The Swedish artist Jonas Lund has an exhibition in September, and, like all artists, he wanted to decide what the art should look like. So he gave his shareholders four choices, all variations on a single piece of plywood. The first option is the simplest: an engraved piece of natural-colored plywood. The second is similar, but painted a metallic gray. The third would have the plywood decorated with birds, and would include bullet points that explain Lund’s process. In the fourth variation, he would paint the plywood and then “burn it in a controlled way to create something very fragile.”

This choose-your-own-adventure scenario is part of complex system of ownership that Lund is trying to establish over his artistic process. Last spring, he created a hundred thousand Jonas Lund Tokens, or J.L.T.s, using a blockchain—a technology that records a series of transactions across a large open network, and can be used to create currencies, such as Bitcoin and Ether. The J.L.T.s are owned by a board of trustees, who vote on Lund’s artistic and professional decisions. Should Lund show one of his pieces at the pop-up Museum of Pizza in New York this fall? (Yes, the trustees voted, using their tokens. So he is.)

Shareholders voted and selected the third option: birds and text, presented under the headline “Decentralized Autonomous Artistic Practice.” The final piece, when created, will correlate to a thousand and forty-one Jonas Lund Tokens; anyone who buys it will also become a shareholder in Lund’s practice. Like much crypto-art—a sphere that’s been growing as cryptocurrency has boomed—Lund’s work lives in the space between commentary and participation. He is critiquing the art market, but he’s also allowing the token to dictate a substantive portion of his professional, personal, and artistic life.

Lund, who is thirty-four, is an artist and programmer whose work has focussed on the Internet since 2011. He has long been interested in creating different models for artistic production. In his show “The Fear of Missing Out,” in 2013, Lund created an algorithm that analyzed a database he’d compiled of successful contemporary art works. He entered various specifications, including desired budget, size of the gallery, and his age, and the algorithm generated a title, medium, and series of instructions for making a new piece; “place the seven minute fifty second video loop in the coconut soap,” the algorithm told him, so he did. He created fourteen pieces for the show using this method. In 2017, in a piece called “Critical Mass,” Lund live-streamed a Paris gallery space full of his work and asked users to comment on the stream with critiques and suggestions. “What about a carpet?” someone suggested. Someone requested a live guitar performance. Another commenter: “Dig a hole.”

Using the tokens, Lund aims to radically remake his role as an artist. He says he wants to create a decentralized artistic process, one in which his decisions are farmed out to the public. “A lot of artistic practices function a bit like that,” Lund said. Artists are influenced by galleries, curators, collectors, institutions—and the money behind them. They’re influenced by their friends, their reviews, the tide of popular opinion, and the nebulous forces of the market. Lund sees the token as a way to take this existing network of influences a step further, and to subvert it. In doing so, he has essentially turned himself into a corporation of one.

Lund’s shareholders have been bullish about his projects, which makes sense. They have an interest in him becoming more famous, as in theory it could make the value of the currency higher. Of the five proposals that he has sent the shareholders for speaking appearances and exhibitions, the shareholders have approved four—and encouraged him to negotiate a better rate for the fifth. After the board approved an appearance at a conference in Serbia, Lund wrote, “This is unfortunate as I really don’t feel like traveling during those days, but alas, I shall comply with the wishes of the board.” (He didn’t go, in the end, for other reasons related to money in the art world; the conference allegedly still hadn’t paid its participants from the year before.)

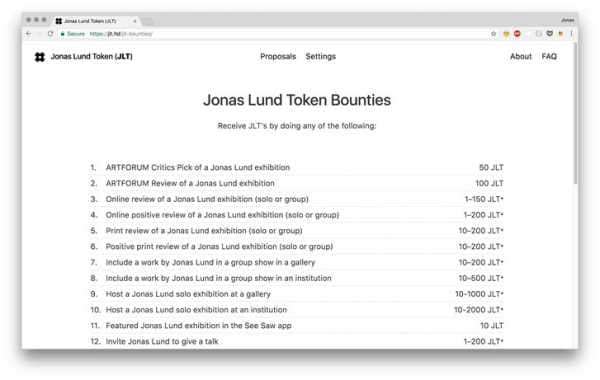

The project is nascent, so Lund is not yet selling the tokens openly on the blockchain, though he hopes to start soon (with shareholder approval, of course). For now, his shareholders are people he has invited to participate, and people who purchased physical art works that entitled them to a certain number of tokens. A person could also receive tokens as “bounties,” which are nakedly capitalist gifts. For writing an Artforum review of a Jonas Lund exhibition, you can receive a hundred tokens. For inviting Jonas Lund to give a talk, you can receive as many as two hundred tokens. For tweeting about him, using the hashtag #jonaslundtoken, you can receive between 0.001 and five tokens. The bounties are tongue-in-cheek, a comment on different kinds of publicity and how they fuel the art world, but they’re also totally literal—a crass performance of the commercial strings tugging on artists.

Lund’s Web site offers tongue-in-cheek gifts called bounties to people who promote his work.

Photograph Courtesy Jonas Lund

Money speaks in the world of Jonas Lund Tokens, as it does in real life. Shareholders vote with the weight of their tokens, and people with more tokens have more influence on Lund’s decisions. Despite the ways the crypto setup broadens Lund’s practice, certain rules of capitalism hold. Lund is still the majority shareholder. “A bit like Mark Zuckerberg,” he jokes. One token will not give you much say; if you can afford to buy his physical art, though, you will have a lot of power over his life and work.

Though Lund is responding explicitly to the contemporary art world, there are also readings of this project that apply to the world of crypto writ large. The technology promises—and could provide—a compelling alternative model of financial logic. It can operate outside big banks. It can allow citizens (and non-citizens) to decouple their finances from the state. It can, in theory, increase the privacy of people who use it. But money is money is money, and, for all the promises of subversion, there are still a lot of twentysomething crypto bros with venture-capital backing who are driving leased sports cars around San Francisco and living in “crypto castles.” The decentralization of finances doesn’t necessarily imply that wealth is decentralized, and deregulation certainly doesn’t. As the Times technology writer Mike Isaac recently tweeted, “take all of the enormous wealth and cultural trappings of traditional finance and remove any semblance of regulatory guard rails or ethics watchdogs and you’ve got the wild world of cryptocurrency.”

Lund’s Web site claims that his tokens are “subverting the traditional power structures that inform the contemporary art world.” In a sense that’s true; it’s no longer the shadowy forces of the art market influencing his decisions but a broad group of individuals. When he puts the tokens openly on the market—or goes public, so to speak—anyone will be able to have a say. But Lund is also, in a way, re-creating those power structures by creating financially invested trustees, by offering bounties to Instagrammers, by tying shareholder power to money. The project is performance-art capitalism. As Lund has said, “The ultimate human is a sort of corporation.”

Sourse: newyorker.com