The half-year report showed that the Norwegian wealth super fund ended the first half of the year with a profit of over $68 billion. The fund managers also announced that they were reducing investments in Israeli companies, which accounted for a quarter of a percent of their equity portfolio. This figure was still higher than in Polish companies, where they had been buying shares of Orlen, developers, and Allegro, among others, and selling shares of CD Projekt, for example.

In the second quarter of 2025, Norway’s largest sovereign wealth fund posted a positive rate of return of 6.42%, according to its half-year report published on August 12. This represents a rebound in the investment portfolio after a weaker first quarter, in which it posted a 0.6% loss.

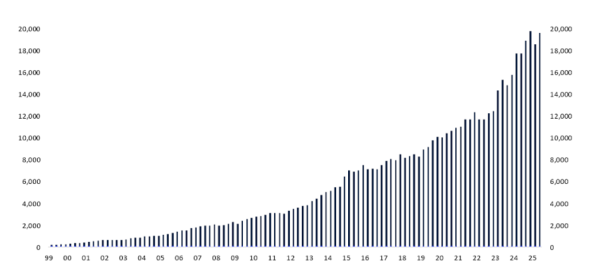

In the first half of 2025, the fund generated a total return of 5.7 percent, which was 0.05 percentage points below the return of the benchmark index set by the Norwegian Ministry of Finance. Assets at the end of June totaled 19.586 trillion kroner (approximately $1.92 trillion), which was 156 billion kroner lower than at the end of 2024.

The value of the Norwegian Wealth Fund’s assets at the end of the quarter, in billions of kroner (nbim.no)

It’s worth noting that the fund’s value also changed due to other factors, including government payments, which totaled CZK 156 billion in the first half of the year, and the impact of exchange rate fluctuations. The depreciation of the dollar and the strengthening of the krona negatively impacted the value of assets, which were valued at CZK 1.01 trillion.

See also: Want to invest? We won’t tell you what, but we will tell you how! Download Investing Academy II

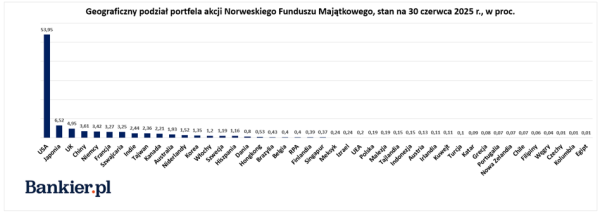

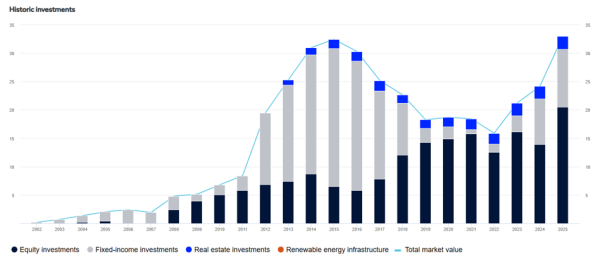

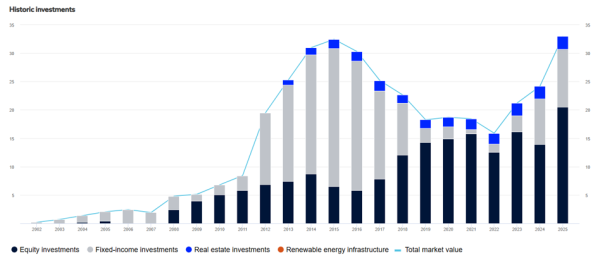

The Norwegian Sovereign Wealth Fund is one of the world’s largest investors, holding approximately 1.5% of all listed equities on global stock exchanges. It also invests in bonds, real estate, and renewable energy infrastructure assets. As of June 30, 2025, 70.6% of the fund’s assets were invested in equities, 27.1% in fixed income, 1.9% in unlisted real estate, and 0.4% in unlisted renewable energy infrastructure.

As reported, the return on equity investments in the second quarter was 8.45 percent, while the return on bond investments was 1.67 percent. Unlisted real estate investments generated a return of 1.59 percent during the reporting period, and investments in renewable energy infrastructure reached a whopping 8.1 percent.

A strong rebound in equity markets after the first-quarter sell-off triggered by the change in US tariff policy meant that the fund’s return on equities for the entire half-year was 6.7%, on fixed income investments 3.3%, and on unlisted real estate investments 4%. The return on unlisted renewable energy infrastructure was 9.4%.

“This result was driven by the strong performance of the equity market, especially in the financial sector,” fund CEO Nicolai Tangen said in a statement.

The fund limits investments in Israel.

The fund’s president also had to put out a firestorm following reports in Norwegian media in early August that the fund had used money from gas and oil production to buy shares in Bet Shemesh Engines Holdings, a company that services Israeli warplanes. The government in Oslo, which has been criticizing Israeli authorities for months over the situation in the Gaza Strip, announced an immediate review of the investment.

On Monday afternoon, August 11, Finance Minister Jens Stoltenberg (former NATO Secretary General) and the fund’s management announced that Norway had sold its shares in 11 Israeli companies that were not part of the Ministry of Finance’s benchmark index. The fund announced the termination of contracts with asset managers in Israel, transferring all operations to the fund’s internal companies.

The ethical dimension of investing in Israel is once again on the agenda. Last December, we informed you about the fund’s management board’s exclusion, following the recommendation of the Ethics Council, of several companies, including Bezeq from Israel, for allegedly contributing to serious “human rights” violations during the war. More on this in the article “Red card from a Norwegian megafund. An Israeli company and a steel giant excluded.”

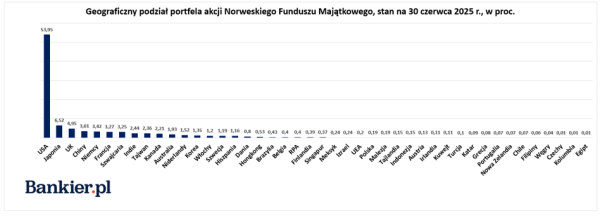

As of June 30, 2025, the fund held assets in 61 Israeli companies (11 of them before the sale). These represented 0.24 percent of its total equity portfolio, which included 8,374 companies from 62 countries. The fund’s largest holding, 53.95 percent of its equity portfolio value, was in U.S. companies. Shares of companies listed on the Polish stock exchange accounted for 0.19 percent.

Changes in the portfolio of companies listed on the WSE

At the end of June, there were a total of 86 Polish companies whose shares were worth CZK 20.5 billion (approximately USD 2 billion) on the balance sheet date. The most valuable block of shares in Allegro was valued at USD 214.56 million. Next were shares in Dino (USD 190.6 million), LPP (USD 184.06 million), and Benefit System (USD 148.97 million). The top ten was rounded out by shares in Żabka (USD 138.87 million), CCC (USD 123.20 million), XTB (USD 98.63 million), Orange (USD 97.91 million), PKO BP (USD 89.15 million), and PZU (USD 84.67 million).

More important than the nominal figure, however, is the change in percentage ownership over the first half of the year. In such a comparison, the new acquisitions immediately stand out. Diagnostyka shares were among them in the first half of the year, accounting for 4.95% of the shareholding at the end of June. Furthermore, shares in Vercom (1.29%) and Unimot (1.86%) were also acquired. [Update] In the first version of this article, we reported on a new stake in Żabka. In fact, the company’s shares were in the Fund’s portfolio at the end of 2024, but allocated to Luxembourg. In the first half of 2025, the stake decreased from 2.37% to 2.32%.

Compared to the end of 2024, at the end of June 2025, Ailleron shares were no longer on the list, meaning a 2.57% stake was sold in the first half of the year. Smaller positions (down to 0.2% of the shareholding) in Amrest, BNP Paribas, Boryszew, Eurocash, and Wawel were also liquidated.

In turn, looking at changes in existing positions, we see a slightly increased stake in Orlen, to 0.08% of the shareholder base. This is a doubling of the position in six months. This occurred during the period when the fund removed the company’s shares from the warning list and during a bull market in the multi-energy giant’s shares. At the end of June, the position was worth $20.7 million. As a reminder, the Norwegians are reducing their stake in 2024. A year ago, at the end of June, they reported a 0.19% stake, while at the end of December, it was only 0.04%.

In turn, the largest changes in position increases, apart from new listings, concern shares in Synektika (+2.74 percentage points), Benefit System (+2.59 percentage points), and two listed developers: Murapol (2.4 percentage points) and Atal (1.73 percentage points). These were followed by additional purchases of shares in XTB (1.19 percentage points) and CCC (1.08 percentage points). In the remaining cases, changes in shareholding did not exceed one percentage point. Allegro (0.98 percentage points) and XTPL (0.91 percentage points) were close to this threshold.

In the context of the largest reductions, besides Ailleron, a significant change in position in CD Projekt is worth noting (-1.3 percentage points). Furthermore, the stake in Selvita was reduced by 1.26 percentage points, Text (formerly LiveChat) by 1.09 percentage points, and Captor Therapeutics by 0.55 percentage points. Shares of Kruk, PLayWay, HiProMine, PZU, Alior, Pekao, PKO, Pure Biologics, Dino, Brainscan, PCC Rokita, mBank, Neuka, and Medinica also saw sales of less than half a percentage point. No changes were recorded in 37 companies.

The largest share of investments in Poland was held by shares of companies listed on the Warsaw Stock Exchange (GPW), with a value of CZK 20.505 billion (approximately USD 2 billion). This represents a significant increase from the CZK 13.96 billion at the end of 2024. The bull market on the GPW contributed significantly to this, raising the WIG20 index by nearly 30% in the first half of the year. There was a significant increase in exposure to Polish bonds, which amounted to CZK 10.21 billion compared to CZK 8.02 billion at the end of 2024. Real estate in Poland was valued at CZK 2.2 billion, similar to December 2024. The total value of assets in Poland increased by 36.4% over the six-month period to CZK 32.96 billion (approximately USD 3.2 billion), reaching an all-time high.

nbim.no