Can a simple transfer to family end up with an account blocked? One of ING Bank Śląski’s clients unfortunately found out about this personally. The bank stopped his transfer and blocked access to electronic banking, but restoring the service required a visit to the branch. How does ING explain the situation? At Bankier.pl, we take a closer look at the case of the unlucky client.

Krzysztof Jurga shared his story on LinkedIn. Since its publication, the post has gathered numerous comments in which other users have also reported problems with ING. The bank itself responded to the client’s allegations, but the explanations were not sufficient for him.

The operation was completed, but the account was blocked.

Mr. Krzysztof’s problems began on May 28 at 2:00 p.m., when he ordered an important transfer to his family at ING Bank Śląski. He chose the immediate one, but the operation was not carried out. Instead , the client received an SMS that the bank had detected a suspicious transaction and blocked online banking and to contact the hotline. Mr. Krzysztof tried to unblock access to the account by phone for over 1.5 hours, going through successive attempts to verify his identity, but the strangest thing was yet to come.

See alsoRecommended: Is Your Bank Raising Fees? Find a Cheaper Account and Get Bonuses. Check It Out!

During conversations with consultants , it turned out that the transfer… had reached the recipient . The unlucky client was assured that everything was fine, but in the evening, logging into the account still did not work. After 5 attempts to contact the hotline, Mr. Krzysztof was told that he had to go to the branch for security reasons, which resulted in filing a complaint.

Strange statement in the branch

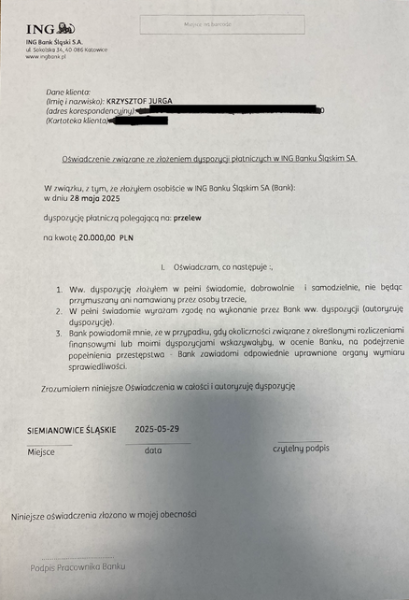

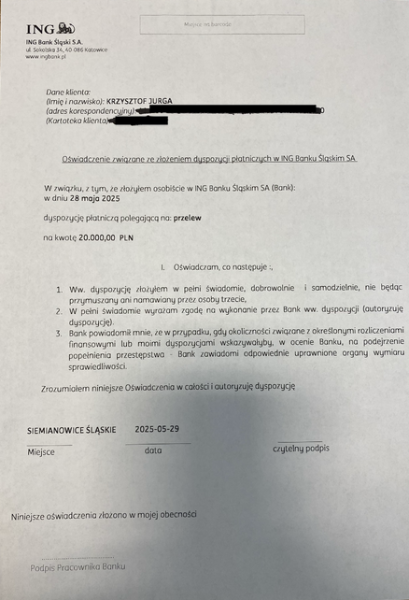

The next day in the afternoon, the client went to the branch, where he gave explanations about the recipient and the purpose of the transfer. However, the employee could not unblock access to the account. After contacting his superiors, it turned out that a written statement would be needed, but not in person, but on a specific form.

photo: Krzysztof Jurga / Bankier.pl

The document raised doubts for Mr. Krzysztof, because one of the points contained consent to the execution of an order, which in practice had already been executed . The client refused to sign the form, but was told that without it the account would remain blocked. Another option was to file another complaint with a 30-day deadline for consideration.

In this situation, Mr. Krzysztof decided to close the account immediately, but since there was not enough cash in the branch, the funds had to be transferred. As he noted, no additional statements were needed then, his instruction was enough for the money to be transferred to the selected account.

ING explains itself

In the comments under Mr. Krzysztof’s post, a discussion about the mechanisms that banks use when they detect suspicious operations and in general security issues arose. One user complained that ING blocked all of his accounts when his ID card expired, while in another institution this was not a problem. Another client made a transfer to a travel agency, but the bank blocked the transaction and the account, as a result of which her reservation and the chance for a vacation were lost.

In response to the publication, an entry from the ING Polska account appeared, explaining that if there is a suspicion that an unauthorized person may have access to the account, the bank blocks banking and asks to contact the hotline . However, Mr. Krzysztof noticed that although the bank’s system recognized him as an unauthorized person, the suspicious transfer was made, and additionally, banking mechanisms prevented confirmation of his identity on the hotline. In the next entry, ING provided more explanations:

In the event that the bank suspects that the client may be the victim of manipulation, e.g. investment fraud, the bank applies additional measures to protect the client’s money, e.g. a visit to a branch. The scheme described in this post looks like a typical investment fraud scheme that banks currently deal with on the market.

Although Mr. Krzysztof ultimately decided to close his account with ING, he is still waiting for the complaint to be considered. On LinkedIn, the bank admitted that there was a lack of sufficient communication on its part, but the question remains why, despite the bank’s doubts, the transfer was made and what aroused his suspicions.

We asked ING for a comment on the whole matter. The bank’s press office’s response is consistent with the commentary previously posted under Mr. Krzysztof’s post. ING maintains that the client’s case fits into a pattern of investment fraud, which triggered security procedures, but admits that it could have communicated the reasons for blocking the account better.

The scheme described in this post appeared to be a typical investment fraud scheme that banks currently face in the market. In such a situation, we have security procedures in place to protect customer money from fraud. In many cases, these types of actions prevent fraud from occurring. It appears that in the course of investigating this particular situation, there was a lack of sufficient communication on our part, for which we apologize.

We will of course review our internal procedures to make our intentions to protect our customers clearer to them, while maintaining the highest security standards.