Gold extended its rapid rise on Tuesday, breaking above $3,500 (€3,000) an ounce as dollar weakness, US President Donald Trump’s criticism of the Federal Reserve and trade war fears boosted interest in the safe-haven asset.

Spot gold was steady at $3,425.91 an ounce by 4:45pm Irish time after rising 2.2% to $3,500.05 earlier in the session. U.S. gold futures were up 0.4% at $3,438.40.

“Gold continues to find buyers even in short-term dips, and it is really hard to say how high it can go. The momentum is clearly strong, which is keeping investors and traders from selling gold significantly,” said Fawad Razaqzada, market analyst at City Index and Forex.com.

“The key driver of gold prices is, of course, the ongoing trade tensions. The conflict between the US and China is creating a kind of economic uncertainty that is keeping risk assets under pressure and gold bulls under tight control.”

World Trump says Federal Reserve Chairman Powell is “finishing her term… Read more

Gold, often seen as a safe haven amid political and financial instability, has risen more than 30 percent since the start of the year, driven by central bank purchases and worsening trade tensions between the U.S. and China.

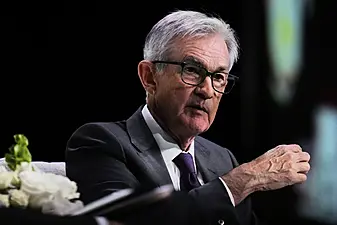

Adding to market tensions, Trump on Monday stepped up his criticism of Federal Reserve Chairman Jerome Powell and called for lower interest rates, shaking financial markets and sending the dollar tumbling.

“I believe tariff uncertainty is the main catalyst for currency depreciation pressure in Asia, which is ultimately one of the key factors driving interest in gold,” said Daniel Ghaly, commodities strategist at TD Securities.

Traders will be watching several Federal Reserve officials this week for clues on future monetary policy amid concerns about the independence of the U.S. central bank.

Sourse: breakingnews.ie