Although two months have passed since the annual shareholders' meeting of 11 bit studios, we are returning to the topic of the general meeting due to the situation of one of our readers who, while attending the meeting, asked the company's management several questions, primarily regarding the controversial “P8” project. To date, he has not received a response, and the company remains silent, even when asked about the matter by the editorial staff of Bankier.pl.

The last ordinary general meeting of shareholders of 11 bit studios, a game developer and publisher, took place on June 12th of this year. This means that two months will soon have passed since the meeting of the company's owners, who are all shareholders. Among other things, they voted on granting discharge to members of the management board and supervisory board for 2024.

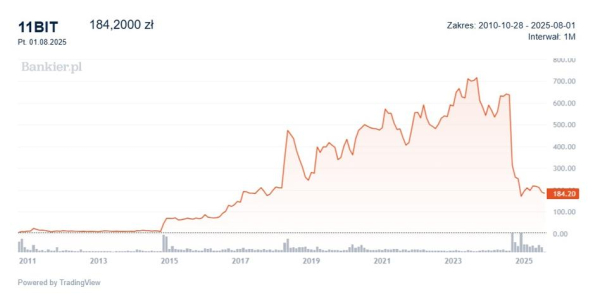

For all shareholders, it was a very turbulent year on the WSE, as during this time the 11 bit share price fell by nearly 69%, and from the annual maximum of PLN 713 (only PLN 30 lower than the historic peak in 2023), the price fell by over 76% by the end of the year.

A tough year for 11 bit studios and investors traumatized after “P8”

This was primarily due to the disappointing launch and sales of “Frostpunk 2,” the postponement of the release of another title, “The Alters,” by over six months, and the December suspension of work on another game, tentatively titled “P8,” without its release, which resulted in a nearly PLN 50 million write-down. This last factor was significant because it was a major game that would determine the studio's results in the coming years. The releases of other titles, particularly “The Thaumaturg,” also failed to impress.

Advertisement See also: With us, you can “buy high and sell low” with impunity. At best, you'll learn how not to do it.

Much has also happened in terms of investor confidence in the board. Its CEO, Przemysław Marszał, announced in an interview with “PB” last September that the “P8” project had completed many stages and was ready for implementation. Furthermore, periodic conferences emphasized that the project's challenges, such as those in 2022, were behind the company, and that work on the game was progressing according to schedule.

It's no surprise, then, that some shareholders wanted to meet with the management and supervisory boards in person to discuss all these matters. This is especially true given the company's failure to provide any clarification, as Michał Żuławiński of the Association of Individual Investors (SII) extensively covered in May of this year's article, “Investors won't let go of 11 bit studios. 'Without P8's explanation, the company will never regain credibility.'” Furthermore, media reports may have worried investors about the situation within the company. Former members of the “P8” team cited burnout, conflicts, and tensions, as well as a lack of transparent dialogue with the management board.

According to information obtained by Katarzyna Kucharczyk from “Parkiet,” developers working on the game complained about the project directors' lack of direction and artistic vision. Problems with achieving milestones and failing to maintain the schedule resulted in constant cost increases. Ultimately, after spending approximately PLN 50 million on its implementation, the project was closed without a release. Part of the team was laid off or reassigned to other roles.

One of the shareholders who appeared at the company's Annual General Meeting in the first half of June 2025 was our reader Mr. Krzysztof, who arrived at the general meeting with a list of specific and precise questions, primarily regarding the “P8” project, to which he had not previously received answers, also with the support of the Association of Individual Investors.

“I attended the 11bit AGM for the first time. I asked questions to the company's Supervisory Board, who were completely unprepared and unable to answer simple questions about P8,” describes Mr. Krzysztof.

“The Chairman of the Supervisory Board requested that the questions be submitted in writing, which I did. I did not receive any answers to my questions. I also submitted a list of questions to the company's management board pursuant to Article 428 of the Commercial Companies Code. Despite the deadline having passed, the company still responded. The matter was reported to the Polish Financial Supervision Authority,” the investor added.

“Unfortunately, this is another outrageous behavior of the company’s management board and supervisory board, who are acting illegally,” says the irritated shareholder, referring to the issue also raised on his behalf and other investors by the Association of Individual Investors (SII).

Investors accused the 11 bit studios management of inappropriate communication, contradictory information, and late and unclear disclosures. They demanded the appointment of an independent auditor and an explanation of the circumstances surrounding the closure of the “P8” project. SII even notified the Polish Financial Supervision Authority of the possible breach of disclosure obligations.

The company will not comment on the matter

Returning to the questions posed by Mr. Krzysztof, a shareholder at 11 bit studios, at the Annual General Meeting, let's summarize a few to understand the specific issues they addressed. Among other things, he asked what the board considered the weaknesses of the game “P8” and the reasons for its cancellation. He also inquired about the experience of one of the three Game Directors responsible for the project before assuming this role.

Questions also concerned the results of the open playtests of the “P8” game conducted in August 2024. The playtesters' ratings of the game and whether the management board informed the supervisory board of the test results. The shareholder inquired about how much of the game had been completed when the project was closed and how many of the planned milestones had been completed at that time. “The company stated that it would not answer questions or comment on the matter. I received this information only verbally,” concludes Mr. Krzysztof.

Even though the Annual General Meeting approved discharge of the management board and supervisory board for 2024, the year in which all the previously described scourges occurred, minority shareholders still remain unanswered on a number of questions regarding the “P8” project. When I asked Mr. Krzysztof about the matter and his questions, first at the general meeting and later in writing, the company remains silent.

The shareholder hasn't received a response since June. I sent my questions to 11 bit on July 1st. It's the holiday season, so I decided to wait longer than usual for a response, but the silence persisted. Finally, on July 16th, I contacted Mr. Dariusz Wolak, who is responsible for investor relations at the company, since the media channel wasn't working.

Despite presenting the matter by phone and requesting comment, or better yet, a response to the question, the next two weeks or more yielded no response. As with the request for comment from SII, 11 bit studios remains silent, employing the tactic of sweeping the matter under the rug.

When it came to presenting the vision of success to investors, we could see quotes in the media from CEO Przemysław Marszał, who said a year ago: “We assume that in terms of results, the years 2024-2026 will be record-breaking for 11 bit studios.”

When it comes to explaining the failure, there's a deafening silence. It's worth noting that the net result for 2024 (PLN 6.9 million) is historically only ninth (due to write-offs) since the company went public in 2010. It was therefore a long way from breaking records, although it's worth emphasizing that revenues in 2024 (PLN 140.5 million) were indeed record-breaking, PLN 53.44 million higher than the second-placed company in 2020.

The law exists, but its enforcement is sometimes ineffective.

To draw conclusions from the described case of 11 bit studios, related to shareholders' rights to information, especially at the AGM, for other investors in similar situations, I asked an expert for comment on their rights in this regard. Attorney Michał Sowiński from Graś i Wspólnicy Kancelaria Prawna responded to my questions.

The right to information at the General Meeting

Pursuant to Article 428 §1 of the Commercial Companies Code, during the General Meeting, the Management Board is obligated to provide a shareholder, upon request, with information concerning the company, if this is necessary for the assessment of a matter on the agenda. A Management Board member may refuse to provide information if providing it could constitute grounds for criminal, civil, or administrative liability. The Management Board may refuse to provide information if it could cause damage to the company, an affiliated company, or a subsidiary or cooperative. The Management Board may provide information in writing outside the General Meeting if there are compelling reasons to do so.

Legal doctrine holds that “important reasons” for providing a written response outside the General Meeting are considered particularly relevant in situations where further analysis or consultation is necessary and the matter cannot be resolved ad hoc. This may be due to the absence of a person with relevant knowledge or the need to obtain data from relevant company units. The Management Board is obligated to provide information no later than two weeks from the date the request is made during the General Meeting. If a shareholder submits a request for information regarding the company outside the General Meeting, the Management Board may provide the shareholder with the information in writing, taking into account the limitations arising from Article 428 § 2 of the Commercial Companies Code. Failure to respond without providing reasons constitutes a violation of Article 428 of the Commercial Companies Code.

A shareholder who is refused disclosure of requested information during the General Meeting and who objects to the minutes may file a motion with the registry court to compel the management board to provide the information (Article 429 of the Commercial Companies Code). The motion must be filed within one week of the conclusion of the General Meeting at which the information was refused. The shareholder may also file a motion with the registry court to compel the company to publish information provided to another shareholder outside the General Meeting. Failure to respond may also justify notifying the Polish Financial Supervision Authority (KNF) or considering appealing the resolutions. It follows from the above that Polish law protects the right to information, but enforcement mechanisms require strengthening, and in practice, their enforcement can be difficult.

![]()

Michał Sowiński