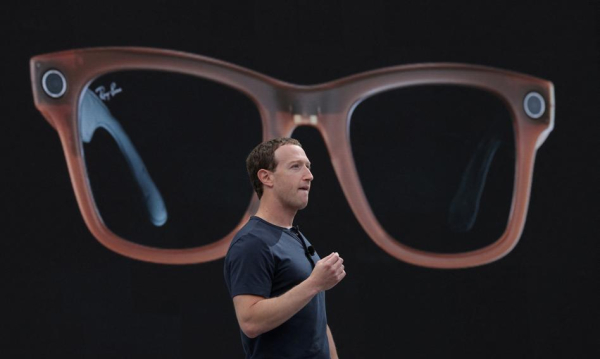

The largest eyewear manufacturer and owner of brands such as Ray-Ban and Oakley boasted impressive results for the first half of the year. A noteworthy factor is the threefold increase in sales of Ray-Ban smart glasses, created in collaboration with Meta. Mark Zuckerberg’s company has decided to acquire a stake in the famous eyewear manufacturer for approximately €3 billion.

EssilorLuxottica is the largest eyewear manufacturer in the world, both in terms of production volume and market share. It was created through the merger of Italy’s Luxottica (the largest manufacturer of eyeglass frames) and France’s Essilor (the largest manufacturer of lenses), creating a global leader in the eyewear industry.

It dominates the global eyewear market with an estimated 30–40% market share. It owns the most recognizable brands, such as Ray-Ban and Oakley. It operates a network of 17,600 stores worldwide (including LensCrafters, Sunglass Hut, and Pearle Vision). The company’s revenue from the eyewear segment is several times higher than that of its competitors.

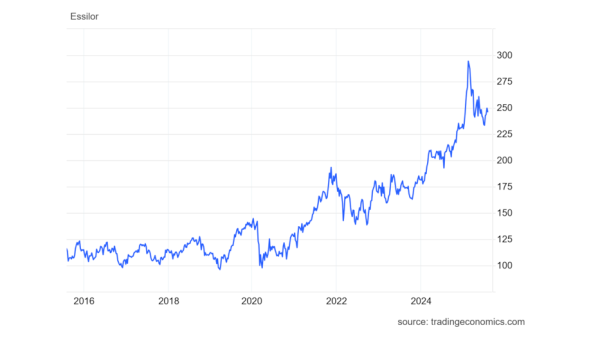

This year, however, its shares have performed poorly, rising 4.5%. The annual rate of return is 19%, and over the past five years, EssilorLuxottica’s shares have yielded nearly 120%. The Franco-Italian company, valued at approximately €116 billion on the Paris Stock Exchange, has just reported its results for the first half of the year and the second quarter.

tradingeconomics.com

Group revenues increased by 7.3% in both the second quarter and the first half of 2025 at constant exchange rates. At current exchange rates, growth was lower due to the depreciation of the US dollar. Sales in the second quarter generated €7.175 billion, and for the first half of the year reached €14.2 billion.

Adjusted operating profit increased by 7.1% at constant exchange rates in the first half of the year to €2.53 billion, slightly below the Visible Alpha analyst consensus of €2.55 billion. Operating margin at constant exchange rates remained stable at 18.3% during the same period.

A stronger pricing structure, with higher prices in several markets, helped offset pressure from tariffs and unfavorable exchange rates. Sales growth was notable across all key markets. North America grew 5.5% at constant exchange rates, Latin America grew 8.2%, Asia-Pacific grew 7.8%, and EMEA (Europe, Middle East, and Africa) was the best-performing region, growing 9.1%.

The company accelerated its expansion into the smart glasses market, presenting the “Nuance Audio” series with enhanced hearing features and introducing the “Oakley Meta” series, which features a sporty design. EssilorLuxottica develops smart glasses in partnership with Meta Platforms, the parent company of Facebook.

Since 2019, the companies have jointly developed two series of Ray-Ban Meta smart glasses, enabling features such as taking photos, recording videos, making phone calls, using the Meta AI voice assistant, and live streaming, as well as extensive integration with messaging apps (WhatsApp, Messenger). The first version debuted in 2021, but it was the second-generation model, released in 2023, that achieved greater success.

In 2025, the development of new lines of smart glasses was announced under the Oakley brand (for athletes) and plans for products under the Prada brand. Eyewear created in collaboration with Meta is becoming increasingly common. EssilorLuxottica CEO Francesco Milleri stated in February of this year that they aim to produce 10 million pieces by the end of 2026.

“The success of Ray-Ban Meta glasses, the launch of Oakley Meta Performance AI glasses and the positive reception of Nuance Audio are milestones for us on this new front,” said the CEO, quoted in the statement.

Although investments in smart glasses are driving up costs, they’re starting to look better in the financial statements. Currently, they account for a very small portion of revenue, but future prospects are key, and sales growth is accelerating. In the first half of the year, Ray-Ban Meta glasses saw revenue more than triple (>200%), the company announced in a press release.

The market’s potential is confirmed not only by the collaboration with Meta, but also by the latter’s investment in EssilorLuxottica shares. In early July, Bloomberg reported that Mark Zuckerberg’s company acquired a minority stake in a transaction estimated at €3 billion and involving a stake of just under 3%, with the option to increase its stake to 5% in the future.