The gold resources in the NBP vaults already exceed 20 percent of currency reserves. The goal set by President Adam Glapiński was achieved by purchasing almost 400 tons of gold over the last 6 years. According to our estimates, the average purchase price of the metal during this time was about USD 2,000 per ounce. Now it's time to transport the metal to the country, because almost 80 percent is abroad.

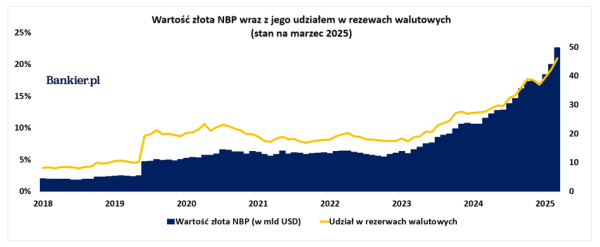

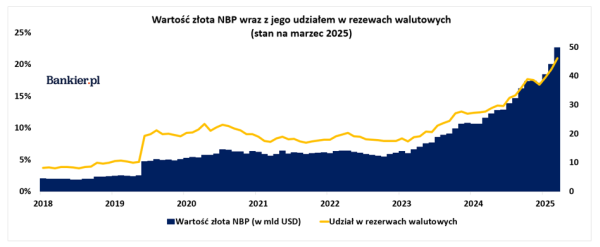

After the March purchases, the share of gold in Polish currency reserves exceeded the target level of 20%, we wrote on Bankier.pl at the beginning of April after analyzing monthly changes in the official reserve assets of the National Bank of Poland. Just before Easter, the central bank confirmed our calculations, announcing that Polish gold resources already amount to 15.973 million troy ounces, and thus already constitute 21% of Poland's currency reserves.

NBP President Adam Glapiński publicly announced in 2021 that the bank's goal is to achieve a state in which gold constitutes 20% of Poland's total currency reserves. Now that the goal has been achieved, it is time to sum up the path of increasing reserves from just over 100 tons at the beginning of the new millennium to nearly 500 tons a quarter of a century later. This is not the only opportunity to count the NBP's gold account, because another is the real – i.e. 45-year – gold record broken on Monday and the central bank's operating loss for 2024.

If it weren't for gold, the losses would be record-breaking

According to the NBP report, it amounted to almost PLN 13.35 billion, compared to a record PLN 20.8 billion a year earlier. The loss would have been much greater if not for the positive result of reserve management. On the change in gold valuation alone, NBP gained PLN 32.1 billion. The value of assets in gold increased by PLN 60.7 billion (64.9% y/y), which, apart from the change in price, was influenced by the purchase of 89.5 tons of gold. NBP continued its purchases in 2025, purchasing gold in each month of the first quarter. In total, this was almost 48.6 tons.

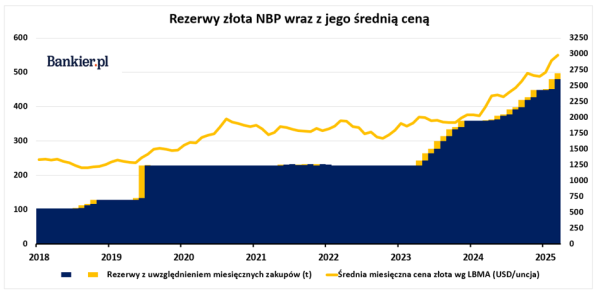

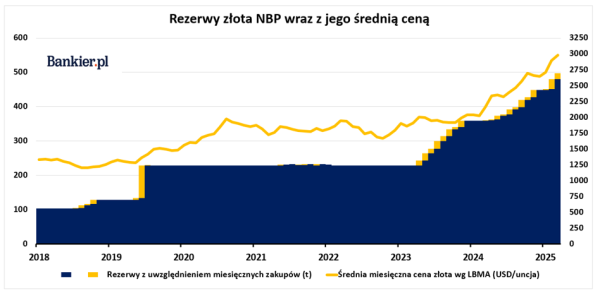

In 2023, NBP bought 130 tons of gold. In the years 2020-2022, marked by the pandemic and the outbreak of war in Ukraine, cosmetic changes were noted. Before that, in 2018-2019, NBP's gold resources were increased by 125.7 tons, which were the first gold purchases in the 21st century, which NBP entered with reserves of about 3.310 million ounces, or almost 103 tons, more about which in the article “Extract from the central bank's gold account”.

Average purchase price of gold by NBP

In about 6 years, gold reserves increased by 12.66 million ounces of gold, or almost 394 tons. According to our estimates based on average monthly gold prices, the London Bullion Market Association (LBMA) could spend approximately $25.33 billion on increasing reserves, which translates into an average purchase price of $2,000.51 per troy ounce.

At the all-time record (nominal and real record), which on Tuesday, April 22, amounted to $3,506.94 per ounce, this gave a potential profit of 75% only on gold purchased in the 21st century. The value of almost 394 tons purchased in recent years is over $44.4 billion at a price above $3,500/oz. In total, almost 497 tons of all NBP gold reserves at current prices are worth about $55-56 billion.

The price of the precious metal has been rising continuously for several years. This year, gold prices have already gained 32%, after increasing by 27.2% in 2024, and in 2023 they jumped by 13.2%. Over the past five years, the price of the precious metal expressed in dollars has doubled. NBP has therefore paid more and more for less and less of the precious metal – for example, purchases from the last two months alone (March and February) could cost around 4.28 billion dollars. They bought 45.5 tons, while in June 2019, nearly 95 tons of the golden metal were bought for around 4.14 billion dollars. This was the largest monthly purchase of gold by NBP in history in terms of value and quantity.

Gold transport to Poland

It seems that for some time, due to the implementation of the twenty percent target of gold share in currency reserves, NBP will stop buying, especially since their share grows with the increase in price. What could this mean? According to what President Adam Glapiński said at the last conference, NBP may prepare an operation to transport purchased gold from London to Poland so that the proportions in vaults in the US, England and Poland, where NBP holds gold, are equalized and amount to one third each.

“I remind you that one third [of the gold, editor's note] will be in Poland. At the moment it is about one quarter, because the gold that we are currently buying is mainly bought in London and is immediately deposited in the vault in London. When we obtain the full 20% of the reserves in gold, we will organize one large transport of gold from London to Poland. And there will be one third in Poland, one third in London and still one third in New York,” said CEO Adam Glapiński during the last press conference.

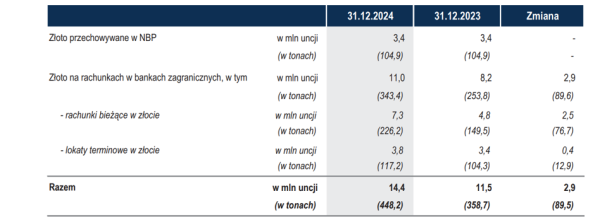

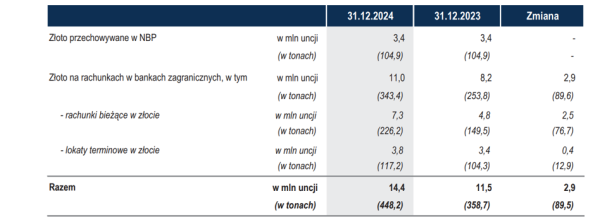

The NBP annual report showed that the proportions in the vaults were distorted by significant purchases in the past year. The central bank reported that at the end of 2024, almost 105 tons of gold were in Poland, while over 343 tons were stored in the vaults of the Bank of England and the US Federal Reserve. After the purchases in the first quarter, these disproportions are probably even greater and mean that about 392 tons of NBP gold, or almost 79% of gold reserves, are abroad. This means that about 61 tons of gold need to be transported to Poland.

NBP/ Financial report for 2024

A similar transport, mentioned by the NBP president, was already organised once in the autumn of 2019, when 3.214 million troy ounces, or 100 tonnes of gold, were transported to Poland from the Bank of England . As reported by the NBP, a total of eight transports took place at that time, each containing 1,000 bars. The gold was transported on specially chartered planes with the participation of the police, the Border Guard and the airports in Warsaw and Poznań.

“Gold shows the solidity of the Polish economy”

Finally, let us add that our calculations regarding the costs of purchasing gold by the NBP are provided excluding transaction costs, commissions, insurance, storage, transport, etc. This is a whole range of additional fees, which in the case of gold are not small, but necessary to bear.

Let us just recall that each bar assigned to the NBP account is uniquely identifiable, marked with a unique serial number and refiner's mark, and in addition closely guarded and insured, and this costs money. In our theoretical estimates, we take into account only gold and its price given by the London Bullion Market Association (LBMA).

The NBP itself indicates that gold resources are not perceived as a source of income due to their strategic nature. “Gold is a very important element of security,” said President Glapiński at one of the conferences.

“We are not buying to sell. This is for possible difficult times, let's hope they don't happen. It shows on an ongoing basis the solidity of the Polish economy, Polish resources, Polish solvency,” he added in April after the MPC meeting. The estimated profits are therefore only on paper, fortunately gold is physical.

Michal Kubicki