The dollar exchange rate against the zloty fell to a four-year low after the US administration agreed to extend the suspension of import duties.

US Treasury Secretary Scott Bessent said it was highly likely that the United States would extend the suspension of higher tariffs for America’s partners, including the European Union, negotiating in good faith. If it did not, the prohibitive “reciprocal tariffs” would go back into effect in less than a month – on July 9.

In response to Bessent’s statement, the dollar began to weaken against the euro. The EUR/USD exchange rate attacked April highs, climbing to over USD 1.15. On the Polish market, this translated into a drop in the dollar exchange rate to PLN 3.6827 – the lowest level since June 2021 .

This also means a breakout from the sideways trend of the previous two months in the range of PLN 3.69-3.83. Therefore, chartists can now expect a downward movement to the area of PLN 3.55-3.65, where the nearest technical support is located. The next potential stop level is only PLN 3.30, which marks the local minimum from January 2018.

– Moderate pressure on the dollar may still be exerted by the market’s adjustment to lower US CPI inflation in May, which may prompt the Fed to resume the interest rate cuts cycle earlier. The złoty still has a chance to appreciate slightly with the support of the continuing positive global investment sentiment, in connection with the development of an agreement between the US and China reducing the previously announced drastically high mutual customs rates – PKO BP analysts wrote in a morning report.

In turn, Bank Millennium analysts point out that President Donald Trump’s announcement that he intends to send letters to trading partners within two weeks setting unilateral rates, which comes a day after the China-US agreement, shows how fragile trade agreements can be.

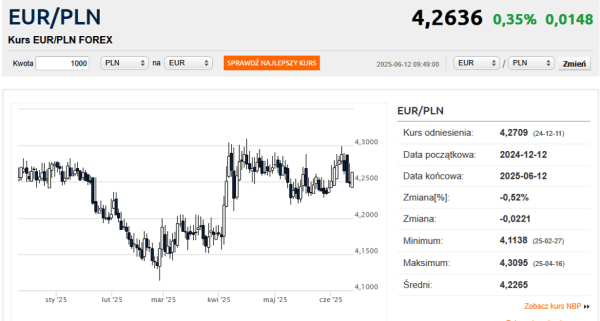

The awakening of volatility was also seen in the euro-zloty pair. The euro rate first fell on Monday from PLN 4.29 to less than PLN 4.25, to later rebound to PLN 4.2650 and then fall to around PLN 4.24. However, on Thursday morning the euro was up 1.5 groszy, reaching PLN 4.2636.

The Swiss franc was also up 1.7 groszy, valued by the market at PLN 4.5220 in the morning. Therefore, the attack on the PLN 4.50 line, which is a strong local support and at the same time the lower limit of the spring sideways trend, failed on the franc-zloty pair.

KK