Earlier this week, the Austrian Erste Group signed an agreement to buy 49% of Santander Bank Polska and 50% of Santander TFI for a total of 7 billion. The new investor expects the takeover to be completed by the end of this year. If all regulatory approvals are obtained, it can be assumed that the rebranding of branches and the streamlining of the product offering will begin in the first half of 2026.

This does not mean, however, that the Santander brand will completely disappear from the Polish market. The Spaniards have another bank in Poland – Santander Consumer Bank. Before finalizing the planned takeover, the Santander Group plans to acquire a 60% stake in Santander Consumer Bank, currently owned by Santander Bank Polska, in order to have 100% of shares in this company.

However, we can be basically certain of one thing – the “big” Santander will disappear from the Polish market because the new investor will change its name to one that will refer to Erste (e.g. Erste Bank Polska). It will not be in its interest to maintain the old brand, whose name will refer to the Santander Group. The Erste Group has its logo in blue and white, so these colors will replace the fiery red used by the Spanish.

Advertisement See alsoWe recommend: up to PLN 700 bonus and no fees for active use of a personal account at Santander Bank Polska

Customers can expect another rebranding

So what steps can we expect next? After the bank changes its name, it will probably start a quick rebranding of its branches and ATMs. In 2018, when Bank Zachodni WBK was changing into Santander Bank Polska, the cost of changing banners, signs, decor of branches, etc. amounted to around PLN 70 million. Today, such an operation can be much more expensive – it is possible that the expenses will exceed PLN 100 million. On the other hand, it must be remembered that in 2018, Santander Bank Polska had to “color” over 600 branches red. Today, it has half as many.

Customers will not have to take any action, because their agreements will remain in force. This happens after every bank “merger”. They will continue to use their accounts, cards, save and repay loans on the old terms. Over time, the bank will replace their cards with new ones – with the Erste logo. However, this does not mean that other changes will not occur. The bank will probably start to organize its products in the long term, introducing new accounts, deposits and electronic banking.

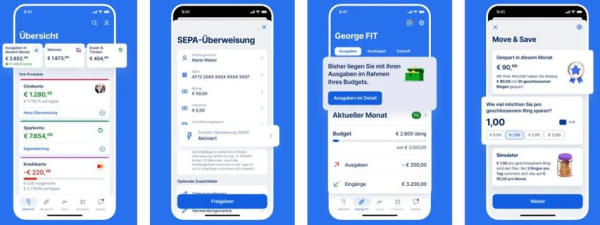

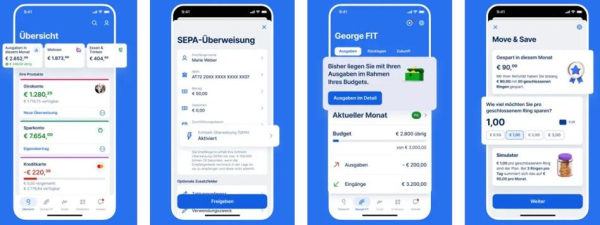

The Erste Group offers the same mobile program in all of its markets – an application called George. It is therefore very likely that it will also introduce it to Poland, withdrawing the current application. The George program will most likely be adapted to the needs of local users, so it will include services unavailable in other markets, such as Blik. Perhaps the new investor will surprise us with other new products in its offer. Changes to electronic banking will probably not take place immediately, perhaps in a year or two at the earliest.

photo: Erste Group / ERA Arqueologia

What next for “little” Santander?

In the case of changing the name of Santander Bank Polska, we will be dealing with a slightly different situation than in the case of the rebranding of Bank Zachodni WBK. It is worth recalling that the Spaniards bought BZ WBK in 2011, and the name change took place only in 2018. Here, as mentioned above, it will not be in the interest of the new investor to maintain a competitive brand.

Especially since there will still be a “small” Santander on the market, namely Santander Consumer Bank. This is an institution that currently specializes in consumer loans and savings. The bank does not offer traditional accounts and does not issue debit cards. It is difficult to say how the situation will develop here. Let us recall that after the 2008 crisis, there was speculation that the Spaniards would withdraw from Poland altogether. At that time, there were clear indications for this. For example, in 2009, they closed nearly 50 branches, laying off 200 people. Almost overnight, they also stopped selling housing loans. Ultimately, however, there was a 180-degree change – in 2011, they entered our market for good, additionally taking over BZ WBK.

photo: Katarzyna Waś-Smarczewska / Bankier.pl

Today, Santander Bank Polska is one of the leading banks in Poland – it ranks third after PKO BP and Pekao SA in terms of assets. The group employs over 11 thousand people, serves almost 6 million customers, maintains 4.8 million personal accounts for individual customers and has over 300 branches throughout the country. In turn, the Erste Group already has around 17 million customers on the domestic market and in the countries where it operates.

In 2024, the profit attributable to shareholders of Santander Bank Polska Group amounted to PLN 5.2 billion. Total income increased by 7% year-on-year. In the first quarter of this year, the Group's profit amounted to PLN 1.7 billion.