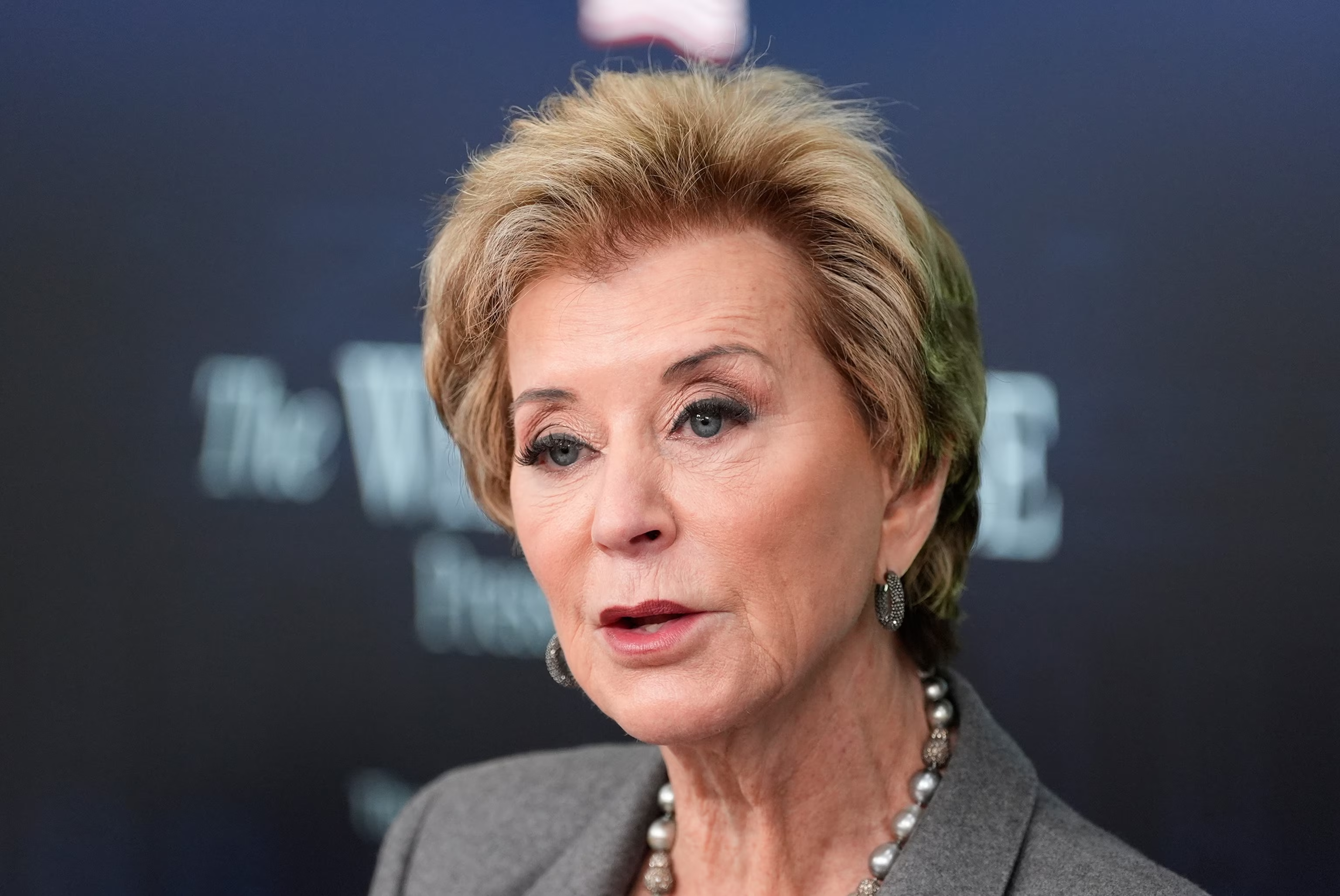

3:39FILE – Education Secretary Linda McMahon speaks with reporters in the James Brady Press Briefing Room at the White House, Thursday, Nov. 20, 2025, in Washington. (AP Photo/Alex Brandon, File)Alex Brandon/AP

The U.S. Department of Education is postponing wage garnishments and involuntary collections for borrowers in default on their student loans, as stated in a release from the agency on Friday. The Department indicated that this temporary suspension was implemented to further refine the student loan repayment process while it undertakes "major" reforms.

"The Department concluded that involuntary collection methods such as Administrative Wage Garnishment and the Treasury Offset Program will operate more effectively and equitably after the Trump Administration enacts substantial enhancements to our flawed student loan system," Under Secretary of Education Nicholas Kent remarked in a statement.

This action provides temporary relief to millions of Americans struggling to repay their loans. In addition to the garnishments and collections, the Education Department announced that tax refund interceptions from the Treasury Department are also being halted.

FILE – Education Secretary Linda McMahon speaks with reporters in the James Brady Press Briefing Room at the White House, Thursday, Nov. 20, 2025, in Washington. (AP Photo/Alex Brandon, File)Alex Brandon/AP

Describing the initiative as a "ridiculous" and "incoherent" political concession, the Committee for a Responsible Federal Budget (CRFB) charged the Trump administration with "reviving and extending" pandemic-related student loan pauses that it had promised to end.

"We are not in a pandemic or financial crisis or deep recession," stated CRFB President Maya MacGuineas. "There is no rationale for emergency measures regarding student debt, and no valid reason for the President to retreat on efforts to actually restart debt repayments," she noted.

The Department of Education building is seen in Washington, D.C., Nov. 18, 2024.Jose Luis Magana/AP, FILE

The nonpartisan nonprofit organization, which serves as an independent provider of unbiased policy analysis on fiscal policy implications, claims that the U.S. could forfeit up to $5 billion annually in collections, leading to increased loan balances.

Approximately 5 million borrowers are in default on their student loans, indicating they have not made any payments for at least nine months or 270 days. Once a loan officially defaults, it qualifies for mandatory collections.

Earlier this month, a coalition of advocacy organizations, including Protect Borrowers, urged the agency to cease enforced collections on defaulted borrowers.

Aissa Canchola Bañez, policy director at Protect Borrowers, stated that the administration’s proposals would have been "economically imprudent" given the affordability concerns.

Wage garnishment, a legal process whereby a person’s earnings are required by court mandate to be withheld by an employer for debt repayment, was set to commence for defaulted borrowers last week.

Announcements regarding collections were made last year following a five-year pause due to the pandemic. Education Secretary Linda McMahon has informed reporters that the department had collected approximately $500 million from defaulted borrowers prior to the new pause declared on Friday.

The announcement on Friday followed McMahon’s earlier statement that wage garnishments had been "temporarily suspended" during a press briefing earlier this week as part of her Returning Education to the States tour.

Under the Working Families Tax Cuts Act, a new income-driven repayment model will become available for borrowers on July 1, 2026, following the administration’s decision to terminate Biden-era initiatives.

The department stated that its decision on Friday will provide defaulted borrowers with the opportunity to work on rehabilitating their loans in the interim.

Sourse: abcnews.go.com