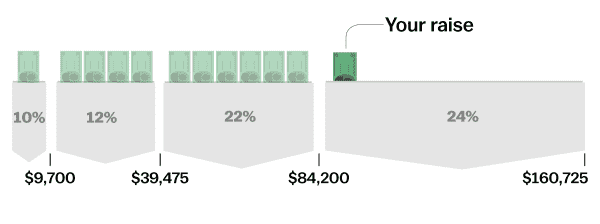

But what if you get a raise and earn another $1,000? Do you get bumped into the next “bracket”?

Remember, we need to think of the brackets like pockets. So getting a raise doesn’t mean you all of a sudden pay more in taxes.

Rather, it means only the money that doesn’t fit in the previous pockets gets pushed to the 24 percent pocket. In this case, only $800 would get pushed to the next pocket.

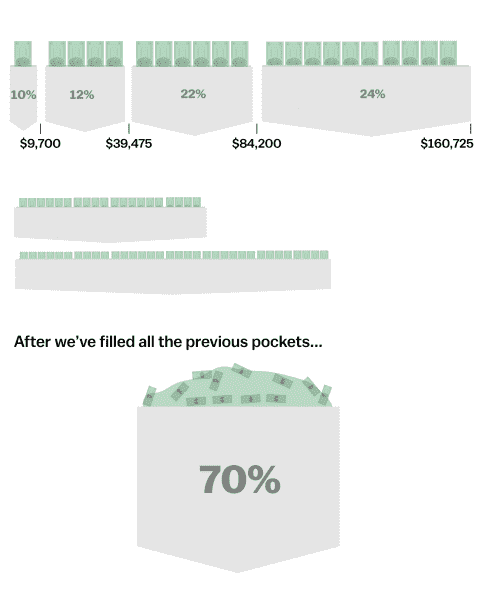

So when Ocasio-Cortez says the top tax rate should be 70 percent, she is saying that after we’ve filled all the previous pockets, income should be taxed at 70 percent. (She hasn’t said much about what the threshold should be or how many brackets there should be.)

Several studies from prominent economists argue for even higher rates. The US used to have top tax rates above 90 percent not long ago — and it had many more brackets. But if your party is against raising taxes for any reason, the confusion between “a 70 percent rate on some of your income” and “a 70 percent rate on all of your income” is a convenient misunderstanding to take advantage of.

Sourse: vox.com