Generation Z will become the richest and most populous generation in the next decade, according to a report published by Bank of America. Their global income is estimated to reach $36 trillion in the next five years, rising to $74 trillion by 2040.

The authors of the study point to a very rapid increase in this value from $9 trillion, recorded in 2023. In their opinion, the consumption patterns of this generation, which includes people born between 1995 and 2012, may have a destructive impact on the global economy, markets and social systems. Within ten years, Generation Z will constitute 30% of the world's population and will become the largest age group in the world.

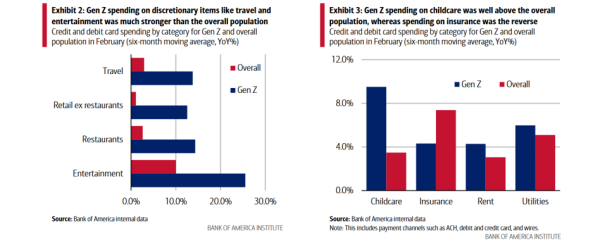

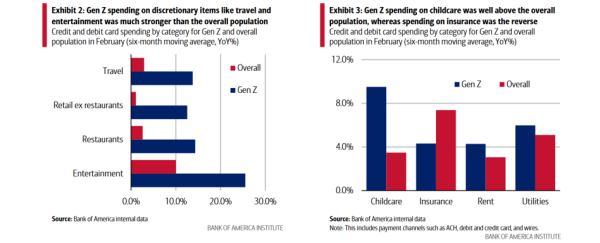

Bank of America, which analyzed internal debit and credit card data, found that Generation Z has seen a much greater increase in spending on essential and high-end products compared to other generations.

“We found that, on average, Gen Z does not have enough money to cover their monthly expenses. (…) Gen Z's spending is almost twice as high as their savings, as the high cost of living puts financial pressure,” the report reads.

As noted, this generation spends particularly heavily on entertainment and travel – the increase in these expenses year-on-year was 25.5%.

Bank of America

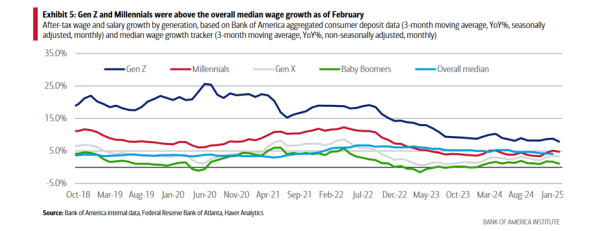

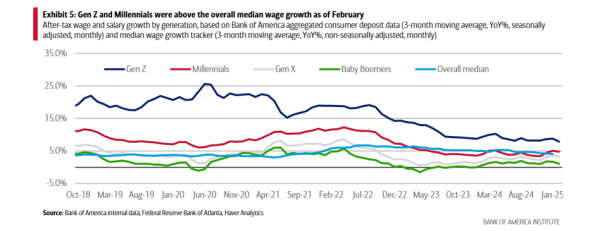

At the same time, today’s 20-somethings are expected to face a lot of challenges in finding work. The number of Gen Z households receiving unemployment benefits rose by almost 32% in February compared to the same time last year, and unemployment is rising among those new to the job market. The report’s authors are concerned that more than 52% of Gen Z respondents said they don’t earn enough to have the life they want, with the high cost of living being one of their top financial challenges.

According to the study, 32% of Generation Z believe they have much less than their parents did when they were their age. Respondents emphasized that while they understand the importance of saving, many of them are unable to put aside as much money as they would like.

Bank of America

The Bank of America study was conducted in April and May 2024. It involved more than 2,000 respondents aged 18 to 27. (PAP)

mzb/ szm/