It is commonly said that gold is the best hedge against inflation. This is not entirely true. The relationship between gold and inflation is difficult and changes over time. However, this is not the most important thing in all this.

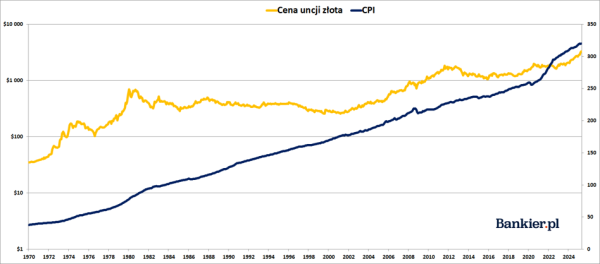

Many investors treat gold as an “anti-inflation” remedy. It is worth remembering, however, that gold is not always and everywhere able to beat inflation. In this context, the years 1980-2000 are usually cited. During this period, the price of gold fell from $850 to less than $300 per troy ounce. During the same period, the cumulative CPI inflation in the United States was almost 114%. The real losses were therefore huge.

Gold price adjusted for CPI inflation for the United States. ()

It is worth remembering, however, that the starting point was a special moment. It was the culmination of the powerful gold bull market of the 1970s, which ended in the fumes of a speculative bubble in January 1980. The then dollar record ($850 per ounce) in real terms – that is, after taking into account the decline in the purchasing power of money over time – was broken only recently. Yes, it took more than 45 years for gold prices in real terms to equal the peak from January 1980.

See alsoTake your first steps towards safe investments – read our guide to Treasury Bonds!

Inflation and Gold: Numbers and Principles

Since the Federal Reserve was established in December 1913, the U.S. dollar has lost nearly 97% of its purchasing power, according to calculations based on the official inflation calculator of the government's Bureau of Labor Statistics. In the seven years since, the purchasing power of the dollar has fallen by half. The dollar's depreciation accelerated again after World War II, but the real inflationary explosion in the United States occurred after 1971, when President Richard Nixon suspended (and then completely severed) the convertibility of the dollar into gold.

In August 1971, the CPI index was at 39 points, and the official price of gold was USD 35. In April 2025, the CPI index exceeded 320 points, and the price of gold reached USD 3,500/oz. This means that the royal metal in dollar terms increased in price over this period a hundredfold, while the CPI inflation officially reported by the government was “only” 720%. Gold therefore beat the official measure of the increase in the cost of living in the US by a huge margin. However, the matter is complicated by the fact that for the previous half-century, inflation was not zero and in the years 1921-1971 amounted to 102.5%, while the price of gold was raised only once: from USD 20.67 to USD 35/oz. – i.e. by almost 70%.

At the same time, the above chart shows long periods when gold was unable to beat even the official CPI. It is also clear that the prices of the royal metal do not always go up. In addition to the long-term bear market of 1980-2000, we also had a period of declines in 2012-2015 or the tiring “side mushrooms” of 2016-2018 or 2020-2022. These were times that tested the patience of even the most faithful goldbugs. And in these periods, portfolios “loaded” exclusively (or mostly) in gold brought disastrous results compared to the stock or bond markets.

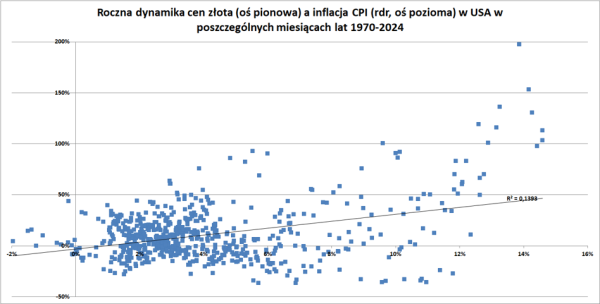

In fact, the relationship between gold and inflation is much more complicated. An analysis of data from the last half-century shows that the highest nominal rates of return on gold (i.e. in USD) were recorded when CPI inflation in the United States exceeded 12%. In such months, there was not a single case of negative annual dynamics of the price of the metal. However, we can see a few other interesting coincidences. Namely, in conditions of price deflation, gold prices tended to achieve positive annual dynamics!

Gold, on the other hand, fares the worst in low dollar inflation (i.e. below 2%). These are usually periods of stable economic growth, which favors stock markets or risky debt more than defensive metals. And third, even in times of significantly increased inflation in America (i.e. in the range of 4-12%), there were quite a few months when annual gold rates of return were negative. As you can see, gold does not always follow inflation in the short term.

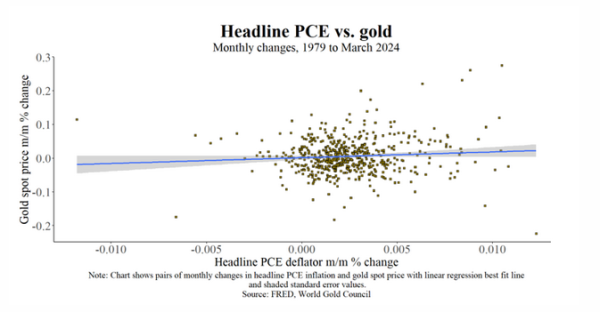

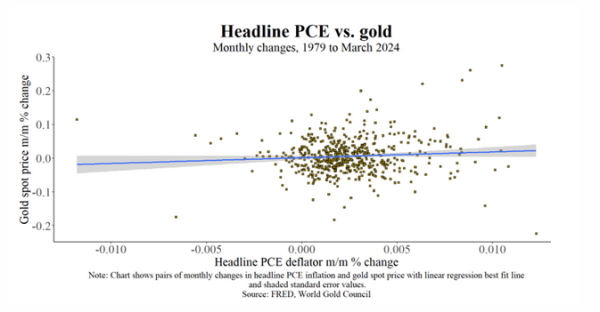

Even more consternation may arise when monthly gold price changes are plotted against the monthly change in the U.S. Consumer Expenditures (PCE) deflator (the Federal Reserve’s preferred measure of inflation). The data from 1979 to 2024 show that monthly gold price changes are almost completely uncorrelated with monthly PCE inflation. In such a case, gold is hardly a good anti-inflation hedge. Especially in the short term.

CFA Institute Research Challenge Global Final

That said, it should be noted that the correlation between gold and US inflation varies over time. There were periods when it was clearly positive, but also when it was negative. This may be due to the fact that the gold market usually “precedes” the inflation that is being realized. That is, the prices of the precious metal grow at an advance (as in 2018-2019, when they anticipated the arrival of the inflationary wave), only to behave indifferently during the inflationary peak (as in 2021-2022) and even start to decline before we saw the inflationary regression in the data.

In short, gold is not an “iron” anti-inflationary hedge in all circumstances, and especially not in the short term. In this competition, stocks and real estate have usually performed better in the long term. Instead, gold is a hedge of the real value of property over long and ultra-long periods of time, counted in generations. And above all, it is a kind of “systemic hedge” that safely transfers value during periods of war, revolution, or all sorts of monetary “resets.”

It is an asset independent of the government, banks (including central ones), technology and is free from credit risk. It is difficult to control and can easily (and discreetly!) change owners. It is also an excellent complement to a long-term investment portfolio, reducing its volatility due to its low correlation with other financial assets. And these are the main reasons why it is worth investing part of the portfolio in gold. “Anti-inflation” itself should not be the main motive here.

We invite you to read the rest of the materials in the series Tydzień złota . All of them will be available at this link.