Both June and the entire second quarter of 2025 brought a slight recovery to the real estate market. Demand for mortgages and activity in the rental market increased, and the latest urban.one index readings also show a rebound. Despite the highest rates on record, especially on the secondary market, we can still say that it's a buyer's market.

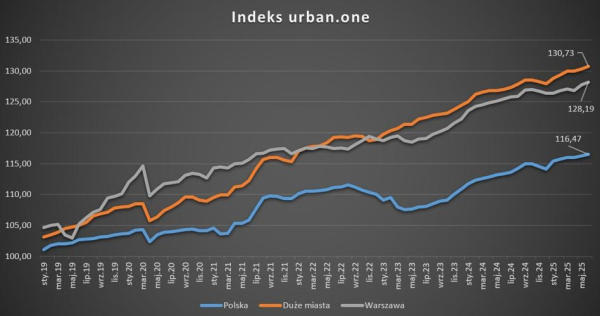

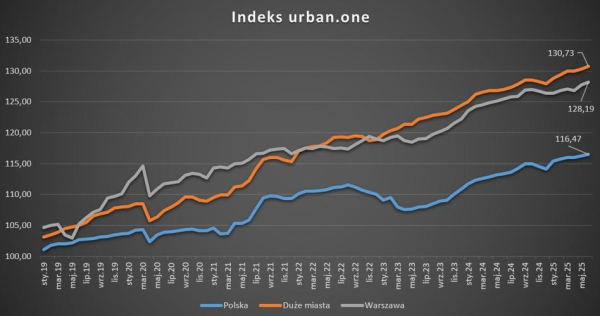

According to the latest urban.one index readings, we should expect apartment prices to stabilize after the second quarter of 2025, with some slight increases expected. In June, the index for Poland as a whole reached 116.47 points , which was 0.22 points higher than in May and 3.08 points higher than the same month last year.

In the case of the largest Polish real estate markets, with the exception of Warsaw, the index settled above 130 points and reached 130.73 points in June (+0.41 points m/m and +3.71 points y/y). For Warsaw alone, it was 128.19 points (+0.44 points m/m and +2.7 points y/y).

Bankier.pl based on Cenatorium data

“In recent weeks, the real estate market has begun to recover slightly, driven by interest rate cuts, cheaper mortgages, and the introduction of a new law increasing the transparency of developer housing prices. Currently, the market is maintaining price stability amid a high supply of apartments ,” notes Małgorzata Wełnowska, senior real estate analyst at Cenatorium.

Advertisement See also: Is your neighbor showing off his new lawnmower? You fight for the new Hyundai. It's time to start the holiday arms race!

He adds that with demand still relatively low, although recovering, and supply still high, developers are showing a tendency to reduce the number of offers, which is intended to keep apartment prices stable.

Developers are slowing down, but offers are increasing

Data from the Central Statistical Office (GUS) indicates decreased developer activity on construction sites. According to the data, in the first half of 2025, developers began work on 68,333 apartments, which was 15.2% lower than last year. While the stagnation in 2023 is still a long way off, the first half of 2025 was also worse in this regard than 2022 and 2021.

The number of apartments put into use is the lowest in seven years, which is the result of stagnation on construction sites in the aforementioned 2023.

However, there are significantly more offers than during the same period last year, as clearly visible in the Warsaw primary market. The second quarter of 2025 brought a further decline in new apartment sales in the capital and an increase in the number of new listings launched by developers, as we recently reported in our summary of data from CBRE and tabelaofert.pl.

Increased activity is evident in the secondary market. While, with local exceptions, there are still more listings than a year ago, supply is slowly but steadily decreasing. According to Otodom Analytics, in June, the seven largest secondary markets recorded 46,200 listings for second-hand apartments. This was 1.5 percent more than a year ago and 5 percent less than in May.

More people willing to take out a loan

A recovery on the demand side, but only among buyers using credit, is indicated by data from the Credit Information Bureau, according to which 19,200 housing loans were granted in Poland in June – 3.2 per cent more than a month earlier and 29.7 per cent more than in the same month last year.

Throughout the second quarter of 2025, the number of mortgage loan agreements remained at 56,400, up 13.9% quarter-on-quarter and 20.8% year-on-year. Nominally, the number of mortgage loans granted was nearly 10,000 higher than a year ago.

According to price monitoring conducted by Cenatorium, June saw declines in average asking prices across Poland's largest real estate markets. In Wrocław, Łódź, Poznań, and Kraków, the declines ranged from 0.2% to 1.5% month-on-month. Reductions were more readily available on the secondary market.

A similar situation occurred in Warsaw, where second-hand apartments in classifieds fell in price by an average of 1.1 percent. The average price of new apartments offered by developers rose by the same amount, but by a similar amount.

Students have revitalized the rental market

The rental market is seeing a revival, though this is likely due to the seasonal nature of student housing searches. While prices for the most popular sizes have begun to rise, year-on-year increases are typically in the range of 1-4%.

The highest rates in history, however, aren't deterring prospective tenants, often facing tough odds. As Ilona Łyżczarz, a housing market expert at Otodom, notes, June this year was the best month of the year for responses to apartment rental ads. They were 8% higher than last June, which was the best month to date.

Rental profitability remains similar, or even slightly higher, than a year ago. As we reported recently, however, the rate of return is still closer to recent lows than to peaks.

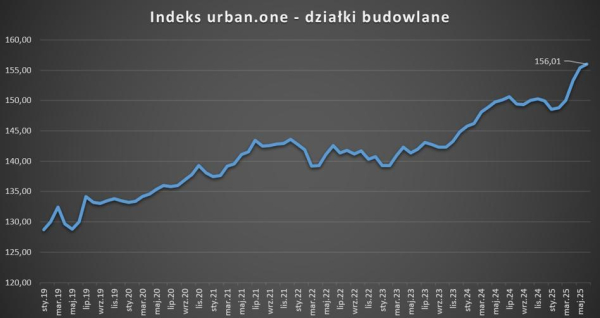

Plots of land are getting more expensive and probably won't stop.

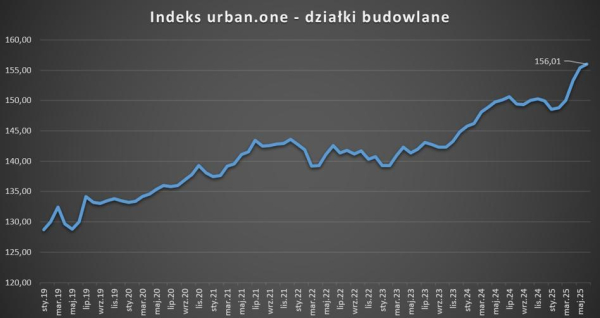

The latest reading of the urban.one index for building plots indicates that the upward trend will inevitably continue. In June 2025, the index reached 156.01 points – 0.6 points more than in May and 5.91 points more than in June 2024.

Bankier.pl based on Cenatorium data

Let us recall that after a break in the series of price increases at the end of 2024, the first months of 2025 brought a significant increase in the average amounts paid for building plots – both in the capitals of the voivodeships and in smaller towns.