In the era of Donald Trump's second trade war, investors are asking themselves how American protectionism will affect gold prices. What do analysts think about this and can we find good analogies from the past that tell us what awaits the royal metal?

Governments have long used protectionism to justify it by supporting domestic industry and combating trade imbalances. Tariffs can also be used to exert political pressure in the international arena. However, the economic effects of such measures often go beyond trade and lead to different economic outcomes than politicians intend.

Tariffs—simply taxes on imported goods that are intended to boost domestic production by raising the prices of foreign products—can protect jobs and industry, but they often lead to higher prices for buyers, which in turn raises inflationary pressures, disrupts supply chains, and increases economic uncertainty. Analysts agree that Trump’s tariffs won’t directly affect gold prices. But indirectly, they could have a very significant impact on the market.

Assumptions and actual effects of tariffs

According to Donald Trump, the goal of his protectionist policies is to rebalance trade, reindustrialize the United States, and reduce fiscal deficits by taxing entities that engage in “unfair” trade practices. Analysts at the Amundi Research Center, however, question whether tariffs are the right mechanism to achieve these goals.

“According to economic theory, the size of the trade imbalance is more closely linked to the disparity between domestic savings and investment. While tariffs cannot significantly change Americans’ saving and investment behavior, prevailing economic theory — supported by empirical evidence — suggests that the likelihood of President Trump making a significant change to the U.S. trade balance is low,” Amundi analysts pointed out.

Moreover, structural changes, not tariffs, would be essential to reviving U.S. manufacturing. The decline in manufacturing’s share of U.S. GDP has coincided with the growth of the service sector (such as finance and technology) and rising costs for American workers. Amundi says the key question is whether tariffs can revive manufacturing competitiveness and trigger a shift of resources from Wall Street and Silicon Valley back to the rust belt states, which has been met with skepticism.

It is also important to note that the cost of tariffs will not be borne solely by foreign entities. Historically, they have been absorbed largely by consumers. This is because the importer has to pay the duty when bringing the goods into the country. Higher costs are usually passed on down the supply chain, from suppliers to end customers. Companies may take some of the hit and not raise prices in order to remain competitive. However, this will reduce their profit margins and may lead to cost cuts such as job cuts.

One of the first effects of the Trump administration’s tariffs could therefore be an increase in inflationary pressures. Another effect that we are already seeing is the international tensions that have led to an all-out trade war between the United States and China. Although the conflict has been suspended, it is unclear what will happen after the 90 days that the tariffs have been suspended. The deadline is August.

Customs and Gold Prices – Lessons from History

photo: NARA / Everett

History provides numerous examples of the impact of tariffs on the economy (and therefore gold prices), although the results have varied, depending on many different factors, and cannot be easily extrapolated to the present situation. Starting with an example from 200 years ago, the Corn Laws in Britain from 1815 to 1846 introduced high tariffs on grain imports to protect British agriculture, which caused food prices to rise and contributed to inflation. Gold prices, however, have remained stable, although they have become more widely seen as a safe store of value.

The tariffs introduced by France between 1870 and 1910 to protect domestic industry and agriculture also contributed to rising prices and economic turmoil. Before trade liberalization, tariffs indirectly led to an increase in demand for gold amid concerns about inflation. Similar effects were seen in the Prussian tariffs introduced in 1879 by Otto von Bismarck. Again, protectionist policies led to higher production costs and prices, and gold saw increased demand as a hedge against inflation.

Gold's limited response, however, was caused by the tariffs introduced by the Smoot-Hawley Act of 1930, which was intended to strengthen the American economy, which was mired in the Great Depression. For economists, this is the prime example of the negative effects of tariffs. The stifling of international trade deepened the crisis and brought retaliatory measures against the United States. Nevertheless, the United States was facing deflation at the time, and in 1933, under Executive Order No. 6102, issued by President Franklin D. Roosevelt, American citizens were prohibited from owning gold in any form and were ordered to sell it to the Federal Reserve at a price of $20.67 per ounce. After the dollar was devalued in 1934, the price of gold rose to $35 per ounce.

Nixon’s 10% surcharge on imports in 1971 coincided with the end of the gold standard and high inflation, which led to a dramatic increase in the price of the royal metal from $35 to over $180 an ounce between 1971 and 1974. The Bush administration’s 2002 tariffs on steel and aluminum raised production costs, but the broad inflationary effects were limited. Gold was already on an upward trend due to the weakening dollar.

The recent US-China trade war under the first Trump administration in 2018-2019 resulted in higher consumer prices, supply chain disruptions and market volatility. Gold prices rose from $1,200 to over $1,500 an ounce due to economic uncertainty. The global economic turmoil caused by Covid contributed to record inflation, with gold reaching its peak of $2,050 an ounce in March 2022.

Gold at $4,000 an Ounce? Yes, but…

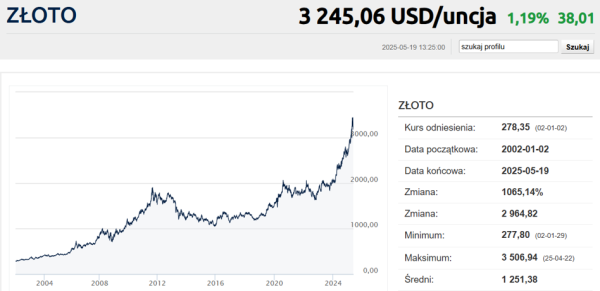

Gold prices in the last 23 years (Bankier.pl)

As a rule, tariffs rarely act as a direct catalyst for gold prices to rise, but the economic and political reactions to their introduction are another story altogether. The potential inflationary effect of tariffs, as described earlier, was pointed out in an April analysis by Goldman Sachs analysts, who predicted that the price of the royal metal would rise to $3,700 an ounce by the end of 2025 and break through $4,000 an ounce by mid-2026.

Gold at $4,000 per ounce in the second quarter of 2026 is also seen as a realistic scenario by JP Morgan. The bank's analysts have drawn attention to the strong demand for gold from investors and central banks. Tensions in international relations and uncertainty about the future of the global economy, fueled by Donald Trump's tariff policy, mean that both institutions and small savers are looking for support in gold, who invest in it, among others, through ETFs.

In the first quarter of 2025, central banks purchased a total of 243.7 tons of gold. Demand for gold from ETF funds amounted to 226.5 tons (the highest in three years). Among the largest institutions buying the precious metal, the National Bank of Poland was in first place, increasing its reserves by 49 tons in the January-March period. The NBP's gold reserves currently amount to over 509 tons. The royal metal was also purchased in the first quarter by the People's Bank of China (13 tons) and the central banks of Kazakhstan (6 tons), the Czech Republic (5 tons) and Turkey (4 tons).

“The basis for our forecast that gold prices will reach $4,000 per ounce next year is the continued strong demand for gold from investors and central banks, averaging around 710 net tons per quarter this year,” JP Morgan emphasized. The bank's analysts also outline a second scenario, which is less optimistic from the point of view of gold prices. If the US economy proves resistant to tariffs, which would allow the Fed to take a much more proactive approach to combating inflation, further growth in the price of the precious metal may slow down.

We invite you to read the rest of the materials in the series Tydzień złota. All of them will be available at this link.