Save this storySave this storySave this storySave this story

In 1886, Leo Tolstoy published a short story called “How Much Land Does a Man Need?” Its protagonist, a poor farmer named Pahóm, dreams of becoming a landowner. He thinks, “If I had plenty of land, I shouldn’t fear the Devil himself!” The Devil is listening, and decides to orchestrate a series of events. Pahóm borrows money to buy more land. He raises cattle and grows corn and becomes prosperous. He sells his lands at a profit and moves to a new area where he can buy vast tracts for low prices. He’s briefly content, but as he grows accustomed to his new prosperity he becomes dissatisfied. He still has to rent land to grow wheat, and he quarrels with poorer people about the same land. Owning even more would make everything easier.

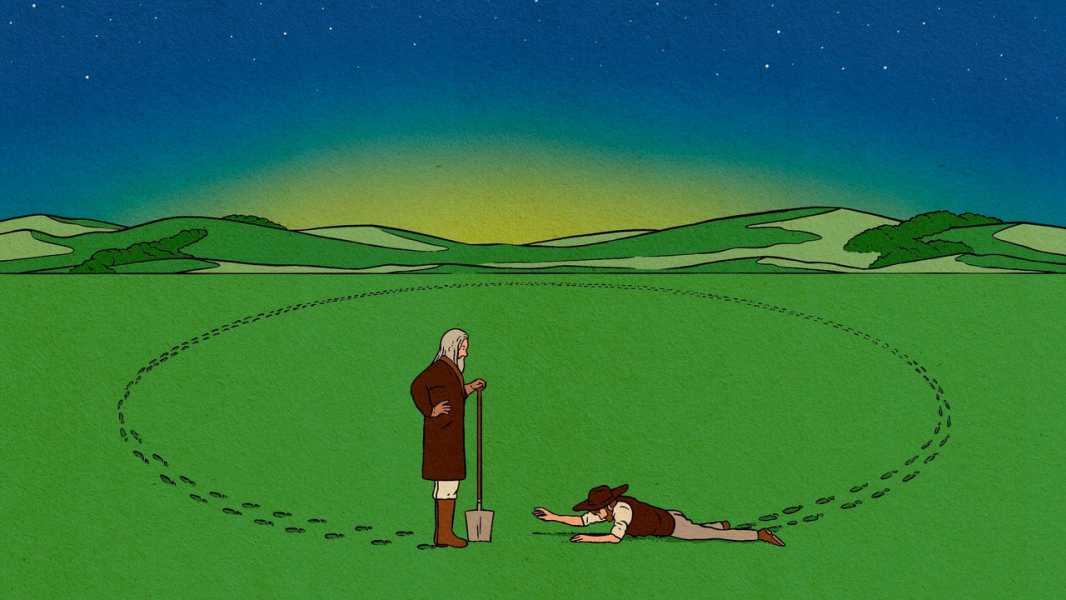

Pahóm soon hears of the Baskhírs, a distant community of people who live on a fertile plain by a river and will sell land for almost nothing. He buys tea and wine and other gifts and travels to meet them. Their chief explains that they sell land by the day. For the minuscule price of a thousand rubles, Pahóm can have as much land as he can cover in a day of walking, as long as he returns to the starting point before sunset. The next morning, Pahóm sets out through the high grass of the steppe. The farther he goes, the better the land seems. He walks faster and faster, farther and farther, tempted by distant prospects. Then the sun starts to slip toward the horizon. He turns back, but fatigue sets in. His feet grow bruised, his heart hammers, and his shirt and trousers become soaked with sweat. With aching legs, he charges up the hill toward the chief, who exclaims, “He has gained much land!” But Pahóm has already collapsed, and a stream of blood flows from his mouth. The Baskhírs click their tongues in pity, and then Pahóm’s servant takes the spade and digs a simple grave, six feet long. The question in the story’s title is answered: that’s all the land a man needs.

Tolstoy wasn’t an economist; in fact, he was so profligate with money that he once lost his family’s rural estate in a card game. But “How Much Land Does a Man Need?” contains many insights about money, psychology, and economic thinking. Pahóm, pursuing growth at all costs, seeks only to maximize his profit; he expands relentlessly into new regions of perceived opportunity, ignoring negative “externalities,” such as the exhausted soil and the damage he does to his relationships. For a time, his cycle of expansion looks like success, and at every stage Pahóm has apparently good reasons for expanding. His neighbors are obnoxious; not renting is more efficient; good land is cheap. In a narrow sense, he’s behaving rationally.

But a series of seemingly rational decisions somehow culminates in catastrophe. At each new level of wealth, instead of enjoying the resources he already has, Pahóm quickly becomes dissatisfied, returning to a previous level of happiness. Late in the story, when he is desperately exhausted, he could easily choose to forfeit his thousand rubles, rest in the grass, and then walk leisurely back to the starting place. Yet he believes that he’s invested so much effort that it would be foolish to stop, and continues pouring more energy into a doomed endeavor. Moments before his death, Pahóm realizes his essential error. “I have grasped too much and ruined the whole affair,” he thinks. How could a calculated business venture have gone so horribly wrong?

One way to understand Pahóm’s misfortune would be to say that he failed to think clearly. Today, behavioral economists, who study the psychology of economic life, talk about the “hedonic treadmill” and the “sunk-cost fallacy,” considering them errors in reasoning; they’d probably say that Pahóm falls victim to these patterns of faulty thinking. But Tolstoy saw the same patterns differently, as risks within a landscape of moral possibilities. The Devil himself uses them to gain power over Pahóm’s soul; the acquisitive quest they inspire has moral consequences, deforming Pahóm’s beliefs and behavior. Prior to the Devil’s interference, Pahóm had humble values: “Though a peasant’s life is not a fat one, it is a long one,” his wife says at the beginning of the story. “We shall never grow rich, but we shall always have enough to eat.” A life unencumbered by self-destructive greed was available to him. Yet, as Tolstoy’s story winds to a close, the Baskhírs’ sharply limited interest in wealth strikes Pahóm not as a challenge to his own values but as a business opportunity; he perceives them not as wise but as “ignorant.”

Tolstoy saw a moral dimension to economic thinking. There was a time when mainstream economists saw it, too. “It seems clearer every day that the moral problem of our age is concerned with the Love of Money,” the economist John Maynard Keynes wrote, in 1925. Keynes, like Tolstoy, recognized that many major topics of economics are inescapably moral and political: the “master-economist,” he wrote on another occasion, “must be mathematician, historian, statesman, philosopher—in some degree.” With an optimism that proved premature, Keynes described a future when “the love of money as a possession—as distinguished from the love of money as a means to the enjoyments and realities of life—will be recognized for what it is, a somewhat disgusting morbidity.” Critiquing the “decadent” and “individualistic” nature of international capitalism after the First World War, he wrote, “it is not intelligent, it is not beautiful, it is not just, it is not virtuous.”

Today, it’s hard to imagine many mainstream economists deploying this kind of moral and aesthetic language. Instead, economics relies on a technocratic, quasi-scientific vocabulary, which obscures the ethical and political questions that lie at the heart of the discipline. In a 1953 essay, for instance, Milton Friedman argued that economics could be “an ‘objective’ science, in precisely the same sense as any of the physical sciences.” Countless other economists have subsequently accepted this view. From this perspective, the moral evaluations of Keynes, Tolstoy, or anyone else are irrelevant. This pose of scientific impartiality allows mainstream economists to smuggle all sorts of dubious claims—that economic growth requires high inequality, that increasing corporate concentration is inevitable, or that people can only be motivated to work by desperation—into policy and discourse. This becomes an excuse for maintaining the status quo, which is presented as the result of inevitable and immutable “laws.” In the famous phrase of Margaret Thatcher, “There is no alternative.”

And yet, some economists, reviving the attitudes of Keynes and Tolstoy, have appeared more open to the idea that economics is a branch of political philosophy. Thomas Piketty has described “the powerful illusion of eternal stability, to which the uncritical use of mathematics in the social sciences sometimes leads.” The economist Albert Hirschman suggested that those at the top of society often seek to “impress the general public” by proclaiming that their status is the “inevitable outcome of current processes.” He went on, “But after so many failed prophecies, is it not in the interest of social science to embrace complexity, be it at some sacrifice of its claim to predictive power?” In 1900, in a book titled “The Slavery of Our Times,” Tolstoy struck some of the same notes. “At the end of the eighteenth century, the people of Europe began little by little to understand that what had seemed a natural and inevitable form of economic life, namely, the position of peasants who were completely in the power of their lords, was wrong, unjust, and immoral, and demanded alteration,” he wrote. You can’t change the laws of physics. You can, however, change the rules of the economic game.

But how should we change them? It’s possible to imagine a future in which people look back on economic systems that fail to reflect the true price of goods—including their impact on workers, the natural world, and future generations—as uncontroversially wrong. They may see current corporate ownership models that permit extraordinary concentrations of power and wealth, for instance, as absurd. But what will replace them? What are the real alternatives? Tolstoy’s approach isn’t likely to strike us as appealing. He concentrates, for the most part, on moral and spiritual reforms.

And yet it’s possible to marry economics and morality, by adopting economic models and policies that give tangible reality to the otherwise empty platitude that a better world is possible. Initiatives such as participatory budgeting, climate budgeting, job guarantees, employee ownership, true prices, genuine living wages, a public utility-style job market for irregular labor, less dogmatic economics education, and new investment-capital models that decrease wealth inequality are all powerful elements of a more just and sustainable economy. Better yet, they already exist. There’s no stronger response to charges of utopianism than showing models that are already working.

It’s possible to incorporate these approaches into our existing world. Mayors and elected officials, for example, can implement climate or participatory budgeting without making drastic changes elsewhere in government. Leaders of workforce boards and officials in the Department of Labor can help create public markets for irregular workers—after all, private-sector gig-work systems, like Uber, already exist. Business owners can convert to novel-ownership structures (as Patagonia did, in 2022), or start selling goods using true prices. Investors can use their capital in ways that reduce wealth inequality. Professors of economics and business can make students and the public aware of alternative approaches. And ordinary people who don’t hold powerful positions can support these efforts. The town of Mondragón, in northern Spain, is home to the world’s largest integrated network of worker and multi-stakeholder coöperatives, and has also experimented with participatory budgeting. The city of Amsterdam, in which true pricing originated, also practices a version of climate budgeting. And many businesses with shared ownership also pay a genuine living wage. Real people are living a vision of the economy as a place of moral action and accountability, rather than a value-free, self-regulating zone of unalterable laws.

In 1933, just before the opening of the World Economic Conference, Keynes addressed a radio audience. “The world’s needs are desperate,” he said. “We have, all of us, mismanaged our affairs. We live miserably in a world of the greatest potential wealth.” Of economists, he asked, “Isn’t the present shocking state of the world partly due to the lack of imagination which they have shown?” Tolstoy wasn’t an economist, but he can teach us a valuable economic lesson. We must shift our notion of the economy from an impersonal sphere of abstract forces into a human arena of ethical decisions. To do otherwise is, to paraphrase, Keynes, not intelligent, beautiful, just, or virtuous. ♦

This is drawn from “The Alternative: How to Build a Just Economy.”

Sourse: newyorker.com