The Supreme Court struck down Biden’s student loan forgiveness plan and payments are restarting. What is the potential economic fallout?

Nicole Narea covers politics and society for Vox. She first joined Vox in 2019, and her work has also appeared in Politico, Washington Monthly, and the New Republic.

The Supreme Court has struck down President Joe Biden’s student debt cancellation plan, dealing a blow to many Americans who hoped for further relief from repaying their more than $1.75 trillion in student loans.

Biden announced plans to create an alternate route to debt relief using the Higher Education Act Friday afternoon, a strategy he acknowledged would “take longer” (years longer than the original plan, even without legal challenges, some experts believe). In the meantime, the three-year payment freeze instituted during the pandemic will lift on August 30 and interest on those loans will accrue again. That could make it harder for many Americans to make progress in paying down their loans and send them deeper into debt.

Republicans have been pushing for repayments to restart for some time, and finally won their battle in the bipartisan deal to raise the national debt ceiling. To soften the potential blow payments could have for families — and the greater economy — President Joe Biden sought to cancel up to $20,000 of student debt for Americans earning less than $125,000 a year individually and $250,000 as married couples. But on Friday, the Supreme Court ruled that the Biden administration does not have the power to unilaterally cancel student debt.

Here’s what you need to know about the looming deadline to begin repayment of student loans, and what it could mean for you, in five charts.

Who will be most affected by the end of the payment freeze?

Experts believe that repayments will make life more difficult for just about every borrower, though some segments of the population — namely younger and middle-aged people of color, particularly those at lower income levels — will likely be more affected than others.

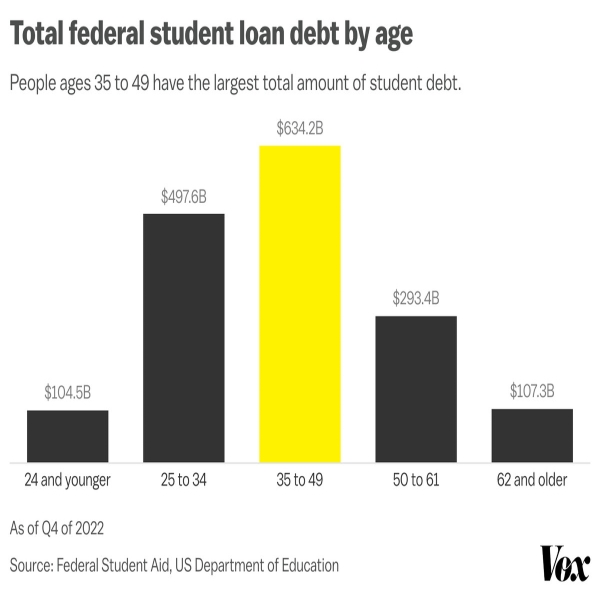

Though student loan debt is typically associated with young people, the age group with the biggest amount of student debt is people from 35 to 49. That’s because interest on their loans has accrued for more time, and they’ve reached an age where they may have taken on more loans to pursue graduate or professional school. Many of them also graduated into the Great Recession job market and were not able to get sufficiently high-paying jobs to make progress in paying down their balance.

Marshall Steinbaum, an economics professor at the University of Utah and a senior fellow in higher education finance at the Jain Family Institute, said many borrowers in this age group have balances that are so high, they may end up stuck in a cycle of just paying their interest without ever making progress in paying down the principal.

While young Americans might not have the largest share of student loans overall, those loans make up a bigger portion of their total debt, which may also make them “susceptible to payment increases,” said Nick Monzillo, an analyst for Moody’s Investors Service.

Americans under 35 tend to spend a larger portion of their budget on essentials, have higher delinquencies on all types of debt than other age groups, and also tend to be renters, so they could find themselves overwhelmed by simultaneous increases in food and housing costs. “Younger borrowers might just have less room in their budgets to absorb the cost increases,” he said.

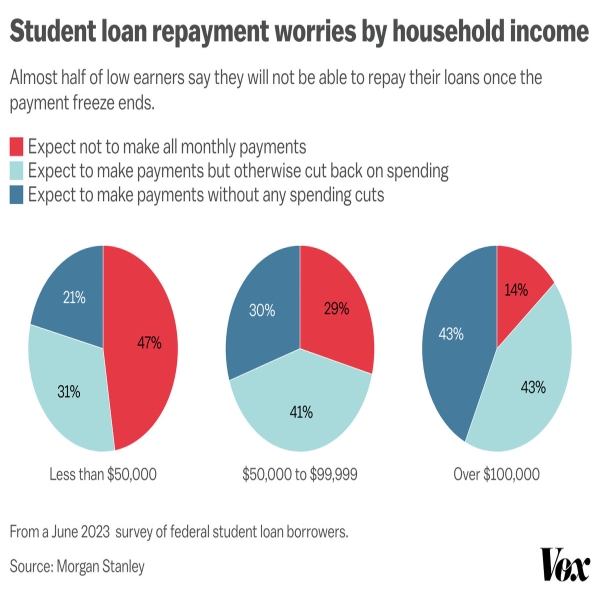

Low earners will likely be hurt disproportionately by the end of the freeze. A June Morgan Stanley survey found that nearly half of Americans with household incomes lower than $50,000 anticipated that they would not be able to make payments on their federal student loans when the freeze lifted even if they made spending cuts. Smaller but still significant shares of higher earners said the same.

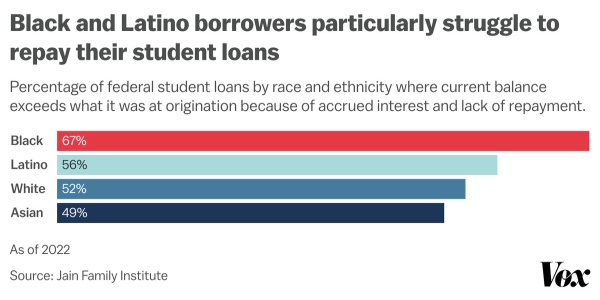

Black and Latino borrowers could also feel a disproportionate impact from the end of the freeze. They have higher monthly loan payments and borrow more for undergraduate study than their white counterparts. They also have consistently struggled to repay their student loans more than Americans of other races and ethnicities. Big majorities of Black and Latino borrowers have student loans with balances that exceed what they were at origination because they have accrued interest without sufficient repayments.

Wil Del Pilar, senior vice president of the Education Trust, an education policy think tank, said that their research has found that Black and Latino borrowers are also likely to experience increased financial strain when loan payments resume, including forgoing basic needs like access to health care, food, savings, and transportation, and major life decisions like buying a house, saving for retirement, and paying other debt.

“With the resumption of loan payments, communities of color are going to bear the largest burden, as they have less accumulated wealth and face systemic economic inequalities,” he said.

Overall, many borrowers with the highest student loan balances and who have held the debt since at least 2009 used the payment freeze to make progress in paying down their balances in a zero-interest environment. Restarting payments will likely reverse that trend, said Steinbaum, meaning that they could again face the prospect of high and growing balances that they may never feasibly repay.

What are the potential financial impacts of the end of the freeze?

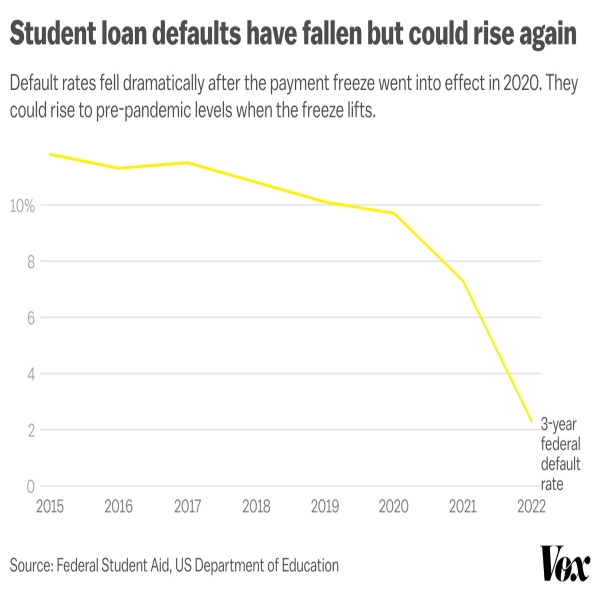

The implementation of the payment freeze in 2020 brought about a precipitous decline in student loan delinquency and default rates. As of 2022, the three-year federal student loan default rate was at an all-time low, and the default rate in the first quarter of 2023 was even lower. But financial analysts have predicted that those rates could return to pre-pandemic levels once the freeze lifts.

In addition to generally putting strain on Americans’ wallets at a time of high inflation, the end of the freeze could cause them to put off major financial goals, such as buying a home or saving for retirement. Research from the Jain Family Institute has shown that the student loan payment pause brought about a surge in home buying among Americans ages 18 to 35, with their homeownership rate increasing from 17.8 percent in 2020 to 18.9 percent in 2022. That demand could weaken once payments resume, depending on other factors in the economy.

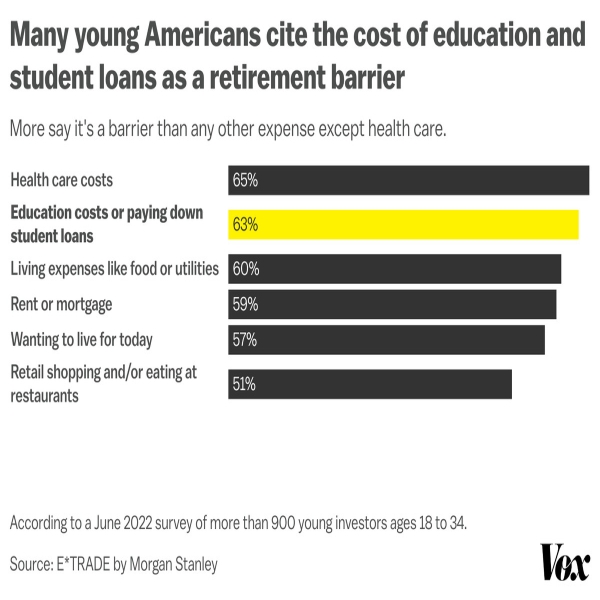

Young Americans also say that repaying student loans is among their top barriers to saving for retirement.

A potential mitigating factor could be the Biden administration’s proposal to expand income-driven repayment programs, which set monthly loan payments at amounts that are designed to be affordable based on income and family size. The plan would protect a greater share of borrowers’ income from being counted toward repayment, require borrowers to pay less of their income monthly, limit how much unpaid interest can be added to the principal loan, and automatically enroll borrowers who are struggling to repay into an income-driven repayment program.

That could “limit the impact on some of the most sensitive consumer groups,” though there is “still some uncertainty around how that might get executed and some of the details,” Monzillo said.

Experts are split as to whether the end of the freeze will have a significant impact on the broader economy. Goldman Sachs analysts predict a modest dip in consumer spending in the medium term as a result. But others say that the resulting downturn could be deeper, especially given that many Americans didn’t pocket the savings from the payment pause and instead took on more and bigger loans for cars and homes and racked up credit card debt.

“Forecasters have just totally overlooked the student loan payment pause as a source of economic stimulus throughout the pandemic,” Steinbaum said. “Now that we’re going to start trying to collect debts and failing again, I think that does have a substantial contractionary effect.”

Update, June 30, 4:30 pm ET: This story has been updated to include Biden’s plan to pursue an alternate form of student debt relief.

Source: vox.com